In January, the Federal Reserve kept the fed funds rate steady at the 4.25 %-4.5 % range, pausing its rate-cutting cycle after three consecutive reductions in 2024. During the last meeting, the Fed indicated that economic activity continues to expand, the unemployment rate has stabilized at a low level in recent months, labor market conditions remain solid, and inflation remains somewhat elevated.

In February, the inflation rate decreased for the first time in three months, and the unemployment rate held steady at 4.1 %, a slight decrease from January’s 4.0 %. The next Federal Reserve interest rate meeting and decision is due on March 19th, 2025.

While the stock market offers the potential for higher gains, it doesn’t come without risks for those approaching retirement and retirees, as evident from the volatility this past several weeks.

Treasury Bill Rates Still Attractive

According to the FDIC, the national average savings account yield has dropped to 0.41 percent APY, while the average checking account rate is a meager .08 %, and money market rates average .68 percent.

Higher rates are available from some banks, including those available online. The average money market yield would earn you a measly $68 per $10,000 savings for the entire year!

Treasury Bills are still earning around 4.3%. You can select “auto reinvestments” for up to two years. Auto renewals can be stopped prior to the next reinvestment date if the funds are needed. The rates change for each new issue. The shorter-term (4, 8, and 13-week) Treasury Bill yields have averaged 4.3 to 4.5 percent over the past year and the 10-year Notes recently yielded 4.625 %.

Although the Federal Reserve intends to reduce rates over time as conditions warrant, Treasury Bills continue to earn attractive yields. Treasury interest payments aren’t subject to State taxes.

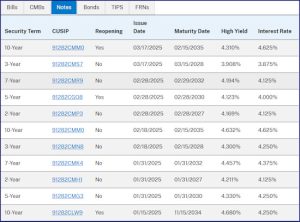

Treasury Bill Investment Rates

Purchasing Treasury Bills, Notes, and Bonds

Visit TreasuryDirect.gov [3] to register, explore the options, and purchase Treasury bills, notes, bonds, TIPS, and savings bonds. You are buying directly from the government and eliminating the middleman; no fees are charged for purchases.

Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; they can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

- Treasury Bills In-depth [4]

- Treasury Notes In-depth [5]

- Treasury rates (Yields) [6]

- Auction schedule [7]

Note: If you buy a long-term Treasury Note or Bond, you can only sell it on the secondary market through a brokerage house. If you purchase Notes and Bonds on Treasury Direct, you must transfer them to your private brokerage account to sell them before the maturity date. I only purchase long-term Treasuries through my broker in case I need to sell them before maturity.

Agency RIFs and Reorganization Plans (ARRPs) [8]

CDs and Savings Bonds

Many online banks, credit unions, and some regional banks are offering competitive rates for savings accounts and CDs, from 3.5 percent to higher in many cases. Rates are not falling as fast as the Fed anticipated, and I’m still rotating savings through short-term T Bills at attractive rates. Longer term CDs or 2, 3, 5, 7, or 10-year Treasury Notes can lock in higher rates. CDs have no market risk if you stay under their insured FDIC limits.

Treasury Notes currently offer anywhere from 3.875 to 4.625 percent. These notes also have the potential for capital gains if interest rates continue to decline and you decide to sell them on the secondary market before maturity.

Treasury Note Interest Rates

I-Savings Bond Rates

I Bonds issued November 1, 2024, to April 30, 2024, earn 3.11%. This includes a 1.2% fixed rate. You can’t cash them in for one year. Plus, if you redeem them within the first five years you lose three months’ interest.

If the I Bonds you purchased previously didn’t have a fixed rate, you will only earn the inflation rate when the new rates are announced for the next six months. I Bonds with a high fixed rate are a great buy, some of my early I Bonds have a 3% fixed rate and are currently earning 5.33%. Here is a table [9] that shows what I Bonds are earning today based on the date of purchase.

Many I-bonds were sold with a zero fixed rate, which can dramatically reduce returns as the inflation rate decreases. On the flip side, when the inflation rate goes negative, like it did in the late 1990s, I-bonds don’t decrease in value.

Dissecting DOGE – Purpose and Process explained [10]

Market Observations

Considering the uncertainty around tariffs and other factors, the stock market has been on a roller coaster ride this past month. Brokerage accounts invested in equities have suffered the most while we wait for stability to return.

This highlights the necessity for those planning their retirement and retirees to consider more stable fixed-income investments, as outlined above. This is especially true if the stock market is keeping you up at night [11].

Summary

The rule of 100 still applies for those approaching retirement. Subtract your age from 100, and the remainder is what many financial planners consider a conservative investment mix to reduce risk as we age. For example, if you are 65, according to this formula, you should have only 35% of your retirement portfolio in stocks, with the rest in bonds, money market accounts, and cash.

I still prefer to invest in the safety of Treasuries, CDs, conservative stocks, mutual funds, and market leaders that have been around for many decades, pay dividends, and have sound fundamentals. Many retirees set aside a small portion of their investments for the more aggressive growth stocks, mutual funds, and ETFs of the day.

CDs and Treasury Notes are viable options if you can lock up your discretionary savings and investments for 12 months or longer. As noted on the above charts, Treasury Bill rates are moderating down a bit.

Short-term T-Bills continue to provide impressive yields, considering many banks still low ball their savings rates for established accounts. These banks are betting on the reluctance of many to move funds from their savings and checking accounts elsewhere.

Helpful Retirement Planning Tools

Federal employees and recent retirees with security clearances can

search thousands of high-paying defense and government contractor job [12]s.

- Financial Planning Guide for Federal Employees and Annuitants [13]

- TSP Guide [14]

- Budget Work Sheet [15]

- Retirement Planning for Federal Employees & Annuitants [16]

- The Ultimate Retirement Planning Guide – Start Now [17]

- Deciding When To Retire – A 7-Step Guide [18]

- 2025 Federal Employee’s Leave Chart [19]

- Medicare Guide [20]

- Social Security Guide [21]

[22]

[22]Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide [23] - February 19th, 2026

- Online Retirement Application (ORA) Update [24] - February 13th, 2026

- The End to the Silver Script Madness – News Flash [25] - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) [26] - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update [27] - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! [28] - January 15th, 2026

- Tax Forms Availability – What to Expect This Year [29] - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook [30] - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option [31] - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup [32] - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? [33] - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide [34] - November 6th, 2025