Posted on Friday, 16th September 2022 by Dennis Damp

Print This Post

Print This Post

We provided our first 2023 COLA projection update last July. Costs continue to rise and mortgage rates are now up to 6%, almost double from where they were at the beginning of the year. Our COLA will be considerably higher than last year’s 5.9% for CSRS and 4.9% for FERS.

2023 COLA PROJECTIONS

According to Wilbert J Morell III, a retired Navy Engineering Project manager, “If the Inflation trend continues through September, inflation for the last 12 months ending on 30 September will be 8.1%. If the CPI-W remains constant for the month of September, the 2023 Social Security and CSRS COLAs effective on 1 December 2022 will be 8.6%, and the FERS COLA for 2023 will be 7.6%.”

Inflation has moderated a bit and this projection is .4% lower than the last update. Review how COLAs are calculated and annual COLA allocations back to 1999. With supply chain issues continuing and the potential strikes within the transportation sector, the 2023 COLA could end up higher.

Wilbert tracks these statistics monthly and is highly knowledgeable about our federal retirement benefits.

TREASURY BILL YIELDS CONTINUE TO RISE

In my article titled “Ditch your Bank’s Low Savings Rates” I described the advantages of Treasury bills (T Bills) and in a subsequent article I outlined how to ladder them to take advantage of the rising rates. What continues to astounds me is that my local bank and credit union has kept their savings rate at a mere .04% all this time!

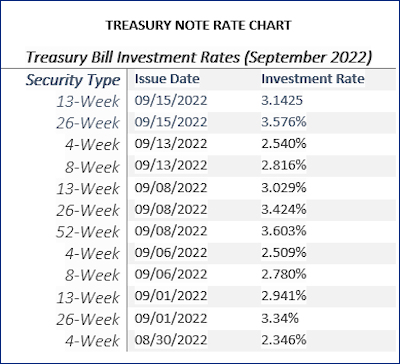

When I started purchasing 4 and 8-Week bills last February they were yielding slightly more than my local bank and credit union savings rate. The 4-week bill rate has increased to 2.540% as of September 13, 2022, just 9 months later. The 8-week bill now yields 2.816%; the 52-week bill is 3.603% and higher than the 10-year note rate! The rate chart below lists Treasury Bill performance for September of this year.

Late September the Federal Reserve is expected to raise the rate by at least .75% to as high as 1%. T Bill rates will rise accordingly. It is estimated that the fed rate will be in the mid 4% range or higher by years end.

Banks take advantage of their depositors knowing they are generally reluctant to move funds from their savings to higher earning options. A person with $50,000 in his or her bank savings account earning .04% interest receives $20 a year for keeping those funds in the bank. Moving that same amount to a 52-week T Bill currently earning 3.603% would earn the depositor $1,801, or $1,761 more than their bank would pay them!

I’ve kept my 4 and 8-week ladders reinvesting for the near term until the rates plateau; then I plan to convert them to either 52-week bills or longer-term notes depending on how high the rates move. Interest rates reached 16.63% in 1981 and many locked in longer term notes, bills and bonds at very high rates, in the low to mid-teens!

TREASURY NOTE RATE CHART

PURCHASING TREASURY BILLS

As I stated in the past articles on this subject you can purchase Treasuries direct from the government at www.treasurydirect.gov or thorough your stock broker. Generally, I purchase short term bills direct from the government. Longer term notes, bonds, and TIPs are best suited for your brokerage account.

If you are holding long term notes, bonds and TIPs you can only sell them on the secondary market before maturity. Treasury Direct canceled their sell direct program some time ago. Owners must transfer Treasuries they want to sell before maturity to their private brokerage account to sell them on the secondary market; it can take months for the government to complete the transfer.

I elect the new issue auction option when purchasing Treasuries through my brokerage account. If you buy previously issued Treasuries you could end up paying a high premium if the newer issued notes and bonds are paying a higher coupon rate.

EARNINGS RETURNED TO YOUR SAVINGS

When you purchase Treasury Bills you buy them at discount. In other words, if you buy a $10,000 (26-Week T Bill) earning 3.576%, the Treasury withdraws $9,821.20 from your account. At maturity, 26 weeks later they deposit $10,000 back to your account. If you choose to reinvest, the Treasury deposits the earnings back to your account until the final maturity date when the full amount is returned.

This is confusing to some, in the above example the $10,000 would earn 3.576% or $357.60 if held for one year. When you buy a T-Bill for less than a year the earnings are prorated. In this case you would receive half a year’s interest, $178.80. If you purchased a 52-week T-Bill you would buy it for $9,642.40; at maturity $10,000 would be returned to your account.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Federal Employee News: 2026 Pay, Benefits, and More - March 6th, 2026

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

Tags: 2023 COLA, Savings Options, Treasury Bill Yields

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post