Blue Cross Blue Shield (BCBS) is offering a new lower cost fee-for-Service Focus Plan in 2019. This article compares the BCBS Focus plan to the GEHA Standard plan. Many federal annuitants opt for a lower cost Federal Employee’s Health Benefit (FEHB) plan [2] once they sign up for Medicare [3]. The majority of FEHB plans waive many of the copayments, coinsurance, and deductibles for those who have Medicare as their primary provider.

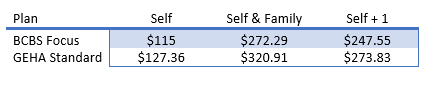

Monthly 2019 Premium Rates

Plan Coverage

According to the FEP BLUE guide, “There’s a lot that FEP Blue Focus covers, but there are some things it doesn’t cover. These include: routine dental services, Non-preferred drugs, skilled nursing facility care, hearing aids and long-term care. To see a complete list of exclusions, download the FEP Blue Focus brochure [4].” You must stay in-network. However, according to BCBS, 96% of hospitals, 95% of doctors and over 65,000 Preferred retail pharmacies are in their network. Plus, there’s no referral needed to see a specialist, and your coverage travels with you overseas.

GEHA provides reimbursement for both preferred and non-preferred providers and their Standard Plan covers dental services. They also pay for hearing aids, up to $2,500 every three years. Download the GEHA 2019 Plan Brochure [5] for your personal review.

Plan Highlights

- Provider Coverage – GEHA Standard Plan covers Preferred Provider Organization (PPO) and non-PPO providers. BCBS limits coverage to PPOs.

- Doctor Visits – $15 GEHA copay for office visit (non-PPO 35%), BCBS Focus members pay nothing for preventative visits with preferred providers, $10 copayments for the first 10 visits for professional doctor’s visits, after the 10th visit 30% of the plan allowance and a deductible applies. No coverage for non-PPOs.

- Hospital Inpatient – GEHA PPO services require payment of 15% for covered services and 35% non-PPO. BCBS Focus requires 30% payment for PPO services, no reimbursement for non-preferred.

- Outpatient Services requires payment of 15% for covered hospital services and 35% for non-PPO under the GEHA plan and BCBS Focus requires a 30% payment of the plan allowance (deductible applies). No coverage for non-preferred services.

- Accidental Injury – With GEHA Standard you pay nothing up to the plan allowances of covered charges within 72 hours of an accident. BCBS Focus specifies nothing for Preferred outpatient hospital and physician services within 72 hours (regular benefits apply thereafter.) There are payments required under the Focus plan for non-participating providers of the difference between the plan allowance and billed amount for outpatient hospital and physician services within 72 hours.

- Hearing aids – covered up to $2,500 every 3 years with GEHA, no coverage under the BCBS Focus plan.

- Dental Services – GEHA covers 50% up to the Plan allowance for diagnostic and preventive services per year as follows: Two examinations per person per year, two prophylaxis (cleanings) per person per year, two fluoride treatments per person per year and $150 in allowed X-ray charges per person per year (payable at 50%). BCBS Focus limits coverage to treatment of an accidental dental injury within 72 hours (regular benefits apply thereafter). Note: When you are covered by more than one vision/dental plan, coverage provided under your FEHB plan remains as your primary coverage. FEDVIP coverage pays secondary to that coverage

- Both plans provide comprehensive prescription drug programs. GEHA Standard includes a mail order program, BCBS Focus does not. Review each plan’s brochure for specifics. For example, under the GEHA Standard plan members pay the lessor of $10 or the pharmacy’s usual and customary cost for generic drugs. BCBS Focus charges a $5 copayment up to a 30-day supply from their preferred retail pharmacy. There are different payment schedules for non-network pharmacies.

- Catastrophic Cost Protection – Under the GEHA Plan you pay nothing after $6,500 Self Only ($13,000 Self Plus One or Self and Family) per year for PPO providers. The limits increase for non-PPO providers to $8,500 Self Only ($17,000 Self Plus One or Self and Family) per year for Non-PPO providers. BCBS Focus has similar limits for PPO providers and there is no catastrophic protection for services provided by non-PPO providers except under certain situations as outlined in their brochure on page 18.

FEHP Cost Savings After Signing up For Medicare

When Original Medicare is the primary payor, Medicare processes your claim first. In most cases, your claim will be coordinated automatically and your FEHB plan will then provide secondary benefits for covered charges.

For members enrolled in the GEHA High and Standard Options, GEHA waives some costs if the Original Medicare Plan is your primary payor – They will waive some out-of-pocket costs as follows:

- Inpatient hospital benefits: If you are enrolled in Medicare Part A, they waive the deductible and coinsurance. When you are enrolled in the high option, and you use a PPO facility, they will also waive the inpatient admission copayment.

- Medical and surgery benefits and mental health/substance use disorder care: If you are enrolled in Medicare Part B, they waive the deductible and coinsurance.

- Office visits PPO providers and MinuteClinic (where available): If you are enrolled in Medicare Part B, they waive the copayments for PPO office visits.

- Prescription drugs: If you have Medicare Parts A and B, you will pay a copayment or coinsurance for drugs through CVS Caremark and at retail pharmacies. Review costs on page 85 of their plan brochure.

- Manipulative Therapy benefits: There is no change in benefit limits or maximums for manipulative therapy care when Medicare is primary.

- Physical, speech and occupational therapy benefits: There is no change in benefit limits or maximums for therapy when Medicare is primary.

- GEHA does NOT waive the $300 (High Option) or $500 (Standard Option) copayment for specialty pharmacy medications not dispensed by the CVS Specialty Pharmacy. If Medicare denies coverage, they do not waive the coinsurance.

- If you obtain services from a non-Medicare provider, they will limit their payment to the coinsurance amount they would have paid after Original Medicare’s payment based on their Plan allowance and the type of service you receive.

(Download the GEHA Payment Schedule [6] for Medicare participants. )

For members enrolled in the BCBS Focus option, BCBS waives some costs if the Original Medicare Plan is your primary payor – They will waive some out-of-pocket costs as follows:

When Medicare Part A is primary –

- They will waive their calendar year deductible and coinsurance

- Once you have exhausted your Medicare Part A benefits, you must then pay the coinsurance once the calendar year deductible has been satisfied for the inpatient admission. Note: Precertification is required.

When Medicare Part B is primary –

- They will waive their calendar year deductible, coinsurance and copayments for inpatient and outpatient services and supplies provided by physicians and other covered healthcare professional and outpatient facility services.

Note: BCBS does not waive benefit limitations, such as the 10-visit limit for home skilled nursing visits. In addition, they do not waive any coinsurance or copayments for prescription drugs.

You can find more information about how the BCBS Plan coordinates benefits with Medicare in their highly informative Medicare and You Guide for Federal Employees [7].

For specifics and clarifications download the plan brochures. If you have questions after reviewing the plan brochures call the provider for clarifications and additional guidance.

- GEHA (1-800-821-6136)

- BCBS (1-800-411-2583

General Observations

There is much to consider when changing plans to avoid coverage issues and to reduce your costs down the road. Take your time and review the various programs available to you by all providers in your area. I limited this article to a comparison between two popular low-cost options that many enrolled in the traditional Medicare Parts A and B program might find worthwhile exploring. I’ve been enrolled in the GEHA Standard plan for a number of years starting before enrolling in Medicare at age 65. Prior to that my wife and I were enrolled in the BCBS Basic plan. Both served our needs.

Since enrolling in Medicare, we haven’t paid any copayments, coinsurance or deductibles even though my wife and I had multiple operations and last year I ended up in the emergency room.

Medicare Part B does require a monthly payment [8] and it is income adjusted. However, you can often offset the additional costs by changing to a lower cost FEHB plan [2]. Also, some FEHB plans will actually reimburse you for some of your Part B Premiums. For example, BCBS Basic Option members can get a $600 reimbursement for paying Medicare Part B premiums.

Open season runs from November 12, 2018 through December 10, 2018 and plan brochures are now available from most providers. OPM will have all plan brochures available online [9] November 7th or you can sign up to access them via the OPM FEHB Online portal [10].

Request a Federal Retirement Report™ [11] today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Additional Resources:

Helpful Retirement Planning Tools

Distribute these FREE tools to others that are planning their retirement

- FEHB Open Season [14]

- Retirement Planning Guide [15]

- Financial Planning Information [16]

- Thrift Savings Plan [17]

- Master Retiree Contact List [18] (Important contact numbers and information)

- 2018 Leave and Schedule Chart [19] (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator [20](FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Down But Not Out – Imagine if This Was You! [21] - April 12th, 2024

- Is Working in Retirement A Necessity Today? [22] - April 5th, 2024

- Retirement Progression – One Day at a Time to Infinity [23] - March 15th, 2024

- Fixed Income Investment Update – Bonds & More [24] - March 8th, 2024

- Updated Guidance, Clarifications, & Observations [25] - February 23rd, 2024

- Estate Planning Guide Revisited – Setting up Your Plan [26] - February 9th, 2024

- Considering Your Options – Should You Stay the Course? [27] - February 2nd, 2024

- Tax Forms Availability and Annuity Statements [28] - January 26th, 2024

- TSP RMDs & Withdrawals Plus Site Navigation Tips [29] - January 19th, 2024

- Preparing for the New Year - 2024 Updates [30] - January 5th, 2024

- 2023 in the Rear View Mirror – Observations and Updates [31] - December 15th, 2023

- T-Bills, Savings Bonds, and CD Investments in the Spot Light [32] - December 8th, 2023