Posted on Friday, 17th July 2020 by Dennis Damp

Print This Post

Print This Post

This is a challenging time for all and uncertainty abounds. When we listen to the morning news, we hear of new setbacks in our fight to get back to normal; whatever that may end up being. Unfortunately, we are fighting a war on several fronts: from the pandemic to national unrest, and fueled by a political divide. Many businesses, small and large, and their employees will eventually lose this battle, they don’t have the resources to remain in business if we don’t jump start the economy.

Our children are now the pawns in this ongoing war: should they be in school or shelter in place. What would cause less harm? That debate rages on and I can only hope that reason prevails. This situation impacts all of us.

I believe there are still many reasons to be hopeful, even with all of the confusion that surrounds us. America will persevere over time as we always have in the past. Life goes on with challenges but unabated for many while those in certain industries have many obstacles to overcome and are suffering greatly.

Observations

Many retirees never used an ATM, a bank drive through or wore a mask in public before the virus attacked. Masks are now mandatory and actually I don’t mind them to a certain extent, I look 15 years younger with my mask on; most couldn’t tell if I’m 55 or 71 when I’m wearing it! Who knows, I may get carded at Lowe’s the next time I buy a can of spray paint!

Prior to the arrival of COVID 19, retirees often preferred using cash unlike the younger generations that rely so heavily on their ATM and debit cards. I visited Walmart yesterday and all of the self-checkout kiosks limited transactions to credit or debit cards. They only had one check-out lane open for cash customers and the line was very long. I bit the bullet, and used my bank card. I do use cards for large purchases and to fill up at gas stations.

Cards may be a safer bet at times, when you consider that circulated hard currency is handled by many others. Yet, I would never want to live in a cashless society. It would strip us of our privacy and allow those controlling the cards, government and large companies, to track our every move and know absolutely everything about us. Plus, how would you pay at small venues such as garage sales, farm markets, and so many other places.

Many companies are limiting transactions to cards due to an apparent coin shortage. Shortly after the crisis started, my wife and I rolled over $700 worth of coins that we deposited in two large jars over the past 10 years. I’m sure many others did the same. If we all turned them in, now that the banks are opening back up, I believe the system would be flush with coins again.

Doctors and hospitals are back in business for the most part. My cardiologist appointment went smoother than expected. I left a half hour yearly to beat the traffic. The drive downtown, on what would have normally been a busy work week, was uneventful. Hardly any traffic at all. Upon arrival, the hospital staff took my temperature and I was asked if I had exposure to Covid 19 or was sick lately. Only one other patient was in the waiting room and every other chair was turned around and unusable. They took me in for the exam 5 minutes after arriving and I left the office 10 minutes after my normal scheduled time! To reduce contact, they take everyone as soon as they can to get them back on their way. I recall sitting in waiting rooms for up to 5 hours in the past and I like this new expedited, and coordinated scheduling.

With the restaurants closed many that frequently dinned out were forced back to the kitchen! My wife and I share the cooking and eat in most of the time, maybe eating out once or twice a month and mostly takeout. This wasn’t an issue for us. However, so many were blindsided by this change. Today, you can’t hardly buy a can of Campbell’s soup at our local grocery store, packaged meal selections sell out shortly after being stocked, and canned goods are flying off the shelf. Before this started, I was considering purchasing stock in Campbell Soup (CBP), analysts gave them a thumbs down because most millennials were moving away from packaged and processed foods. The same with Kraft Foods. Today it’s a whole different world in just three short months. Campbell Soup is rated #1 for timeliness by Value Line and has a dividend yield of 2.8%, Kraft yields 3.35%. I purchased General Mills (GIS) instead, still a good choice and it yields 3.2%.

Working from home is and will continue to be a preferred method for many companies and individuals alike. The benefits are tremendous from my perspective. Worker satisfaction, childcare flexibility, some businesses report improved productivity, considerably less time on the roads which reduces accidents and stress for commuters, and improved air quality. Plus, communicable diseases like the everyday flue would be less likely to spread since many will by default be socially distancing. Companies could reduce their leased-space, have lower overhead expenses and the list goes on and on. Of course, there are downsides as well, with a reduced need for office space those companies owning those properties will have challenges, the downtown stores and restaurants that services workers will also suffer. It is a sea change from how we worked in the past.

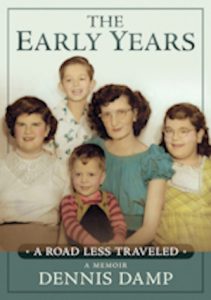

I completed a major milestone this month, a memoir titled “The Early Years, A Road Less Traveled.” This book, my 28th in a life long series of books will probably be my last, and a fitting close to my book writing career. It was 18 months in the making. The book chronicles my family’s early years up to age 31.

The road I traveled was paved with constant change—11 moves before the age of 16—poverty, hardship, challenges, and heartache. Yet, that formed my character and ambition; It made me who I am today.

The Early Years will be available from Bookhaven Press later this year. The Preface, Chapter One, and Epilog are available online if you wish to read them. This is a limited production.

Times are changing and at warp speed today. Just think about where we were just 100 years ago, most transportation was still by horse and buggy! The industrial and technological changes are mind numbing when you think about it. Change is inevitable and a constant; without it we stagnate.

Helpful Retirement Planning Tools

Request a Federal Retirement Report™ to review projected annuity payments, income verses expenses, FEGLI, and TSP projections.

- 2020 GS Pay Scales

- Retirement Planning For Federal Employees & Annuitant

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2020 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

Posted in FINANCE / TIP, LIFESTYLE / TRAVEL, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post