Posted on Friday, 27th May 2022 by Dennis Damp

Print This Post

Print This Post

Updated 6/14/2025

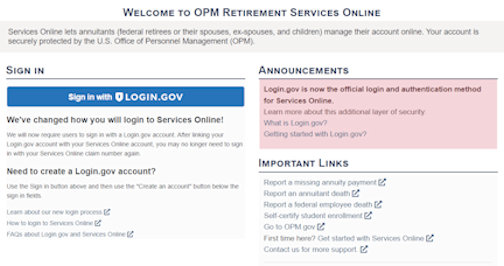

Retirees use OPM Services Online to start, change, or stop federal or state income tax withholding, download 1099-R forms, change their mailing addresses, start or change direct deposits, and view annuity payments. This system is available to those under the Civil Service Retirement System (CSRS), Federal Employees Retirement System (FERS), FERS Special, or the Organization Retirement and Disability System (ORDS).

OPM is switching to multilevel authentication procedures for its online services to prevent others from gaining unauthorized access to our accounts.

The new procedures may confuse some, especially older retirees unfamiliar with computers and internet protocols. However, once you create a new account or use your existing login.gov account and pair it with your original OPM Services Online account, it won’t be so daunting.

LOGIN.GOV ACCOUNT

OPM is deploying enhanced security protections for accessing your servicesonline.opm.gov account on May 26th. Login.gov provides an extra layer of security by using multi-factor authentication and stronger passwords to protect your account.

Other government agencies, such as the Small Business Administration and the Social Security Administration, already use this process to provide secure access to their services.

I logged into my Social Security account to check this out. They now allow access using Login.gov, or you can still use your original access user name and password. If you use your original access credentials, Social Security now requires a second verification level: a text message code sent to your cell phone or email address on file.

When I read OPM’s email announcing this change, I set up my www.login.gov account. This will save time and confusion when visiting OPM’s online services starting on May 26th. Setting up a new login.gov account is unnecessary if you already have one.

LINK SERVICES ONLINE ACCOUNTS TO LOGIN.GOV

The following screen is what I encountered at Servicesonline.opm.gov on the morning of May 26th. Since I had already created my LOGIN.GOV account, I simply clicked on “Sign in with LOGIN.GOV” and entered my LOGIN.GOV username and ID. If you haven’t set up your new login.gov access, you will be prompted to do so.

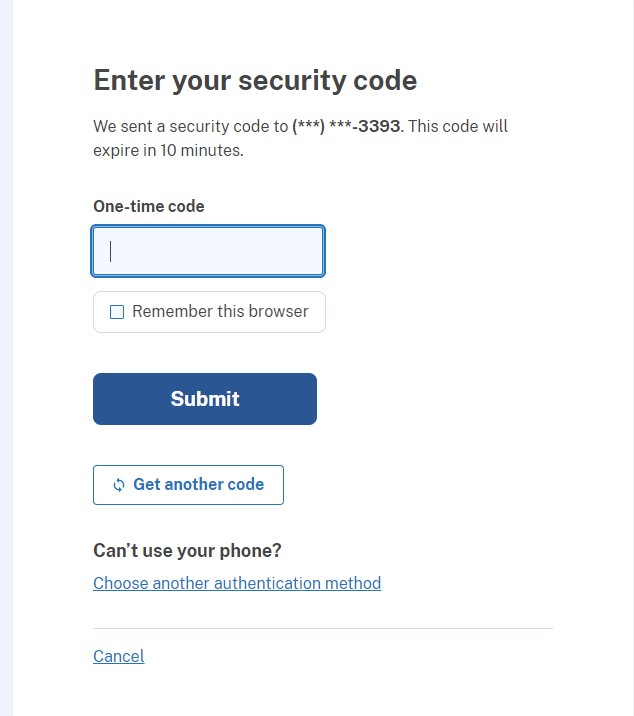

After signing up for this service and using it to access your servicesonline.opm.gov account, you will be prompted to enter a code prior to gaining access to your account. The code is sent to either your cell phone or email address to verify that you are the one accessing your account.

The next screen advises account holders to click on “Connect to servicesonline.opm.gov” and the following screen popped up asking me to enter the code that was sent to my cell phone.

After entering the code and clicking “Submit,” I was redirected to my account and home page. I logged in and out of my site several times to ensure it worked properly. The only change I encountered was the login process; all other features of my original account were the same as before. If you experience problems, use OPM’s step-by-step guide, and you will be back online in no time.

I use OPM’s online services frequently. It is difficult to get through to OPM by phone, and with their online services, you can often download what is needed or make changes to your account online instantly.

If you already have access to this service, follow the guidance when entering after May 26th to keep your account active. This is a good time to sign up for those not currently using this site.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspects of unique or special circumstances. Federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance, including OPM’s retirement center.

Over time, various dynamic economic factors relied upon as a basis for this article may change. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Tags: Login.gov Access, OPM Services Online

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post