Posted on Friday, 26th August 2022 by Dennis Damp

Print This Post

Print This Post

Forward this to others that may find this information helpful.

They can sign-up to receive my free Retirement Lifestyle Newsletter.

Our updated excel annuity calculator spreadsheet projects your annuity and maximum survivor benefit growth through 2061 using an estimated average annual Cost of Living Adjustment (COLA). This calculator was developed by Frank Cullen, an old friend. We both retired from federal service many years ago.

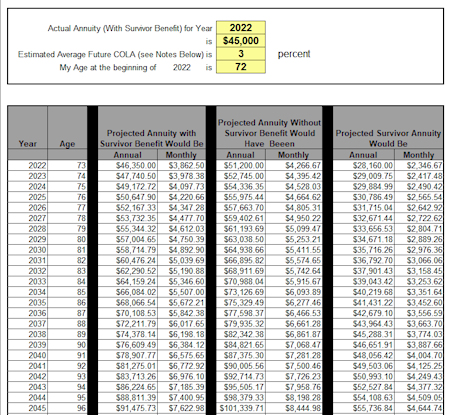

Projected CSRS / FERS Annuity Calculator (Sample)

(Enter your estimated annuity and Average COLA)

In the sample chart above, the retiree’s annuity increases 81% over the next twenty years with a projected average COLA of 3%. This estimate could be conservative considering the runaway inflation we are experiencing now and for the foreseeable future. If stagflation takes hold, as many economists expect, the average annual COLA could be higher.

Those planning their retirement can use this spreadsheet to estimate the growth of their annuity and their spouse’s survivor benefit over time. Use your actual annuity or estimates you receive from your human resource office, if still employed, for these projections.

Deciding When To Retire – A 7-Step Guide

This spreadsheet, originally developed for CSRS retirees, accurately determines your projected monthly and annual annuity, based on an estimated average COLA growth rate, with and without survivor benefits for 40 years and your survivor’s annual and monthly annuity. FERS retirees can use this spreadsheet with minor adjustments as noted below and on the excel form.

Current federal employees doing advanced planning can use our FERS Annuity Calculator or CSRS Annuity Calculator to estimate what their annuity would be for various target retirement dates.

A list of annual COLAs going back to 1975 for CSRS and to 1995 for FERS is provided on the spreadsheet and includes the average 2, 3, 5, 10 and 47-year COLA average growth rate to give you an idea of what to use for your estimate.

When I ran my numbers back in 2004, I used 2.5% and my annuity and survivor’s projections were close to the chart’s results for the 17 years I’ve been retired. The average COLA over the past 47 years is 3.68%, during this period COLAs ranged from as low as 0% for two years to as high as 14.3% in 1980! This year’s COLA was 5.9% for CSRS and 4.9% for FERS. The COLA for 2023 is expected to be even higher.

Projected Annuity Calculator (Download the Excel Spreadsheet)

Download and use the Projected Annuity Calculator to determine your potential annuity growth for you and your spouse. Enter your personal information in the 4 yellow blocks provided: the year you retire, annuity, an estimated average COLA, and your age at the beginning of the year. If the Excel chart opens in protected mode, click on “enable editing” at the top of the spreadsheet.

FERS EMPLOYEES

For FERS employees the projected annuity without survivor benefit will be the same; just enter your annuity or annuity estimate, age, year of retirement, what you consider to be a realistic COLA growth rate, and the spreadsheet will calculate your annuity for the next 40 years! The column reserved for your projected annuity with survivor benefits will be lower since the maximum spousal benefit is 50% for FERS, not the 55% for CSRS.

To calculate the FERS survivor’s benefit, multiply the “Projected Annuity Without Survivor Benefits” by .50 and then divide this number by 12 to determine the monthly survivor benefit. For example, in the chart above multiplying the first row’s 2022 “Projected Annuity Without Survivor Benefits” of $51,200 by .50 equals $25,600. Dividing this by 12 provides your spouse with a monthly annuity of $2,133.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Master Retiree Contact List

- Budget Work Sheet

- TSP Guide

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Social Security Guide

- Survivor’s Checklist (pdf)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Tags: Annuity Calculator, Annuity Projections, CSRS Annuity Projections, FERS Annuity Projections

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post