Posted on Thursday, 19th November 2020 by Dennis Damp

Print This Post

Print This Post

This Open Season, federal retirees have new Medicare Advantage Part C (MA) plans to consider joining. Our analysis shows these offerings are an outstanding value. Let’s spend some time discussing how they work, how much you could save by joining one, and how to enroll.

Aetna, Kaiser, and UnitedHealthcare now offer MA plans designed only for federal retirees that are available for enrollment with most of their plan offerings. These MA plans pair a Part B reimbursement—in some cases the full amount—with greatly reduced or no cost sharing for health-care expenses.

Cost-Sharing Reduction for Health-Care Expenses

Checkbook found that these new MA plans have better benefits than virtually all existing FEHB and MA plans. For example, the UnitedHealthcare and Aetna MA plans charge $0 for any inpatient or outpatient benefit and have no out-of-pocket maximum for health-care expenses other than drugs. They promise that you will pay nothing (subject, of course, to the usual restrictions on paying only for medically necessary care). Moreover, they also charge nothing for using non-network providers, so long as they participate with Medicare. The Kaiser MA plans do not let you go out-of-network and the cost sharing benefits are not as generous as you would find with UnitedHealthcare and Aetna. For example, with Kaiser High MA in the D.C. area, you’ll pay a $5 copay to see your primary care doctor or $15 to see a specialist.

Part B Rebate Reimbursement

Most of the MA plan options provide some form of reimbursement for the Medicare Part B premium, and some even provide a full reimbursement. UnitedHealthcare Choice plans, and some Kaiser High and Standard plans offer full reimbursement of the Part B premium. The Aetna Advantage plan provides a $900 per person rebate, and the United Advantage plan provides a $600 per person rebate.

Not all MA plan options provide a Part B reimbursement; Kaiser Basic, some Kaiser Standard plans, and Kaiser Prosper plans have none. For any retirees that are subject to higher Part B premiums as a result of income above $88,000 for an individual or $176,000 for a couple, some of the Kaiser plans cover a portion of the higher premium, but not all of it. Overall, the MA plan options aren’t as good of a deal for retirees that pay the income tested Part B premiums.

How Much Money Can You Save?

Checkbook’s Guide to Health Plans provides yearly cost estimates (premium plus expected out-of-pocket expenses for someone like you) for every FEHB plan, taking into consideration the impact of adding Medicare Part B and reviewing any Medicare Advantage options offered by the plans. Their analysis shows that many of the new MA plans provide tremendous savings for federal retirees. Order your Checkbook Guide today to compair plans of interest. Federal Retirement readers can save 20% by entering promo code FEDRETIRE at checkout.

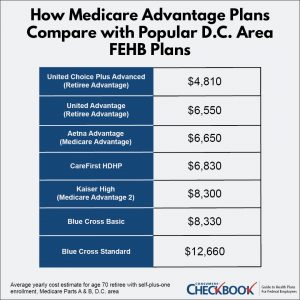

Here’s a snapshot of some of the new MA plan options and other popular FEHB plans available in the D.C. area for an age 70 retiree with self plus enrollment.

Where are these plans available?

The Aetna Advantage and United Advantage plans are available nationwide. Kaiser plans are available in the Washington D.C. area, Atlanta GA area, Denver CO area, Northern CA, Southern CA, Fresno CA area, and in the states of Washington, Hawaii, and parts of Oregon and Idaho. United Choice plans are available in almost half of the states.

How do I enroll?

In order to join one of the new MA plans, retirees must sign up for the regular version of the FEHB plan, be signed up for both Medicare Parts A and B, and then sign up for the MA plan with their carrier.

For more information about these plan offerings, consult Checkbook’s Guide to Health Plans for Federal Employees or contact these carriers.

- Aetna – https://www.aetnafeds.com/aetna-medicare-advantage.php or call 866-241-0262.

- Kaiser – https://healthplans.kaiserpermanente.org/federal-employees-fehb/medicare/ or call 877-904-0016.

- UnitedHealthcare – https://uhcvirtualretiree.com/fehbmvp/how-the-plan-works or call 844-481-8821.

Checkbook’s Guide to Health Plans for Federal Employees can be purchased at GuidetoHealthPlans.org. Save 20% by entering promo code FEDRETIRE at checkout.

Annuitants generally have the ability to sign up for traditional Medicare, Parts A and B along with their FEHB coverage or opt for Medicare Parts A, B, and C. In the past, most suspended their FEHB coverage when they signed up for an MA Part C option to reduce their insurance costs. The MA plans listed in this article require enrollment in Medicare Parts A, B, and C along with their respective FEHB plan and manage to provide significant cost savings.

If you are considering other Medicare Advantage Part C plans that don’t require FEHB participation, and desire to discontinue your FEHB component, you may wish to suspend your FEHB Plan instead of canceling it. This way, if the MA coverage incurs more costs than anticipated or benefits are insufficient, you have a path back to a viable FEHB Plan provider during the next open season.

Another precaution, be careful when considering Medicare Supplement Plans. They are totally different from Medicare Advantage Plans and you can’t suspend your FEHB coverage and will not be allowed to return to the FEHB program if the Medicare Supplement Plan proves too costly and has insufficient coverage. Many Supplement Plan sales representatives are unfamiliar with the FEHB program and its many advantages.

This article is a collaboration between Kevin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net.

Helpful Retirement Planning Tools

- Schedule a Retirement Benefits Seminar in Your Area

- Retirement Planning For Federal Employees & Annuitant

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- What to Consider Before Enrolling in Medicare B (Part 2)

- Should You Change to a Lower Cost FEHB Plan When You Sign Up for Medicare(Part 3)

- Medicare Part B and FEHB Update (Part 4)

- How to Delay Part B Premiums

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

- A 30-second Check Could Change Your Retirement Plan - October 20th, 2025

- Prescription Drug Costs – Major Price Cuts Coming - October 17th, 2025

- Government Shutdown Continues – Suffering the Consequences - October 15th, 2025

- Health Care Premiums Announced for 2026 – Hold on to your Hat! - October 13th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post