Posted on Thursday, 26th February 2026 by Dennis Damp

Print This Post

Print This Post

Fixed‑income opportunities continue to evolve as investors evaluate shifting interest‑rate expectations, inflation pressures, and a challenging global economic growth environment. After two years of central bank tightening, bond markets have entered a more balanced phase—one defined less by rate shocks and more by subtle positioning, yield‑curve dynamics, and various opportunities across credit sectors.

The annual inflation rate in the United States as of January 2026 is 2.4%. This marks a decrease from the same time last year, when the rate was 3.0% in January 2025.

Over the past 12 months, the U.S. stock market has experienced significant, broad-based growth, with the S&P 500 rising roughly 15-16% and the Dow Jones Industrial Average (DJIA) experiencing similar, sustained gains.

The market reached record highs over a dozen times during this period, driven by tax cuts, AI and tech investments, and recently, a broadening out beyond the tech sector amid some volatility.

While the stock market offers the potential for higher gains, it also carries risks for those approaching retirement and retirees. Fixed income offers the stability your portfolio requires to preserve your retirement nest egg and to smooth out the volatility markets experience.

Treasury Bill Rates Still Attractive

As of February 17, 2026, the FDIC national average savings account yield is 0.39% APY. While this is the benchmark for traditional, often large, brick-and-mortar banks, high-yield savings accounts (HYSAs) currently offer up to 5.00% APY, which is over 10 times the average. It pays to look around for higher yields, including short-term Treasury Bills.

The average savings account rate would yield just $39 per $10,000 for the entire year, while a 5% yield would yield $500. Quite a difference.

Treasury Bills, Notes, and bonds remain attractive. You can select auto reinvestments for up to 2 years for Treasury Bills; reinvestments can be canceled at any time if the funds are needed. The rates change for each new issue.

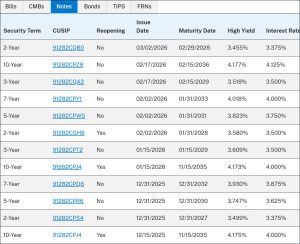

Over the past year (as of February 2026), short-term Treasury bill yields for 4, 8, 13, and 17-week maturities have generally decreased from over 5% to the 3.5%–4.5% range. The 4-week rate dropped to approximately 3.63% (from over 4.2% last year), and the 10-year Notes recently yielded between 4.03% and 4.05%.

Although the Federal Reserve intends to reduce rates over time as conditions warrant, Treasury Bills continue to earn attractive yields. Treasury interest payments aren’t subject to State taxes, a tax savings for all.

Treasury Bill Investment Rates

Treasury Note Investment Rates

It is generally recommended to purchase Notes and Bonds through your broker, and I personally limit my purchases to new-issue bonds.

Treasury Notes and Bonds must be sold on the secondary market. If you purchased them from Treasury Direct and decide to sell them before maturity, they must be transferred to your brokerage account. This can take several weeks to a month or longer in some cases.

As of late February 2026, the 20-year U.S. Treasury bond yield is approximately 4.6% to 4.65%. Some buy long-term bonds on the assumption that interest rates will fall later this year or early next year, while locking in a decent yield. Rates could go either way depending on various factors; you never know what changes will influence the market.

There is a significant risk to long-term bonds; they are highly rate-sensitive, and bond prices move inversely to interest rates. If yields decline, the value of existing bonds increases. If yields rise, existing bonds lose value.

The price of a 20-year Treasury bond will change by approximately 15% to 18% in the opposite direction of a 1% change in interest rates. This high sensitivity, known as “duration,” means if rates rise by 1%, the bond price falls by roughly 15-18%, and vice versa.

This is significant, especially if you will need to tap these funds. However, if you keep the bond to maturity, there is no risk; you will collect the specified yield through the bond’s term, and your entire initial investment will be returned to you when the bond matures. Interest is paid semiannually.

As a 20-year bond approaches its maturity, its remaining term shortens, decreasing its duration. This makes it less sensitive to interest rate moves. For example, a 20-year bond held for 10 years would have an 8 to 10-year duration. Consequently, a 1% change in interest rates would result in an 8% to 10% change in the bond’s value.

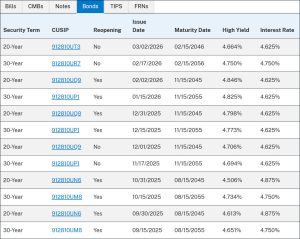

Treasury Bond Investment Rates

Purchasing Treasury Bills, Notes, and Bonds

Visit TreasuryDirect.gov to register, explore the options, and purchase Treasury bills, notes, bonds, TIPS, and savings bonds. You are buying directly from the government, eliminating the middleman, and there are no purchase fees.

U.S. Treasury Note yields are currently hovering around 4% for the 10-year benchmark, reflecting recent market fluctuations driven by economic data. Key maturities generally show yields in the 3.4%–4.7% range, with 2-year notes around 3.46% and 30-year bonds near 4.69%.

The shorter the duration of the Note you purchase, the less sensitive it is to interest rate changes. For example, if you purchased a 5-year Treasury Note, a 2% rise in interest rates will cause the Note’s price to fall, while a 2% fall in interest rates will cause the Note’s price to rise.

The price change depends on the Note’s duration, which is approximately 4.5 years for a 5-year Note. Generally, a 1% change in interest rates results in a price change of roughly 1% per year, or 4.5% in this example.

Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; they can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

- Treasury Bills In-depth

- Treasury Notes In-depth

- Treasury Bonds In-Depth

- Treasury rates (Yields)

- Auction schedule

Note: If you buy a long-term Treasury Note or Bond, you can only sell it on the secondary market through a brokerage house. If you purchase Notes and Bonds on Treasury Direct, you must transfer them to your private brokerage account to sell them before the maturity date. I only purchase long-term Treasuries through my broker in case I need to sell them before maturity.

CDs and Savings Bonds

Many banks and credit unions are offering competitive rates for savings accounts and CDs, from 3.5 percent to higher in many cases. CDs have no market risk if you stay under their insured FDIC limits.

I recently negotiated a competitive savings account rate at my local bank, increasing my interest by over 1.5% above what they generally offer.

Online banks are offering competitive CD rates, with many 1-year terms currently yielding around 4.00% to 4.10% APY, significantly higher than the national averages.

I-Savings Bond Rates

I Bonds issued from November 1, 2025, to April 30, 2026, are earning 4.03%. This includes a .90% fixed rate. You can’t cash them in for one year. Plus, if you redeem them within the first five years, you lose three months’ interest.

If the I Bonds that you purchased previously didn’t have a fixed rate, you will only earn the inflation rate when the new rates are announced for the next six months. I Bonds with a high fixed rate are a great buy; some of my early I Bonds have a fixed rate over 3% and are currently earning over 6%. Here is a table showing what I Bonds are earning today, based on the purchase date.

Many I-bonds were sold with a zero fixed rate, which can dramatically reduce returns as the inflation rate decreases. For example, I Bonds issued between May and October of 2022 were paying 9.66%. However, they had a 0% fixed rate; those same bonds are now paying 3.13%.

The I Savings Bonds issued without a fixed rate, that are over a year old, can be redeemed and reinvested in new I Bonds with a fixed rate to increase your income, or reinvest the funds in higher-yielding short-term Treasuries or CDs. The Treasury will charge a 3-month interest penalty on any I bond cashed in that is under 5 years old.

On the flip side, when the inflation rate goes negative, as it did in the late 1990s, I-bonds don’t decrease in value.

Market Observations

The stock market has been on a winning streak lately, hitting new highs over a dozen times last year. For the most part, we have all seen our TSP, other retirement, and taxable accounts increase in value, sometimes dramatically. The market is like a roller coaster cycling up and down based on political stability, company profits, employment figures, CPI, inflation, and so many other factors, too numerous to mention.

This highlights the need for those planning their retirement and retirees to consider allocating a portion of their portfolios to more stable fixed-income investments, as outlined above. This is especially true if the stock market is keeping you up at night. We are elated when the market is up and depressed when it goes down, as evidenced by our most recent monthly account statements.

Summary

The rule of 100 is used for those approaching retirement. Subtract your age from 100, and the remainder is what many financial planners consider a conservative investment mix to reduce risk as we age. For example, if you are 65, according to this formula, you should have only 35% of your retirement portfolio in stocks, with the rest in bonds, money market accounts, and cash.

Many use the 110 rule today; in that case, at age 65, you would allocate 45% of your investments to stocks and 55% to fixed income.

I still prefer to invest in the safety of Treasuries, AAA-rated corporate bonds, CDs, conservative stocks, mutual funds, and market leaders that have been around for many decades, pay dividends, and have sound fundamentals. Many retirees set aside a small portion of their investments for the more aggressive growth stocks, mutual funds, and ETFs of the day.

CDs and Treasuries are viable options if you can lock up your discretionary savings and investments for a period of time. As noted in the above charts, Treasury Bill rates are moderating slightly.

Short-term T-Bills and Bonds continue to offer impressive yields, given that many banks still lowball their savings rates for established accounts. These banks are betting on the reluctance of many to move funds from their savings and checking accounts elsewhere.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Worksheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2026 Federal Employees’ Leave Chart

- Medicare Guide

- Social Security Guide

The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: CDs, Daily Brief, I Bonds, Market Projections, Retirement Savings, Rule of 100, Savings Bonds, TIPS, Treasury Bills, Treasury Bonds, Treasury Notes

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, General Information, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post