Posted on Wednesday, 29th April 2015 by Dennis Damp

Print This Post

Print This Post

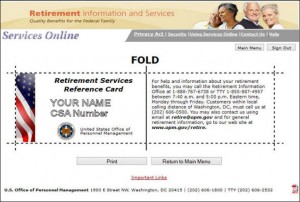

Up until recently the only way you could obtain a federal retirement ID Card, officially referred to as a “Retirement Services Reference Card,” was to call OPM and request a copy. They would send it in the mail and you would receive it in 5 to 7 business days. Recently OPM Services Online added a Retirement Services Reference Card printout function to their service. My card was damaged and instead of calling OPM I simply signed on to OPM Services Online and printed out a new copy. It only took 5 minutes. Here is a screen shot of my card with my name and ID number removed.

When I first printed the card it was too small. My print scale was set at 70%. If you reduce the size of your prints be sure to change it back to 100% before printing your card.

Herb Casey, one of our quest writers, wrote a comprehensive article titled “Connect to OPM Retirement Services Online” that walks you through the site and explains how to get connected. I use this service to printout my 1099-R income tax form at the end of the year. It is sent in the mail but I like to get a jump on my taxes and it is available online and easy to print out. It is often difficult getting through to OPM’s retirement hot line so I use this service whenever I can to change allotments, print out annuity statements and verification of your FEGLI insurance coverage, and other features.

Hearing is Believing

In my article titled “Did You Hear That? A fitting End to a Frustrating Problem” I discuss how it is difficult for many, especially retirees – older folks, to hear the TV clearly and the solution I discovered. Basically I purchased wireless capable hearing aids through Costco and a TV streamer that sends the TV sound direct to your hearing aids. The TV streamer works fine however the downside is that it drains the hearing aid batteries to the point that I was changing the batteries every other day! Also the fidelity of the streamer isn’t nearly as good as what a headset provides.

While researching alternatives online I discovered a sound solution. The web site 4homespeakers.com, a division of JMJ Supply LLC, specializes in the sale and support of wireless speakers, headphones, and hearing impaired devices. They tailor systems to provide a vast array of unique options to suit all of your hearing needs and more. I purchased their RCSA RF Wireless TV Speaker and Headphone Combo about six months ago and my wife and I use it daily. This package offers a wireless 900 MHZ transmitter system that allows you to hear the audio up to 150 feet away from the source. You get a headset with cradle and a small tower speaker for $129.99, now on sale for $79.99. I like the option of having the wireless speaker and headset for my wife and I. If you have dexterity or poor eyesight issues you may want to upgrade to a system with a charging base that you just set the headsets into and they automatically charge. With the system we have, that’s currently on sale, you have to plug in a small charging cable to the headset from the headphone cradle and the connection may be difficult to make if you have sight or dexterity issues.

The system we have, one of many they have available at very reasonable prices, is suited to our needs. My wife uses the headphones and I often use the speaker that is small enough to sit on an end table or on the floor by your chair. You plug the headset cradle into your TV’s audio out RCA jack and it drives both speaker and headset. If you don’t have a RCA audio out jack on your TV they have an analog to digital converter that connects your headset to the Toslink output and another options will connect your audio through a HDMI output. The converters are not included with the package. Check your TV to confirm what connection options you have before ordering. Their tech support can walk you through the setup if you are having problems.

Our TV has an RCA jack and it works fine as long as you turn up your TV audio so that the audio out of the RCA jack is sufficient to power the remote headset and speaker. When you plug in your headset to the RCA jack your TV speakers are turned off.

If you need two headsets or prefer separate small speakers at multiple locations they offer that as well. You will also find high fidelity options available that some prefer. I also purchased a RCA audio splitter that allows us to use two headsets if desired. The reason I ordered the headset and speaker combination is that I can turn off my speaker and read in the same room that my wife is watching TV without distractions. Another benefit of having a speaker is that when both of us have headsets on we can’t hear the phone or doorbell ring.

Check out their site to see what options are best for you. They have numerous videos that demonstrate how each system operates and connects to your TV.

Request a FREE Retirement Benefits Summary & Analysis. A sample analysis is available for your review. Includes projected annuity payments, income verses expenses, FEGLI, and TSP projections.

- Retirement Planning Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2015 Leave & Schedule Excel Chart (FREE Excel chart tracks actual leave balances)

- Survivor’s Guide

- Estate Planning Guide (An 11 part series that will help readers prepare for retirement, understand basic estate planning techniques, and compile their personal “Survivor’s Guide” binder.)

Visit our other informative sites

The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and financial information are subject to change. To ensure the accuracy of this information, contact relevant parties and ask them to review your official personnel file and circumstances concerning this issue. Retirees can contact the OPM retirement center. Our article is not intended nor should it be considered investment advice and our articles and replies are time sensitive. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in BENEFITS / INSURANCE, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS

Comments (0)|  Print This Post

Print This Post