Last January, the Federal Reserve kept the fed funds rate steady at the 4.25%-4.5% range, pausing its rate-cutting cycle after three consecutive reductions in 2024. During their July 2025 meeting, they decided to continue the pause in the interest rate-cutting cycle that began in September 2024.

After Chairman Powell’s announcement, the DOW Index dropped over 700 points by the end of the week. Investors were hoping for an interest rate decrease of at least a quarter point.

This rate-cutting pause could hold short-term at least until September. Some economists are anticipating two rate cuts by the end of the year. However, the Federal Reserve board is driven by data, and no one has a crystal ball foretelling the economy’s performance and future job reports.

While the stock market offers the potential for higher gains, it doesn’t come without risks for those approaching retirement and retirees, even as the market has reached new highs several times in July.

Treasury Bill Rates Still Attractive

According to the FDIC, the national average yield on savings accounts has dropped to 0.38% APY. However, high-yield savings accounts are offering rates up to 4% or more. It pays to look around for higher yields or consider short-term Treasury Bills.

The average savings account rate would earn just $38 per $10,000 savings for the entire year, and a 4% yield would earn $400 for the year. Quite a difference.

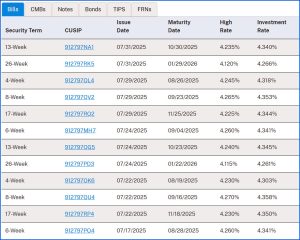

Short-term Treasury Bills are still attractive. You can select auto reinvestments for up to two years, and these can be canceled at any time if the funds are needed. The rates change for each new issue. However, the shorter-term (4, 8, 13, and 17-week) Treasury Bill yields have averaged 4.3 percent over the past year, and the 10-year Notes recently yielded 4.39 percent.

Although the Federal Reserve intends to reduce rates over time as conditions warrant, Treasury Bills continue to earn attractive yields. Treasury interest payments aren’t subject to State taxes, a tax savings for all.

Treasury Bill Investment Rates

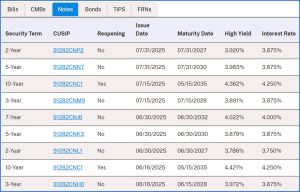

Treasury Note Investment Rates

It is generally recommended to purchase Notes and Bonds through your broker, and I personally limit my purchases to new-issue bonds.

Treasury Notes and Bonds must be sold on the secondary market. If you purchased them from Treasury Direct and decide to sell them before maturity, they must be transferred to your brokerage account. This can take several weeks to a month or longer in some cases.

A 20-year Treasury Bond with a 5 percent coupon, yielding 4.9355 percent, was available from the Treasury last week, as noted in the following table. Some buy long-term bonds on the assumption that interest rates will fall later this year or early next year, while locking in a rate just under 5 percent. Rates could go either way depending on various factors; you never know what changes will influence the market.

There is a significant risk to long-term bonds; they are highly rate-sensitive, and bond prices move inversely to interest rates. If bond yields decline, the value of existing bonds on the market increases. If bond yields rise, existing bonds lose value.

The value of a 20-year Treasury bond will change approximately 20% for every 1% change in interest rates. Therefore, a 2% rise in interest rates would cause the bond’s value to fall by roughly 40%, while a 2% decrease would cause the bond’s value to rise by roughly 40%.

This is significant, especially if you will need to tap these funds. However, if you keep the bond to maturity, there is no risk; you will collect the specified yield through the bond’s term, and your entire initial investment will be returned to you after the bond matures. Interest is paid semiannually.

As a 20-year bond approaches its maturity, its remaining term shortens, decreasing its duration. This makes it less sensitive to interest rate moves. For example, a 20-year bond held for 10 years would have a 10-year duration. Consequently, a 1% change in interest rates would result in a 10% change in the bond’s value.

Treasury Bond Investment Rates

Purchasing Treasury Bills, Notes, and Bonds

Visit TreasuryDirect.gov [3] to register, explore the options, and purchase Treasury bills, notes, bonds, TIPS, and savings bonds. You are buying directly from the government and eliminating the middleman; no fees are charged for purchases.

Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; they can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

- Treasury Bills In-depth [4]

- Treasury Notes In-depth [5]

- Treasury Bonds In-Depth [6]

- Treasury rates (Yields) [7]

- Auction schedule [8]

Note: If you buy a long-term Treasury Note or Bond, you can only sell it on the secondary market through a brokerage house. If you purchase Notes and Bonds on Treasury Direct, you must transfer them to your private brokerage account to sell them before the maturity date. I only purchase long-term Treasuries through my broker in case I need to sell them before maturity.

CDs and Savings Bonds

Many banks and credit unions are offering competitive rates for savings accounts and CDs, from 3.5 percent to higher in many cases. Rates are not falling as quickly as the Fed anticipated, and I’m still rotating savings through short-term T-bills at attractive rates. CDs have no market risk if you stay under their insured FDIC limits.

Treasury Notes currently offer anywhere from 3.75 to 4.25 percent. The shorter the duration of the Note you purchase, the less sensitive it is to interest rate changes. For example, if you purchased a 5-year Treasury Note, a 2% rise in interest rates will cause the Note’s price to fall, while a 2% fall in interest rates will cause the Note’s price to rise.

The price change depends on the Note’s duration, which is approximately 4.5 years for a 5-year note. Generally, a 1% change in interest rates results in a price change of roughly 1% for each year of duration or 4.5% in this example.

Here is What’s in the President’s New Spending Bill [9]

I-Savings Bond Rates

I Bonds [10] issued from May 1, 2025, to October 30, 2025, are earning 3.98%. This includes a 1.1% fixed rate. You can’t cash them in for one year. Plus, if you redeem them within the first five years, you lose three months’ interest.

If the I Bonds that you purchased previously didn’t have a fixed rate, you will only earn the inflation rate when the new rates are announced for the next six months. I Bonds with a high fixed rate are a great buy; some of my early I Bonds have over a 3% fixed rate and are currently earning 5.88%. Here is a table [11] that shows what I Bonds are earning today based on the date of purchase.

Many I-bonds were sold with a zero fixed rate, which can dramatically reduce returns as the inflation rate decreases. For example, I Bonds issued between May and October of 2022 were paying 9.66%. However, they had a 0% fixed rate; those same bonds are now paying 2.86%. They can be cashed in and the funds reinvested in higher-yielding short-term Treasuries or CDs. The Treasury will charge a 3-month interest penalty for any I bond under 5 years old.

On the flip side, when the inflation rate goes negative, like it did in the late 1990s, I-bonds don’t decrease in value.

Market Observations

The stock market has been on a winning streak lately, hitting new highs throughout July. For the most part, we have all seen our TSP, other retirement, and taxable accounts increase in value, sometimes dramatically. The market is like a roller coaster cycling up and down based on political stability, company profits, employment figures, CPI, inflation, and so many other factors, too numerous to mention.

This highlights the necessity for those planning their retirement and retirees to consider more stable fixed-income investments, as outlined above. This is especially true if the stock market is keeping you up at night [12]. We are elated when the market is up and depressed when it goes down, as evidenced by our most recent monthly account statements.

Summary

The rule of 100 still applies for those approaching retirement. Subtract your age from 100, and the remainder is what many financial planners consider a conservative investment mix to reduce risk as we age. For example, if you are 65, according to this formula, you should have only 35% of your retirement portfolio in stocks, with the rest in bonds, money market accounts, and cash.

I still prefer to invest in the safety of Treasuries, CDs, conservative stocks, mutual funds, and market leaders that have been around for many decades, pay dividends, and have sound fundamentals. Many retirees set aside a small portion of their investments for the more aggressive growth stocks, mutual funds, and ETFs of the day.

CDs and Treasuries are viable options if you can lock up your discretionary savings and investments for a period of time. As noted on the above charts, Treasury Bill have been holding fairly steady this year.

Short-term T-Bills and Bonds continue to provide impressive yields, considering many banks still low-ball their savings rates for established accounts. These banks are betting on the reluctance of many to move funds from their savings and checking accounts elsewhere.

Helpful Retirement Planning Tools

[13]

[13]- Financial Planning Guide for Federal Employees and Annuitants [14]

- TSP Guide [15]

- Free Retirement Planning Report [2]

- Budget Worksheet [16]

- Retirement Planning for Federal Employees & Annuitants [17]

- The Ultimate Retirement Planning Guide – Start Now [18]

- Deciding When To Retire – A 7-Step Guide [19]

- 2025 Federal Employee’s Leave Chart [20]

- Medicare Guide [21]

- Social Security Guide [22]

[23]

[23]The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide [24] - February 19th, 2026

- Online Retirement Application (ORA) Update [25] - February 13th, 2026

- The End to the Silver Script Madness – News Flash [26] - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) [27] - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update [28] - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! [29] - January 15th, 2026

- Tax Forms Availability – What to Expect This Year [30] - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook [31] - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option [32] - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup [33] - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? [34] - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide [35] - November 6th, 2025