Posted on Thursday, 5th April 2018 by Dennis Damp

Print This Post

Print This Post

What would encourage a retiree to return to the workforce today? How about a 20% deduction on your new found income! Many that left federal service still have much to offer and can turn a part-time adventure into extra cash that supplements their annuity, Social Security, and TSP payouts. Today, there are many opportunities for those who desire or need to go back to work and recent tax law changes are spurring the return. Yes, the new tax breaks are making it not only desirable but highly profitable for retirees starting a part or full time pass-through business or simply going back to work.

Exploring the Possibilities

For those who don’t have an interest in starting their own business, companies are hard pressed to find the talent they need today and many jobs are going unfilled. This too is driving up salaries as companies must now compete for a limited number of qualified applicants. Employers recruiting federal retirees and those soon to retire post job vacancies on our Jobs Board. A good number of new listings were posted recently. Even those who go back to work for a private company or return to federal service under the rehired annuitant program will benefit from reduced individual income tax rates and lower payroll withholdings.

Another benefit of returning to work is that your Social Security payments will increase over time due to your new payroll contributions. If you are at or over your full retirement age your Social Security check will not be reduced. If you are below your full retirement age and receiving a monthly Social Security check your benefit is subject to the Social Security Earnings Test. The age at which unreduced benefits are payable increases gradually from age 65 to 67 over a 21-year period beginning with individuals who reach age 62 in the year 2000. For example, full retirement age for those born between 1943 and 1954 is 66.

Retired federal employees are sought after by employers for their expertise, work ethic, and ability to accept directions from others. They are mature, seasoned and their common sense often trumps the newer generations that may not have a similar work ethic. Plus retirees typically don’t have young children or require company health insurance plans in general. A huge bonus for employers. The labor participation rate is bound to decrease as the incentives grow to return to work.

Most are unaware of the fact that individuals establishing a small pass-through entity (business); a sole proprietorship, Subchapter S corporation, or a limited liability company will receive a 20 percent 199A deduction for qualified business income starting in 2018. There are some exclusions such as specified service businesses in law, health, accounting, athletics, and the performing arts. However, the specified services exclusions only apply to high income individuals earning over $157,500 on individual tax returns or over $315,000 for joint filers. The deduction is phased out as income rises above these levels.

There are many options to earn extra income in retirement and starting a small business is not a complicated process in most States. You could write for a blog, become a consultant or independent contractor, babysit, walk dogs in your neighborhood, provide yard services, general cleanup, and handyman services to name a few. The possibilities are endless. There isn’t a week that goes by that I don’t see opportunities to open and grow a business.

I formed a single member LLC using NOLO’s guide for my small company before retiring from the FAA in 1999, initially starting out as a sole proprietorship in 1985. Prior to this new tax law small companies paid excessive taxes at the personal income tax rate. Now due to the new pass through 199A deductions hundreds of thousands of small businesses will be able to hire more personnel and pocket more of their profits. You too can do the same.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Opportunities

Selling on EBay – If you like to go to garage and estate sales or simply want to clean out your attic why not sell your finds on EBay? I’ve sold on EBay for years and the process is fairly easy to set up if you are familiar with computers in general. It also helps to have a smart phone.

- Start selling on EBay – Instructions

Note: I know of many who make a profit and even a few hundred bucks a month can help especially if you are retired and on a fixed income. Plus you can work from home! Many sellers go to garage sales and buy sports memorabilia, computer games, collectibles, and other items and resells them on Ebay as a sideline. It is amazing at just what sells today. Browse Ebay listings to see what is popular and find these items at Thrift Stores and garage sales in your area.

Pet Lovers – Why not become a pet sitter and/or dog walker? Many don’t like to kennel their pets and look for local residents to watch them. Did you know that pet owners are willing to pay from $30 to $50 a day for you to watch their pet at your home while they are away? According to Rover.com pet sitters can earn up to $1,000 a month or more. Rover.com is the nation’s largest network of 5-star pet sitters and dog walkers. You can limit your care to as little as one pet at a time and also select the weight range of the dogs you are willing to watch. Lots of options.

Drive For Lyft or Uber – According to Lyft, they match drivers with passengers who request rides through their Smartphone app, and passengers pay automatically through the app. You don’t have to collect fairs or handle cash other than cash tips that you might receive. If you like to drive and have a serviceable car you can earn extra cash for whatever purpose you have in mind and be your own boss.

With Uber you can sign up to be a driver even if you don’t have your own car! They offer short and long-term vehicle options for those needing wheels.

Another driving option is to apply to be a driver with Hertz and other car rental companies. My brother drove cars for Hertz on weekends for a second job for many years. The car rental companies move cars from one distribution point to another and must return cars to the original destination, typically to another airport in the area.

Profiting from a hobby – There are many opportunities for hobbyists to make extra cash doing what they love to do. I network with a large group of retirees through my blogs and websites and the diversity of talented retirees is amazing. Many started successful businesses, Like Randy Baldwin, who we featured in an article titled Life After Retirement – What’s at the End of Your Rainbow.

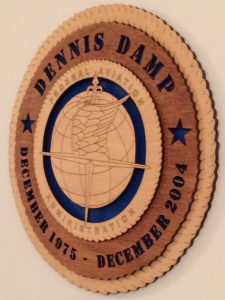

FAA Service Plaque Made by Randy Baldwin

Randy, owns a successful laser engraving company. Chuck Jumpeter owns and operates a nutrition franchise plus became a golf pro at his local country club after retirement. You too can begin a new and exciting career with a little forethought and planning. There is always a need for anyone that can provide a solution to a problem or satisfy a need. Just think about what you can do to not only enjoy your hobby but profit from it as well.

Become a Handyman / Handyperson

If you are good at everyday home projects and repairs how about sharing that knowledge and your expertise with others in your community. You don’t have to do this on your own, www.taskrabbit.com will find you jobs in your area for those needing your unique skill set. People need help with everyday things like cleaning windows, yard work, and general household tasks to everything in between. It’s a relief to have someone to call that you can count on for help when you need it.

You can do this on your own through classified ads or just by letting others know about your services such as churches, local hardware stores, groups that you belong to, etc. After you get your first few satisfied customers you will typically get referred to their friends and neighbors. You can also have a local printing shop make you up business cards and a magnetic sign for your car door saying, Need A Handyman, call xxx-xxx-xxxx.

Basic Lawn Services – Become a gardener

Each year in early to late spring the landscapers come in to clean up the yards and apply new mulch, do some light pruning, edge the beds, etc. A month later the weeds start to come up and before you know it the beds are full of weeds. Some home owners will go out and clean them up, spray roundup to kill them off and they look good again. Many ignore this task and don’t realize that letting the weeds take over is a landscaper’s dream. Next spring you will have to pay them a huge sum to do it all over again. A little maintenance each month not only keeps your property looking great and the envy of your neighbors but it could also reduce the homeowner’s spring clean up the next year.

Offer homeowners general yard maintenance to include mulch bed herbicide treatments, light pruning, flower and bulb plantings, garden cleanup and maintenance, and twig and leaf pickup after storms, etc. You could charge a flat fee for a one hour visit biweekly or monthly plus add the cost for the chemicals and other supplies you might need if they don’t have them on hand. You could also offer to cut small yards with their mower if desired and add other services that you see fit for that homeowner. I would like to find someone in my area that can provide these services.

I could list many more possibilities, they are simply too numerous to mention. With a new tax break comes new opportunities, explore the possibilities and you too may find the avocation in retirement that you desire and deserve.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

- Retirement Planning Guide

- Social Security Information

- Helpful Books

- Master Retiree Contact List (Important contact numbers and information)

- 2018 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Down But Not Out – Imagine if This Was You! - April 12th, 2024

- Is Working in Retirement A Necessity Today? - April 5th, 2024

- Retirement Progression – One Day at a Time to Infinity - March 15th, 2024

- Fixed Income Investment Update – Bonds & More - March 8th, 2024

- Updated Guidance, Clarifications, & Observations - February 23rd, 2024

- Estate Planning Guide Revisited – Setting up Your Plan - February 9th, 2024

- Considering Your Options – Should You Stay the Course? - February 2nd, 2024

- Tax Forms Availability and Annuity Statements - January 26th, 2024

- TSP RMDs & Withdrawals Plus Site Navigation Tips - January 19th, 2024

- Preparing for the New Year - 2024 Updates - January 5th, 2024

- 2023 in the Rear View Mirror – Observations and Updates - December 15th, 2023

- T-Bills, Savings Bonds, and CD Investments in the Spot Light - December 8th, 2023

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, EMPLOYMENT OPTIONS, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE | Comments (0)

Print This Post

Print This Post