Posted on Friday, 2nd November 2018 by Dennis Damp

Print This Post

Print This Post

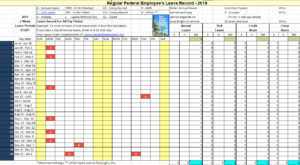

Each year we publish a comprehensive leave record that federal employees can use to track their daily record of annual and sick leave, comp, and credit hours used. Our updated 2019 Excel Leave Chart is designed for active federal employees that are planning their retirement and need to establish realistic target retirement dates. The new Excel 2019 Leave Record Spreadsheet also helps federal employees maximize their annuity through prudent management of their leave balances.

Please share our 2019 leave chart with everyone in your organization. The chart tracks all leave balances and you are able to annotate your work schedule on the chart as well.

A Microsoft Office consulting firm advised us that If the spreadsheet only opens in the protected view status security settings on your agency’s LAN and network will have to be made by your IT staff to allow the form to function. Some agencies increase their security settings to lock out certain documents based on the parameters the IT specialist selects. We do include several hyperlinks in our spreadsheet to link users to additional supporting information such as our sick leave conversion chart and that may be the cause. If you have this problem when opening the form I suggest talking with your IT people to have them allow the form to pass without restrictions.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

- Retirement Planning Guide

- Financial Planning Information

- Thrift Savings Plan

- Master Retiree Contact List (Important contact numbers and information)

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- 2018 Federal Pay Tables

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS | Comments (0)

Print This Post

Print This Post