Posted on Friday, 22nd July 2022 by Dennis Damp

Print This Post

Print This Post

No matter where we look today, costs are rising as fast as the early 1980s. I remember those days well; mortgage rates were double digit and inflation followed suit. We are fast approaching those lofty levels, a record we don’t want to breach.

2023 COLA PROJECTIONS

According to Wilbert J Morell III, a retired Navy Engineering Project manager, “If inflation remains constant at 9.1% and the CPI-W remains constant at 292.542 then the Social Security and CSRS COLAs will be 9.0% and the FERS COLA will be 8.0%.”

Wilber suggests, “with Inflation continuing to grow at the same monthly trend of 1.3% per month and the CPI-W continues at the same monthly trend of 1.6% per month as reported in the 13 July CPI Report, the Social Security and CSRS COLAs will be 12.5% and the FERS COLA will be 11.5%. Unfortunately, if the US inflation trend continues, by the end of December 2022 U.S inflation could be as high as 16.9%, which will be much higher than the 2023 COLAs.”

The 10-year Treasury yield dropped significantly since the last monthly report to 2.96%; and the 2, 5, and 7-year Treasury yields increased significantly higher than the 10-year Treasury yield. The above Reversals validates the U.S. is now in an economic recession.

- Review the COLAs issued from 1999 to the present.

Wilbert tracks these statistics monthly, volunteers to help seniors in his community, and is highly knowledgeable about our federal retirement benefits.

TREASURY BILL YIELDS CONTINUE TO RISE

In my article titled “Ditch your Bank’s Low Savings Rates” I described the advantages of Treasury bills and in a subsequent article I outlined how to ladder them to take advantage of the rising rates. What astounds me is my local bank and credit union; they kept their savings rate at a mere .04% all this time!

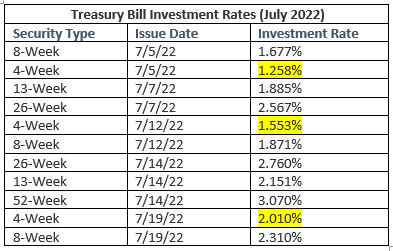

When I started purchasing 4 and 8-Week bills last February they were yielding slightly more than my local bank and credit union savings rate. The 4-week bill rate has increased to 2.011% as of July 19, 2022, just 5 months later. The 8-week bill yields 2.31%; the 52-week bill is 3.070% and higher than the 10-year note rate! The rate chart below lists their performance for July of this year.

I’ve kept my 4 and 8-week ladders reinvesting for the near term until the rates plateau; then I plan to convert them to either 52-week bills or longer-term notes depending on how high the rates move. Interest rates reached 16.63% in 1981 and many locked in longer term notes and 30-year bonds at very high rates, in the low to mid-teens!

TREASURY NOTE RATE CHART

As I stated in the past articles on this subject you can purchase Treasuries direct from the government at www.treasurydirect.gov or thorough your stock broker. Generally, I purchase short term bills direct from the government. Longer term notes, bonds, and TIP are best suited for your brokerage account.

If you are holding long term notes, bonds and TIPs you can only sell them on the secondary market before maturity. Treasury Direct canceled their sell direct program some time ago. Owners must transfer Treasuries they want to sell before maturity to their private brokerage account to sell them on the secondary market; it can take months for the government to complete the transfer.

I elect the new issue auction option when purchasing Treasuries through my brokerage account. If you buy previously issued Treasuries you could end up paying a high premium if the newer issued notes and bonds are paying a higher coupon rate.

There are several issues that I have with the Treasury Direct program in general, poor customer service for retail investors like us, and they don’t send monthly or annual account statements. They are 100% paperless and online. You have to print screens for each purchase to have a record of the transactions and download your annual 1099 forms.

They are difficult to reach. I sent them an email and they replied they were not accepting new email messages at this time. When I called, I was placed on extended holds and haven’t been able to contact them to date. It’s a minor issue but it needs to be addressed. Brokerage houses purchase millions in bonds each week and have a direct line to the Treasury to service their active accounts. I’ve never had an issue with the Treasuries I purchase through my broker.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post