Posted on Friday, 7th May 2021 by Dennis Damp

Print This Post

Print This Post

IRMAA stands for Income Related Monthly Adjustment Amounts. A federal retiree’s total income includes their pension, social security benefits, income from investments (dividends and capital gains), and required minimum distributions from their TSP and other retirement accounts. Many also work part time or own small businesses. All income combined can often increase a retiree’s Medicare Part B and D premiums.

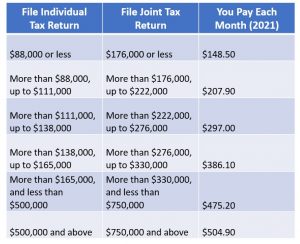

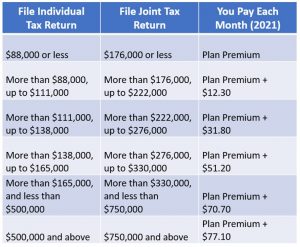

High-income households pay an extra charge—IRMAA—on top of the standard Medicare premium. IRMAA can apply to either Medicare Part B or Medicare Part D premiums. If you fall into one of the high-income categories—more than $88,000 for individuals and $176,000 for couples—the Social Security Administration (SSA) will notify you. The IRMAA notification from SSA might happen when you first apply for Medicare, but it can be triggered at any other time post initial Medicare enrollment if your income exceeds the threshold.

IRMAAs have a two-year lookback. For example, if your income as reported on your tax return from 2019 fell into the high-income category, you would pay IRMAA for 2021 Medicare monthly premiums.

2021 Medicare Part B Premiums & IRMAA

2021 Medicare Part D Premiums & IRMAA

How to Reduce or Eliminate IRMAA if Your Income Is Lower Today Compared to Two Years Ago

Since IRMAA is calculated on your income from two years ago, many federal retirees might have less income today than when IRMAA was initially calculated. If you experience a life-changing event that reduces your income, you can request an IRMAA reduction from the SSA by using the form found here or by calling 800-772-1213.

The following life-changing events are allowed for IRMAA reductions:

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

- Work Stoppage

Most federal employees will have lower income once they retire compared to when they were active employees. Work stoppage is an allowed life-changing event, and every new federal retiree that qualifies for IRMAA should request a reduction from the SSA if they will have lower income in retirement.

One word of caution, Medicare part B premiums are determined by your Modified Adjusted Gross Income (MAGI). Modified Adjusted Gross Income includes capital gains, taxable interest, tax-exempt interest, dividends, annuity income, wages, business income, and IRA distributions.

Example: A two-person household filing a joint tax return had adjusted gross income (AGI) of $250,000 in 2019 and 2020. They both plan on retiring on July 1, 2021, and will therefore spend half of 2021 as active employees and half as retired employees. They expect to have $200,000 in income in 2021 and only $150,000 in income in 2022 when they spend the entire year retired.

SSA would assign IRMAA based on their 2019 AGI of $250,000, and they would have to pay $297 each for Medicare Part B when they retire if they do not ask for an IRMAA reduction. Instead, they should request an IRMAA reduction for 2021 as their expected AGI would place them in a lower IRMAA category, which reduces the Part B premium to $207.90 for 2021. They should also inform SSA that their anticipated 2022 AGI of $150,000 would put them below the high-income threshold and therefore only have it pay the regular Part B premium of $148.50 in 2022.

The SSA requires tax returns and qualified life-changing event documentation for IRMAA reductions. In the case where income is a projection, SSA will confirm the projected income total when that tax return year is officially filed with the IRS. If during the IRMAA reduction process someone overpays on Part B or Part D premiums, the SSA will issue a refund.

This article is a collaboration between Kevin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net. Checkbook’s Guide to Health Plans for Federal Employees provides total cost comparisons (premium + expected out-of-pocket expenses) for all FEHB plans. The Guide shows which FEHB plans coordinate best with Medicare Part B and evaluates Medicare Advantage plans offered by FEHB carriers. Federal Retirement readers can purchase the Guide at GuidetoHealthPlans.org and can save 20% by entering promo code FEDRETIRE at checkout.

Helpful Retirement Planning Tools

- Retirement Planning For Federal Employees & Annuitant

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2021 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Posted in BENEFITS / INSURANCE, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE | Comments (0)

Print This Post

Print This Post