Posted on Wednesday, 18th August 2021 by Dennis Damp

Print This Post

Print This Post

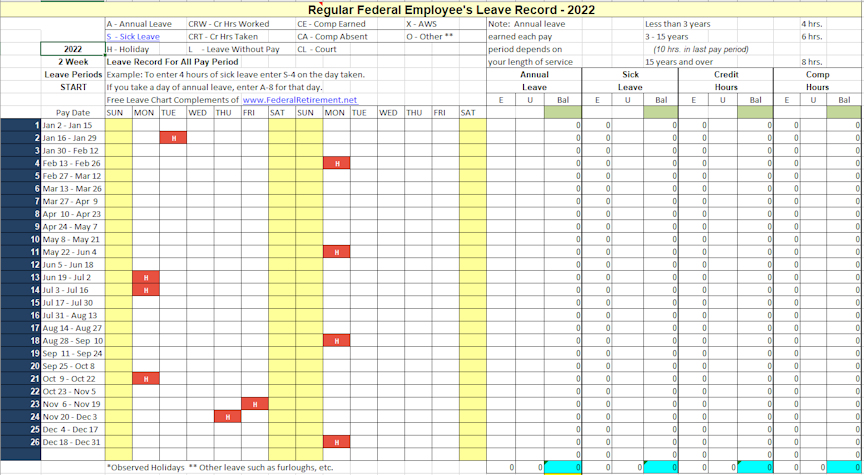

Our 2022 Leave Chart & Schedule Tracker is now available for federal employees to track their schedule, annual and sick leave, comp, and credit hours used. Our updated 2022 Excel Leave Chart is designed for active federal employees that are planning their retirement and need to establish realistic target retirement dates. This spreadsheet also helps federal employees maximize their annuity through prudent management of their leave balances.

Please share our 2022 leave chart with everyone in your organization. It does include the new Juneteenth national holiday. The chart tracks all leave balances and you are able to annotate your work schedule on the chart as well. Simply download the spreadsheet to your desk top for easy availability.

Download the 2022 Leave Record Chart

If your spreadsheet opens in protected view click the “enable editing” button in the yellow bar at the top of the form. However, if you don’t see the enable editing button you may have an older version of Excel or your IT department may have to allow the form to pass without restrictions. We also included a newer slsx workbook version that you can use if you have problems with the earlier version.

A Microsoft Office consulting firm advised us that If the spreadsheet only opens in the protected view status and the newer slsx version doesn’t correct the problem talk with your IT staff. Some agencies increase their security settings to lock out certain documents based on set parameters. We include several hyperlinks in our spreadsheet to link users to additional supporting information such as our sick leave conversion chart and that may be the cause.

Helpful Retirement Planning Tools

- The Ultimate Retirement Planning Guide

- Budget Worksheet – Determine your pre and post retirement total income and expenses

- TSP Guidance

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

- Professional Federal Resume Service (Increase retirement annuities through promotions)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

- Retirement Investments - Down but Not Out - April 4th, 2025

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS | Comments (0)

Print This Post

Print This Post