Posted on Friday, 25th April 2025 by Dennis Damp

Print This Post

Print This Post

The hiring freeze has been extended to July 1, 2025, and applies to all executive departments and agencies regardless of their operational and funding sources.

This freeze prohibits filling vacant federal civilian positions or creating new ones, with exceptions for immigration enforcement, national security, and public safety. When the hiring freeze ends, agencies can hire no more than one employee for every four employees who depart from federal service, except for the above mentioned exceptions.

The memorandum does not apply to military personnel of the Armed Forces, positions related to immigration enforcement, national security, public safety or the Executive Office of the President.

New Federal Employee Category Established

According to a recent fact sheet issued by the Whitehouse, “The proposed rule tackles systemic issues in federal workforce accountability, addressing unaccountable, policy-determining federal employees who put their own interests ahead of the American people.”

This action implements the President’s Executive Action titled “Restoring Accountability to Policy-Influencing Positions Within the Federal Workforce.” Career employees with important policy-determining, policy-making, policy-advocating, or confidential duties are to serve as at-will employees.

These employees will keep their competitive status and must faithfully implement the law and the administration’s policies. This action re-establishes the “Schedule F” category that the previous administration canceled.

Illegal Aliens and Social Security Benefits

On April 15, 2025, the president issued a memorandum outlining the steps needed to ensure that taxpayer-funded benefits are provided only to eligible persons and do not encourage or reward illegal immigration to the United States.

According to a National News Desk and DOGE report, many noncitizens have obtained Social Security cards! Once a noncitizen is in the country under the asylum program, they can apply for a work permit. Once approved, Social Security automatically sends them a Social Security card without presenting an ID or going through an interview.

The Economic Policy Innovation Center states, “Aliens, even those otherwise inadmissible, are provided a reprieve from removal by being granted parole, asylum, or work authorization after applying for asylum. etc.” The inclusions are extensive and range from status as Afghan parolees, Venezuelan (CNHV) parolees, those listed as Temporary Protected Status (TPS), to many listed as withholding of removal by the previous administration.

Aliens can receive welfare benefits from many different public assistance programs, including:

- Food Stamps (the Supplemental Nutrition Assistance Program, “SNAP”)

- Child nutrition programs

- Temporary Assistance for Needy Families (TANF)

- Supplemental Security Income (SSI)

- Child Care and Development Block Grant (CCDBG)

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Obamacare Premium Tax Credit

- Obamacare cost-sharing subsidies

- Medicare

- Medicaid

- Children’s Health Insurance Program (CHIP)

- Pell Grants

- Student loans

- Head Start

- Public housing

This memorandum directs “the Secretary of Labor, the Secretary of Health and Human Services, and the Commissioner of Social Security, in consultation with the Secretary of Homeland Security as necessary, shall take all reasonable measures, consistent with applicable law, to ensure ineligible aliens are not receiving funds from Social Security Act programs.”

End Notes

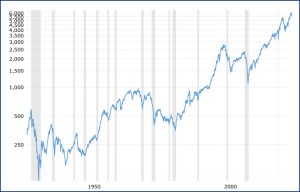

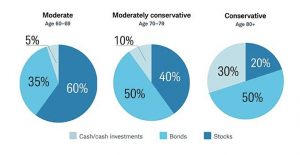

These updates are just a sample of what is happening today. We are all impacted by potential changes to our benefits, market volatility that impacts our retirement savings, government reorganizations and downsizing initiatives, inflation, and so much more.

When I was born, TVs were the new thing that most couldn’t afford, we were tethered to a phone that was a fixture in most homes, and our first phone was a party line that we shared with five other families. Computers were a distant dream, and many of our major appliances were a shadow of what they are and provide today.

Change brings both improvements and disappointments, depending on our circumstances. According to Greek philosopher Heraclitus, “The only constant in life is change!”

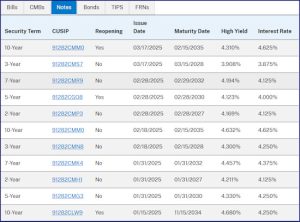

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2025 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: Daily Brief, Hiring Freeze, Illegal Immigrants, Schedule F Employees, Social Security

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, EMPLOYMENT OPTIONS, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post