Posted on Friday, 15th November 2024 by Dennis Damp

Print This Post

Print This Post

If your income has or will increase due to Required Minimum Distributions (RMDs) or accrued interest, dividends, and capital gains from your cash and investments, review the Part B and D IRMAA premiums listed below.

Income-Required Monthly Adjustment Amounts (IRMAAs) make Medicare Advantage Plans less attractive, even though they provide Part B subsidies.

The Centers for Medicare & Medicaid Services (CMS) released the 2024 premiums for Medicare Part A and Part B on November 8, 2024, and the 2024 Medicare Part D income-related monthly adjustment amounts.

The 2025 Part B standard premium and deductible increase is mainly due to projected price changes and assumed utilization increases consistent with historical experience.

Part B Premiums

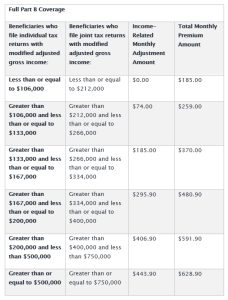

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. As noted below, you will pay more if your income exceeds certain levels.

The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, an increase of $17 from the annual deductible of $240 in 2024.

The following charts show the Income Required Monthly Adjustment Amount (IRMAA) that will be deducted from your Social Security Check or billed quarterly for those not collecting Social Security. You will also be billed quarterly if your Social Security monthly benefit is insufficient to pay these premiums.

CAUTION: Your Medicare Part B and D premiums may vary year to year based on IRMAA and how it is calculated. When your income increases due to capital gains distributions, interest, and dividend income, you may end up in a higher bracket.

Part B & D IRMAAs

A beneficiary’s Part B and D monthly premium is based on their income. IRMAAs affect roughly 8 percent of people with Medicare Part B and D. These individuals will pay the income-related monthly adjustment amount and their Part B & D premiums.

Medicare Part B Income-Related Monthly Adjustment Amounts

- high-income beneficiaries who only have immunosuppressive drug coverage

- Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return, and for

- Premiums for high-income beneficiaries with immunosuppressive drug-only Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return.

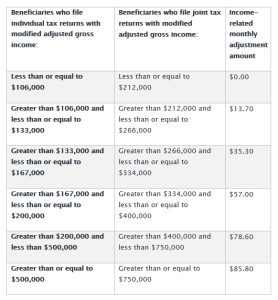

Medicare Part D

A beneficiary’s Part D monthly premium is also based on their income. Part D premiums vary by plan, and regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare.

Summary

Your 2023 earnings determine next year’s IRMAA. Medicare uses your Modified Adjusted Gross Income (MAGI) from two years back to determine where you fall in the above tables. For 2025, they will use your 2023 MAGI as determined by your tax return for that year.

MAGI is your AGI with some deductions, such as interest earned on Municipal Bonds, savings bond interest, and other exempt income added back in.

When you add up all the premiums we pay for healthcare, they can be excessive, especially considering IRMAAs. It’s wise to explore lower-cost FEHB / PSHB healthcare plans to reduce costs as long as your services aren’t compromised. Explore all available options this open season.

Medicare Advantage Plans often offer lower costs and include Part B subsidies. Their comparable vision and dental care may allow federal employees and annuitants to drop their Federal Employee’s Dental and Vision Plan (FEDVIP) insurance.

Suppose you are considering a Medicare Advantage Plan with Part D or a Medicare Prescription Drug Plan (MPDP) option offered by your FEHB/PSHB providers. In both cases, you will be subject to IRMAAs on Parts B and D if your income exceeds the limits listed in the charts above.

Helpful Retirement Planning Tools

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- FREE Retirement Planning Report

- How to Avoid Retirement Processing Delays (UPDATE)

- Financial Planning / TSP

- Budget Work Sheet

- 2024 Pay Tables

- 2025 Federal Employees Leave Record

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

Tags: 2025 Medicare IRMMAs, 2025 Medicare Premiums, Income Required Monthly Adjustment Amount, IRMMA, Medicare Premiums

Posted in BENEFITS / INSURANCE, EMPLOYMENT OPTIONS, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION, WELLNESS / HEALTH | Comments (0)

Print This Post

Print This Post