Posted on Friday, 23rd November 2018 by Dennis Damp

Print This Post

Print This Post

I wrote an article late last year titled “Where Are You Now! Looking at The Numbers” that helped readers evaluate their finances and determine if they had sufficient resources to live comfortably pre and post retirement. We provide extensive financial planning guidance to help anyone from a new hire to a retired annuitant evaluate and assess their financial strength. I mentioned in last year’s article, “few evaluate their finances until their checks start to bounce or they are so much in debt they can’t dig themselves out.” One of the leading causes of divorces today is due to finances and not living within your means.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

I recently developed an 8-page Budget Work Sheet that helps individuals and couples determine where they stand pre and post retirement. The worksheet guides you through listing your income from all sources, loans and debts, utility costs, insurance premiums, monthly savings and investment contributions, and miscellaneous expenses. An individual or couple will know what they are bringing in each month, their total expenses, and where they stand financially.

This worksheet isn’t an excel spreadsheet, it’s a pdf file that you can download and print out. Just lay it out on the table for you and your spouse/partner to fill out together with pen or pencil. It evokes discussions and doesn’t require sitting at a computer to complete. This way everyone knows firsthand where the household money is being spent and how much is needed each month to make ends meet.

Working couples often neglect to balance the books so that each party equitably supports the household to the degree possible. When this happens, it places an unfair burden on whomever is paying the bills and can lead to marital discord.

This work sheet includes a Common Expense column for working couples that reveals how much is needed monthly to support the family. Many newlyweds enter marriage without sufficient financial planning, they are in love and neglect to address the elephant in the room; making financial ends meet. Of course, this is natural to a certain extent especially for the very young. My wife and I are a prime example. We married young, my wife was 19 and I barely 20, while I was in the military earning a measly $98 a month! That was about one third of the minimum wage back then. We flew to Biloxi Mississippi with a few hundred dollars in our pocket, no car, and not knowing what laid ahead. Yet, we persevered and flourished. Most starting out like this end up divorced early on.

Fortunately, federal employees have great benefits, good pay, and are generally older and wiser than the very young at heart. Yet, they too often enter a relationship with blinders on and neglect to take the necessary steps early on in their relationship to right the ship and balance the financial load placed upon them.

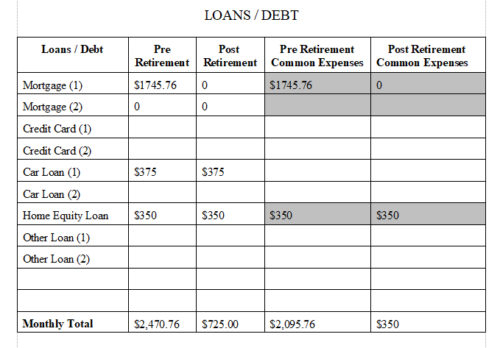

This worksheet allows individuals and couples to evaluate pre and post retirement expenses, there are columns for both entries. For example, under LOANS / DEBT there are four columns as noted on the excerpted table below. If you pay off your mortgage when you retire the post-retirement column would show zero dollars for your monthly mortgage payment. We extend that to common expenses both pre and post retirement for couples to determine what expenses to share when both have income. In this case the mortgage would be a common expense pre-retirement and zero dollars post-retirement.

A car loan could be considered an individual expense if both have a car and income. Tailor the chart and add additional common charges if relevant. I highlighted the expenses that most would consider to be shared by working couples. A single person wouldn’t need the common charges identified because there would not be anyone to share the costs with. This process works for everyone.

Download Worksheet (PDF Version)

Common expenses show the amount needed each month from working couples to pay the household bills, save for a rainy day and how much is spent on each line item. If you are a married couple and one is a stay at home mom or dad the working spouse generally earns enough to take care of business and keep things running. Married working couples, each earning about the same, could equally split the common expenses. When one partner is still working and another a retired annuitant the division would be decided by the pair as to what each can contribute based on all income sources; salary, pension, Social Security, 401k distributions, etc.

This exercise helps working couples share expenses equitable when both have sufficient income to contribute. At the very minimum, it effectively reveals total income to expenses so that you can see if you have anything left after paying the monthly bills.

Another key benefit of completing the worksheet is to discover where all of your money is going each month. Much of the younger generation today don’t know how to balance a checkbook. They use their debit cards until they are rejected for insufficient funds. Then, they go online to see what their balance is and wait for the next paycheck or transfer money from a savings account if they have one.

After completing the worksheet, you will know where and what you are spending your money on and be able to evaluate ways to trim costs. Possibly drop unnecessary cable options, program your HVAC thermostat to reduce utility expenses, replace incandescent bulds with LEDs, cut down on your trips to Starbucks, change to a lower cost cell phone service, and so on. There are many ways to economize today.

It’s a good idea for couples to open a joint checking account in addition to their individual checking accounts. If both are working, each would deposit their share of the common expenses in the joint account each payday for the bills. The excess in the joint account would accumulate for emergencies and discretionary items or you can set aside emergency or vacation savings in a separate account. This way, the person paying the bills should have sufficient funds each month to pay the bills. Even if only one person is working a joint account is necessary so both can pay bills and sign checks.

This is a dynamic process, expenses and income change over time. It’s imperative to revisit your worksheet at lease once a year or whenever there is a major change such as a pay raise, someone retires, or for younger couples when a child is born.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

- TSP Information

- Financial Planning Guide

- How to be Financially Prepared When You Retire (Free Report)

- Retirement Planning Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Down But Not Out – Imagine if This Was You! - April 12th, 2024

- Is Working in Retirement A Necessity Today? - April 5th, 2024

- Retirement Progression – One Day at a Time to Infinity - March 15th, 2024

- Fixed Income Investment Update – Bonds & More - March 8th, 2024

- Updated Guidance, Clarifications, & Observations - February 23rd, 2024

- Estate Planning Guide Revisited – Setting up Your Plan - February 9th, 2024

- Considering Your Options – Should You Stay the Course? - February 2nd, 2024

- Tax Forms Availability and Annuity Statements - January 26th, 2024

- TSP RMDs & Withdrawals Plus Site Navigation Tips - January 19th, 2024

- Preparing for the New Year - 2024 Updates - January 5th, 2024

- 2023 in the Rear View Mirror – Observations and Updates - December 15th, 2023

- T-Bills, Savings Bonds, and CD Investments in the Spot Light - December 8th, 2023

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post