Posted on Saturday, 20th November 2021 by Dennis Damp

Print This Post

Print This Post

Updated 11/23/2022

My recent article titled “GEHA Standard to BCBS Basic Plan Comparison – 2023” stated that Federal Employees Health Benefits (FEHB) Medicare Advantage (MA) plans could possibly save you even more.

These plans were introduced as new options in the FEHB program over the past several years. Many federal employees and annuitants are curious about how they work, are they truly less costly, provide comparable benefits, and provide a viable option for what so many of us have been enrolled in for years?

I was pleasantly surprised with some reservations after several days of research and spending hours on the phone with the Aetna customer service representatives. I focused on the Aetna Medicare Advantage Z26 plan that offers national coverage and incidentally had the lowest premium cost for self + one enrollments among national plans offering this option. This plan’s monthly premium is $275 for their Self + One option and they reimburse your Medicare Part B monthly premium by $75 per enrollee. Your Social Security check actually increases $75 a month! Some plans reimburse even more of your Part B premiums.

The Basics

You can get your Medicare benefits through Original Medicare (parts A and B), or a Medicare Advantage Plan (Part C). If you have Original Medicare, the government becomes your primary health care provider and pays for most medical costs when you get hospital or physician services covered by Medicare. Your FEHB plan becomes your secondary provider and pays most of what Medicare doesn’t.

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. Medicare pays these companies to cover your Medicare benefits. Most importantly, MA plans provide a catastrophic expense protection, unlike traditional Medicare. In return for their additional benefits, most of these plans use preferred provider networks and only pay 100% of your medical expenses if you use one of these providers. But as discussed below, the Aetna Medicare Advantage MA plan contains no such limitation.

Most Medicare Advantage Plans also include Medicare prescription drug coverage (Part D). In many of these plans you pay nothing in addition to your Part B premium to get catastrophic expense protection, prescription drug benefits, and even more. In some of these plans, you pay a small additional premium, usually no more than the equivalent of a month or so of the Part B premium, to get these additional benefits. You usually pay one monthly premium for the plan’s medical and prescription drug coverage. This is how this Aetna plan covers prescriptions, more on this later. For clarification, most federal annuitants aren’t enrolled in Medicare Part D drug coverage, and you don’t have to enroll in Part D to participate in these MA plans. The plans cover this.

To convert to one of the MA plans offered within the FEHB program you must be enrolled in Medicare Part A and B and a FEHB Plan that offers a Medicare Advantage option. In my case I could change my enrollment this open season to the Aetna Advantage Z26 Plan and shortly after, typically three days later, call Aetna to register for their Medicare Advantage option. The reason for the three-day delay is that it takes time for OPM to compile plan changes and post them.

Another revelation, Aetna doesn’t charge a fee for its FEHB MA option! You simply pay the $275 monthly premium for their Z26 plan! It costs nothing to convert. Aetna will initially issue you an Aetna Advantage card and shortly after completing their two-step enrollment, you will receive an Aetna Medicare Advantage Part C card. You must use the Medicare Part C card when visiting the doctor’s office. Keep your original Medicare card handy encase you switch back to Traditional Medicare at an upcoming open season or if you trigger a Qualifying Life Event that warrants a plan change. During open season you can move back to a FEHB plan or possibly elect to enroll in another more cost effective FEHB sponsored MA plan.

Caution

FEHB Plans Offering MA Plans

Three of the FEHB’s Medicare Advantage plans are available nationally for all federal retirees with Medicare Parts A and B: Aetna Advantage, APWU High, and MHBP Standard MA plans. Many other MA plans from carriers including: UnitedHealthcare, Kaiser, and Humana are available in various parts of the country. For example, in the Washington DC area there are nine additional FEHB MA plans offered. (There are also two plans open nationally but only to annuitants with a prior work history in intelligence agencies or as rural carriers.)

How the Aetna Advantage MA Plan Works

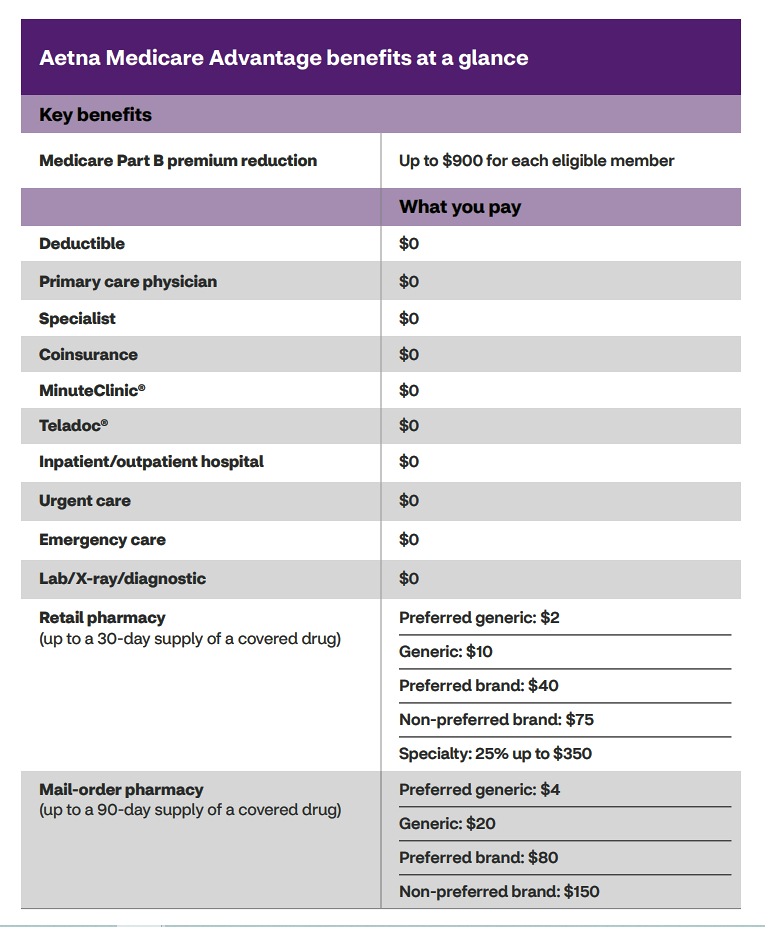

Federal Retirees with Medicare continue paying Part B premiums with this plan. The coverage is the same as Traditional Medicare but includes additional benefits such as $0 deductibles and prescription benefits. There are other programs available to help members maintain and improve their health including fitness membership, hearing aid reimbursement of up to $2,500, and more. One of the major benefits is the reimbursement of $75/month (up to $900/year) of your Medicare Part B premiums with the Aetna plan. For a Self + One or Family enrollment, if both of the spouses are enrolled in Medicare A and B, they each receive $900 a year towards Part B premiums. This is slightly less than half of the Part B premium for 2022 ($170.10 a month or about $2,040 for the year).

Aetna MA Benefits

Certain procedures require pre-certification.

They are marked with an asterisk in their brochure.

It was somewhat confusing reading the plan brochure and differentiating between their Aetna Advantage Plan and the Aetna Medicare Advantage Plan. Their Medicare Advantage plan is summarized in Section 9 of the plan brochure; review Aetna’s Medicare Plan Summary of Benefits Pamphlet and visit their online Medicare and You Guide for additional guidance.

It is my understanding, though not stated clearly in the brochure, that all the FEHB benefits of the FEHB-only Aetna Advantage plan (or MA plans of other carriers) remain in force. This means, for example, that a married annuitant with Parts A and B could enroll in Aetna Advantage’s MA plan, while his or her younger spouse without Medicare would get regular FEHB benefits provided by the Aetna Advantage plan.

Prescription Drugs

I checked all of the prescriptions that my wife and I use and they are not only covered by this plan but the copays are significantly lower for my asthma medications and others. For example, I just paid a $200 copay for Advair through GEHA, the Aetna plan copay would have been $40! A huge savings. Their copays are quite reasonable except for Tier 5 specialty drugs (high-cost/unique generic and brand drugs) where the copay is 25%, but not more than $350. This is true even when you reach Medicare’s Initial Coverage Limit (ICL) of $4,430.

The Coverage Gap starts once covered Medicare (Part D) prescription drug expenses have reached the Initial Coverage Limit. However, according to Aetna’s Medicare Plan Summary, “Your former employer/union/trust provides additional coverage during the Coverage Gap stage for covered drugs. This means that you will generally continue to pay the same amount for covered drugs throughout the Coverage Gap stage of the plan as you paid in the Initial Coverage stage. Coinsurance-based cost-sharing is applied against the overall cost of the drug, prior to the application of any discounts or benefits.”

Those enrolled in an FEHB MA plan are not impacted by the Medicare Gap and ICL. Your prescription drug copays will remain the same throughout the year regardless of any costs.

The following Gap discussion is included here as reference for those who are considering purchasing a Medicare Advantage plan that is not affiliated with a FEHB plan. Prescription drug copays may increase when in the GAP for those individuals.

For those in plans where the employer, union or trusts doesn’t pick up the additional costs while in the gap, the coverage gap begins after you and your drug plan have spent $4,430 on covered drugs in 2022. The total cost of each prescription, which includes the member copay and what the provider paid for the drug, is used to determine when your reach the ICL limit! Once you reach the coverage gap, you’ll pay no more than 25% of the cost for your plan’s covered brand-name prescription drugs until catastrophic drug coverage starts at $7,050. You’ll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail.

Although you’ll pay no more than 25% of the price for the brand-name drug while in the gap, almost the full price of the drug will count as out-of-pocket costs to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending. What the drug plan pays toward the drug cost (5% of the cost) and dispensing fee (75% of the fee) aren’t counted toward your out-of-pocket spending.

Medicare will pay 75% of the price for generic drugs during the coverage gap. You’ll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

Part B & D – Income-Related Monthly Adjustment Amounts (IRMAA) Payments

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. This is a nationwide Medicare requirement, not specifically related to the Aetna Advantage or any other MA plan.

Higher income retirees are also required to pay income adjusted Part D premiums. According to Medicare, you have to pay this extra amount if you’re in a Medicare Advantage Plan that includes drug coverage and your total income exceeds $91,000 for those filing an individual tax return or $182,000 for those filing a joint return. The extra Part B Premiums range from $12.40 to as high as $77.90 monthly based on 5 income brackets. Couples that are both on Medicare each pay this amount. Therefore, a couple’s overall Medicare cost will increase from $24.80 to $155,80 monthly! The income limits for the Part B premiums are identical to those for Part B. Something to be concerned about for sure.

Social Security will contact you if you have to pay Part B or D IRMAA, based on your income. The amount you pay can change each year. The extra amounts you have to pay aren’t part of your plan premium. You don’t pay the extra amounts to your plan. Most people have the extra amounts taken from their Social Security check. If the amount isn’t taken from your check, you’ll get a bill from Medicare or the Railroad Retirement Board. You must pay this amount to keep your Part B & D coverage. You’ll also have to pay both extra amounts if you’re in a Medicare Advantage Plan that includes drug coverage.

What Plans are Available in My Area?

To determine which plans are available in your area use the FEHB comparison tools or visit the plan websites listed in their brochures. Each of the comparison tools and company websites prompt you to enter your zip code and all offerings will show up and include national plans, HMOs, MA Options, and everything in between.

- The OPM’s Plan Comparison Tool includes much of the information you would need to make an informed decision with some limitations.

- the Consumers’ Checkbook 2023 Guide to Health calculates total healthcare cost for each plan option including your FEHB premium, your regular or income adjusted Medicare premium, any Part B reimbursements available, and likely cost-sharing, in addition to healthcare costs, it also calculates FEDVIP costs. This Guide is available in print and online formats and our site visitors can save 20% by entering promo code FEDRETIRE at checkout.

Find Aetna Advantage Medicare Health Care Professionals & Facilities in Your Area

Use their provider search service to determine if your medical providers are in their network. It is a little confusing to navigate. All of the doctors and the medical facilities we use are in their network. As a member of the Aetna Medicare Plan (PPO) with an Extended Service Area (ESA), you can receive services from any provider that is eligible to receive Medicare payment and is willing to treat you. This plan covers both in and out of network providers. (Not all FEHB MA plans cover out of network providers and this is a big plus for the Aetna plan.)

Enrollment Process for the Aetna Medicare Advantage Plans

You can see any provider that is licensed to receive Medicare payments. Selecting the Aetna Medicare Advantage plan does not change your FEHB premium or enrollment code. Retirees with Medicare Parts A and B may elect to join the Aetna Medicare Advantage plan by following the two-step enrollment process.

NOTE: You must complete this two-step process to avoid high deductibles required for the Aetna Advantage plan. This action changes your enrollment from their traditional FEHB offering to a Medicare Advantage Part C option.

Step 1:

Enroll as you normally would through the OPM Retirement website https://retireefehb.opm.gov/ or you can call 1-888-767-6738 (TTY: 1-800-878-5707).

Enroll using enrollment code Z24 for Self Only, Z26 for Self + 1, or Z25 for Family.

Step 2:

Provide Aetna with your Medicare information. Once you are enrolled through the OPM site, your basic information will be transferred to Aetna. (Please allow 7–10 business days.)

In addition, they will need the following to complete your enrollment in Aetna Medicare Advantage:

Your original Medicare effective date for Parts A & B

Your Medicare Beneficiary ID

You may go to www.aetnaretireehealth.com/FEHBP or call us at 1-866-241-0262 and give them this information. If you are over age 65, they will send you a reminder postcard.

For more information call Aetna Retiree Solutions at 1-866-241-0262 (TTY:711) or connect live with their team at www.aetnafedslive.com.

Summary

Overall, Aetna Medicare plan costs are reasonable; with the competitive prescription copays, low premiums, and Part B reimbursements it appears to be a viable option for many. If you are considering one of the FEHB MA plans confirm that your doctors and medical facilities accept the MA plan of interest. Higher income earners will have to weigh the increased cost of part D premiums and other factors to see if this plan makes sense for them.

Another low cost FEHB option is the Aetna Direct Plan N63. It isn’t a Medicare Advantage plan and includes an $1800 Medicare reimbursement. The reimbursement is handled differently, instead of your Social Security check increasing, you apply for reimbursement and they send you a check.

For those still working in federal service take advantage of the Flexible Spending Accounts offered under the FSAFEDS program during this open season or consider switching to one of the High Deductible plans with Health Savings Accounts for far larger tax savings, plus lifetime investment returns. You can save pre-tax dollars and spend them on health care, child care, dental, vision, and other expenses.

Aetna Contact and General Information

You have several options:

- Call Aetna at 1-855-277-4356 (TTY:711)

- Chat live with a health plan specialist or schedule an appointment for a one-on one phone consultation at AetnaFedsLive.com.

- Visit AetnaFeds.com/Advantage

- Medicare and You Brochure

- Review their Plan brochure

Editing Credits: I was fortunate to have Walton Francis, an expert in analysis and evaluation of public programs including Medicare and the Medicare Advantage program, review and edit this article. Francis along with Kevin Moss are associated with the Center for the Study of Services (CSS), a nonprofit organization, and the publisher of Consumers’ Checkbook and the Guide to Health Plans for Federal Employees.

Helpful Retirement Planning Tools

- Retirement Planning For Federal Employees & Annuitant

- The Ultimate Retirement Planning Guide – Start Now

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (2)

Print This Post

Print This Post

November 22nd, 2021 at 7:55 pm

I am 65 and currently have original medicare parts A&B and kept my FEHB plan in order to cover my wife who is not yet 65. If I switch to a Medicare Advantage plan not part of FEHB,

will I be able to keep both as before or will I have to cancel or suspend my FEHB?

Thanks

November 28th, 2021 at 7:05 am

There are several things to be concerned about. If you sign up for a MA plan that is not part of the FEHB you may be subject to the prescription drug gap. The MA plans that are part of the FEHB cover the shortfall when in the Part D gap, and your prescription copayments stay the same throughout the year as listed in their brochures. I just posted a correction to the first article I wrote on this subject that will help. Most FEHB plans that aren’t MA Part C plans waive your copayments, coinsurance and deductibles except for prescription drug copays. How this works, when you signed up for Medicare, Medicare becomes your primary provider and the FEHB plan is your secondary coverage. You must notify the FEHB plan you are enrolled in Medicare so they can make this change in your plan. Your FEHB plan pays most of what Medicare doesn’t. Your wife will remain in your existing FEHB plan and your FEHB plan is still her primary and only coverage since she isn’t in Medicare yet. When she signs up for Medicare you must notify your FEHB plan and after that her primary coverage will become Medicare; most FEHB plans waive your copayments when you sign up for Medicare. If you join a non FEHB Medicare Advantage plan you can suspend your FEHB coverage if desired. This will allow you to join the FEHB plan down the road at another open season. If you cancel it you can’t return. You don’t suspend your FEHB coverage if you sign up for a FEHB MA plan. Visit our Medicare page to find links to a number of articles I wrote on what to do when you turn 65, etc.