My article, titled “TSP Traditional to ROTH IRA Conversions Coming Soon [2],” has one area that needs further clarification and one typo under the “Benefits and Timing” heading. Additionally, I had intended to address the income tax impact in a separate article; it is included here for convenience.

I illustrated how much a couple with total taxable earnings of $112,000 this year could convert to a Roth IRA without increasing their Medicare premiums. Here is the corrected paragraph:

If your current joint income in 2025 from all sources is approximately $112,000, converting up to $100,000 to a Roth will keep you in the first Medicare IRMAA bracket [3] of $212,000. Your Medicare premium would be $185. Single filers are limited to an income of $106,000 before going to the next premium tier.

IRMAAs and AGI

The Income-Required Monthly Adjustment Amount (IRMAA) is a premium surcharge applied to higher-income Medicare beneficiaries. It applies to participants in original Medicare and Medicare Advantage plans.

Medicare premiums are determined by adding the following tax-exempt income back to your Adjusted Gross Income (AGI), creating the Modified Adjusted Gross Income (MAGI) that is used for determining your IRMAA:

- Untaxed foreign income that was excluded from your gross income.

- Tax-exempt interest from sources such as municipal bonds.

- The portion of your Social Security income that isn’t taxed.

The Two-Year Lookback

The last paragraph in the Benefits and Timing section had a typo stating that Medicare premiums for 2026 are calculated based on your 2025 income tax return, so you wouldn’t pay a higher Medicare premium until 2027 if you entered a higher tier.

Medicare premiums are determined from your tax return two years back, so it should have read as follows:

Medicare premiums for 2026 are calculated based on your 2024 income tax return. You wouldn’t pay a higher Medicare premium until 2027 if you entered a higher tier this year.

Another clarification includes the limits for both single and joint filers, stating that care must be taken because any amount exceeding the $106,000 limit for those filing individual tax returns and $212,000 for those filing joint returns would result in increased Medicare premiums. Therefore, it’s best to underestimate to avoid increased premiums.

The Pensioned Americans Retirement Company (PARCO) specializes in issues like this to help federal employees and annuitants successfully manage their retirement benefits [4]. They provide the support you may need to maximize the benefits that you have earned over the course of your career.

Income Tax Bracket Consideration

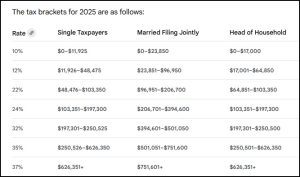

If your Roth contribution causes your income to exceed the current tax bracket you are in, your federal tax rate would increase. The federal income tax rates for 2025 remain unchanged from those for 2024: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

In the illustration from the previous article, a joint filing with $112,000 of taxable income in 2025 could convert $100,000 to a Roth IRA without increasing their Medicare Premium in 2027.

A married couple filing jointly would be in the 22% tax rate with $112,000 of taxable income. However, their tax rate would increase to 24% if they converted the full $100,000.

If they reduced their Roth conversion to $94,000 or less, their federal tax rate would stay at 22%. It’s best to contribute less than the maximum in case your taxable income rises unexpectedly due to increased mutual fund annual distributions, RMD increases year-over-year, savings bond interest, or interest and dividend income.

Regardless of the impact on your Medicare premiums or whether or not you end up in a higher tax bracket, whatever you transfer to a ROTH is fully taxable in the year you convert a part of your Traditional TSP to a ROTH.

Let PARCO help you determine how much to convert to a ROTH and when [4].

Input Appreciated

I want to thank Marty and Gerry for bringing this to my attention. I updated our blog article [2] to incorporate these changes. Please keep your feedback coming.

Update – Reduced Schedule

You may have missed this in a previous article, and I wanted to mention it again here. I intend to reduce the frequency of my blog and email newsletter posts to twice a month, and it’s time to settle into the life of a retiree and enjoy what is yet to come. If something pressing arises, such as this issue, I may still publish brief announcements between bi-monthly posts to keep everyone informed of significant events or changes that are forthcoming.

Please continue to send your questions and comments. I derive my articles from the input you submit. It’s been a pleasure providing this service for the past 21 years, and I hope to continue on a reduced schedule in the future.

Helpful Retirement Planning Tools

[5]

[5]- Financial Planning Guide for Federal Employees and Annuitants [6]

- TSP Guide [7]

- Free Retirement Planning Report [8]

- Budget Worksheet [9]

- Retirement Planning for Federal Employees & Annuitants [10]

- The Ultimate Retirement Planning Guide – Start Now [11]

- Deciding When To Retire – A 7-Step Guide [12]

- 2026 Federal Employee’s Leave Chart [13]

- Medicare Guide [14]

- Social Security Guide [15]

[16]

[16]The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Federal Employee News: 2026 Pay, Benefits, and More [17] - March 6th, 2026

- Protecting Your Retirement Nest Egg – Fixed Income Update [18] - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide [19] - February 19th, 2026

- Online Retirement Application (ORA) Update [20] - February 13th, 2026

- The End to the Silver Script Madness – News Flash [21] - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) [22] - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update [23] - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! [24] - January 15th, 2026

- Tax Forms Availability – What to Expect This Year [25] - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook [26] - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option [27] - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup [28] - December 2nd, 2025