Posted on Friday, 19th October 2018 by Dennis Damp

Print This Post

Print This Post

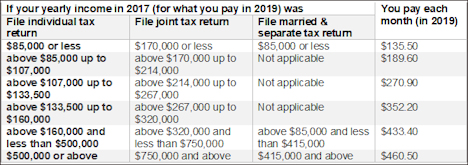

Medicare recently announced the standard Part B premium amount of $135.50 for 2019. Most people will pay the standard Part B monthly premium. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium and an Income Related Monthly Adjustment Amount (IRMAA). This extra charge is added to your monthly payment. Premiums due to IRMAA range from $189.60 to as high as $460.50 a month for the highest income bracket.

Those who retire and are covered under a working spouse’s health care plan can defer signing up for Medicare Part B without penalty. The cost for part B is determined by your Modified Adjusted Gross Income (MAGI). The modification adds any tax-free income that you earned to your standard adjusted gross income tax that is listed on your IRS 1040 form. For example, if you own tax free municipal bonds, even though bond interest isn’t federally taxed that income is included to determine your MAGI for Part B premium determination.

The premium increases this year were minor, the standard premium increased only $1.50 per month, from $134 to $135.50. The IRMAA increases are listed below:

There are definite advantages for federal retirees to sign up for Medicare Part B. The following list of Medicare articles will help you decide what is best for you and your family.

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- What to Consider Before Enrolling in Medicare B (Part 2)

- Should You Change to a Lower Cost FEHB Plan When You Sign Up for Medicare (Part 3)

- Medicare Part B and FEHB Update (Part 4)

- How to Delay Part B Premiums

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Additional Resources:

Helpful Retirement Planning Tools

Distribute these FREE tools to others that are planning their retirement

- FEHB Open Season

- Retirement Planning Guide

- Financial Planning Information

- Thrift Savings Plan

- Master Retiree Contact List (Important contact numbers and information)

- 2018 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post