Posted on Friday, 6th May 2022 by Dennis Damp

Print This Post

Print This Post

Wild stock market swings and volatility in all sectors is causing investors to pause. Our retirement accounts are on the block and as inflation continues on its rampage, investors seek safe harbors to wait out the storm. Unfortunately, we are in for quite a ride.

Our recent trip down south was an eyeopener every time we stopped to fill up along the way. Locally I paid $4.28 a gallon for gas this week!

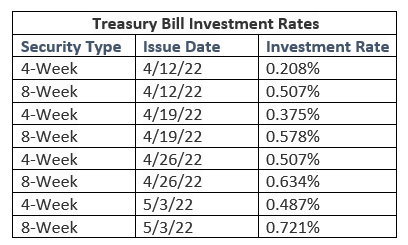

There are a few bright spots that will at least help to alleviate some of the pain. Our COLA next year is expected to be one of the highest in decades and I-Bond yields are increasing dramatically as well. Treasury bills and notes are also rising as the Federal Reserve increased interest rates another .5% last week.

Banks are flush with cash due to their savings account owner’s inability to find better rates of return. They issue loans based on these dormant funds; banks and credit unions get away with paying us almost nothing for that privilege.

Investing in I-Bonds and Treasuries provide ways for all of us to earn a substantially higher rate of return on a portion of our savings and fixed income investments. The current I-bond rate is 240 times greater than my local banks .04% rate and the recent 8-week Treasury Bill’s rate of 0.721% rate is 18 times higher.

I-BOND COMPOSITE RATE

As of May 1st, I-Bond owners are now receiving the new Composite Rate of 9.62%. You will receive this rate for a full six months from the date of purchase resulting in an 8.37% rate over a twelve-month period. The previous six-month rate was 7.12%. There are few places today where you can earn high yields guaranteed by the US Government.

A $100,000 investment in I-Bonds will earn $8,370 for this 12-month period compared to just $40 at my local bank that is paying a meager .04% yield! Banks aren’t inclined to pay fair and reasonable rates. This is why I moved much of our savings to Treasury Bill ladders this year.

I started buying I bonds in 1999 and purchased my first $1,000 I-Bond in May of 2000. It is now worth $3,408 and earning 10.64%! A comparable EE bond that I purchased in January of that year, at half face value, is worth $1,078 and earning .77%. I stopped buying EE bonds that year.

My article on I-Bonds discussed the limits and options that you have to purchase these investment gems.

PAPER I-BONDS

I was able to purchase additional paper I-Bonds this year! Yes, you can still buy up to $5,000 a year in paper I-bonds but only with your income tax refund. Last year I purposely overpaid my estimated quarterly federal income taxes with the intention of taking advantage of this loophole. It worked; the Treasury sent me 12 paper bonds in the mail! They sent a mix of bonds ranging from as low as $50 to as high as $1,000.

I was expecting one to five bonds, not 12 all sent in a separate envelope through regular mail. They may be using the paper bonds they had on hand and sent whatever was available.

TREASURY BILL LADDERS

There are ways to Ditch Your Bank’s Low Rates and earn considerably higher yields. I use Treasury Bill ladders to ensure I have sufficient cash available when needed and am earning a reasonable yield. Treasury Bill ladders are an excellent option when interest rates are increasing.

A Treasury Bill ladder is a savings strategy where you invest in several Bills with staggered maturities to take advantage of higher yields. They also provide cash, if needed, at recurring intervals. With the Federal Reserve set to raise rates several more times in 2022 this strategy is a viable and attractive option.

Four or eight-week bills can be used for funds that need to be available at recurrent intervals. A 4-week bill ladder consists of dividing the amount available by four and investing that amount weekly for four weeks. Short term bills are auctioned every Thursday with a settlement date the following Tuesday.

One fourth of your invested amount will be available weekly. Four-week bills can be reinvested through Treasury Direct for up to two years (24 times). You can stop reinvestments at any time and at maturity the full amount will be electronically deposited back into your designated bank account.

An 8-week bill ladder consists of investing half of your available funds in an 8-week bill and on the fifth week purchase another of equal value. Half of the funds would be available every four weeks at the new rate. Another option is to use 8 instalments, divide the available amount by eight and buy an 8-week bill each week for eight weeks. If you have $40,000 to invest, purchase a $5,000 bill for eight consecutive weeks. After the initial 8-week investment you will have $5,000 available each week. The 8-week notes pay a higher yield.

- NOTE: Check with your bank to see if there is a maximum number of monthly withdrawals and deposits from your savings and money market accounts. Regulation D, a Federal Reserve Board rule limits withdrawals and transfers to six each statement cycle. This rule was waived by the Federal Reserve during the pandemic. Many banks maintained the limit, while others increased the number of withdrawals and transfers permitted. Withdrawals through tellers at branch offices don’t count toward the six transfers or withdrawal limits each statement cycle.

TRESURY NOTES

Treasury Bills are a good way to earn a higher yield for a portion of your immediate savings that must be available for emergencies. Treasury Notes are longer term investments with 2, 5, 7, and 10-year durations. The 2-year note issued on 5/2/2022 yielded 2.5%! Just try getting that rate for a CD at any bank, an impossible task today. As the Federal Reserve raises rates Treasury yields typically follow suit.

Notes are purchased direct from the Treasury or through your stock brokerage account and interest is paid semiannually. If purchased through a broker, you can sell it on the secondary bond exchange before maturity, there is market risk and commissions to deal with when doing so. If interest rates are higher on new Treasury Notes when you sell, you could take a loss. If held to maturity, there is no market risk. Notes purchased through Treasury Direct must be transferred to a broker if you wish to sell them before maturity.

There are other considerations when buying notes. Read the detailed Treasury Note information available on their website.

I-BONDS VERSES TIPS

I-bonds can only be purchased direct from the Treasury and have a fixed and variable inflation rate. They protect us from inflation by adjusting their variable inflation rate semiannually based on changes in CPI. Interest is earned on the bond every month and is compounded semiannually, twice a year. The interest the bond earned in the previous six months is added to the bond’s principal value; then, interest for the next six months is calculated using this adjusted principal.

Purchases of I-bonds are limited to $10,000 per person yearly through Treasury Direct and an additional $5,000 in paper bonds if you have an income tax return due at the end of the years.

The interest rate on TIPS stays constant for the life of the bond. The face value of TIPS is adjusted based on CPI and the fixed interest rate of the bond at issuance is then applied to the adjusted face value.

The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When TIPS mature, you are paid the adjusted principal or original principal, whichever is greater.

TIPS can be bought and sold through your stock broker without any purchase limits. They are also available via mutual funds and ETFs.

TREASURYDIRECT.GOV

Many are hesitant to purchase Treasury Bills and Notes online through TreasuryDirect.gov. I understand the hesitation, unlike brokerage accounts they don’t send out monthly statements; you have to print the website screens to have documents for your files and estate plans. Tax forms are also downloaded from the site and not sent via regular mail. However, you are buying direct from the government and eliminating the middleman; there aren’t any fees charged for purchases. Here is more information on the Treasury’s programs:

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances. Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. Consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Too Much too Soon & Cable TV Subscription Costs - July 26th, 2024

- The Art of Downsizing – Why, Where, & When? - July 12th, 2024

- 2025 COLA Estimates & Retirement Processing Update - June 28th, 2024

- The 2024 Election - Voting Early This November - June 15th, 2024

- These Boots Are Made for Walking – That’s Just What I'll Do! - May 26th, 2024

- Federal & Postal Employees Health Benefits Update - May 17th, 2024

- Postal Service Health Benefit (PSHB) Providers Announced - May 3rd, 2024

- Down But Not Out – Imagine if This Was You! - April 12th, 2024

- Is Working in Retirement A Necessity Today? - April 5th, 2024

- Retirement Progression – One Day at a Time to Infinity - March 15th, 2024

- Fixed Income Investment Update – Bonds & More - March 8th, 2024

- Updated Guidance, Clarifications, & Observations - February 23rd, 2024

Posted in ESTATE PLANNING, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (2)

Print This Post

Print This Post

May 16th, 2022 at 10:45 am

Great information I stumbled across -would like more -Thanks!

May 16th, 2022 at 11:00 am

Mary, I suggest subscribng to my federal employees retirement planning newsletter. All of the articles on this blog are originally sent to our email newsletter subscribers. Here is also a master list of all artilces that you can review.