Posted on Friday, 5th May 2023 by Dennis Damp

Print This Post

Print This Post

Please forward this to others that may find this information helpful.

They can sign-up to receive my free Retirement Planning Newsletter.

Fixed income investments continue to provide a safe haven for our cash as long as we are Vigilant. With the failure of First Republic Bank last week, the third so far this year, all must ensure deposits at their banks are properly covered by the Federal Deposit Insurance Corporation (FDIC).

Approximately 70% of First Republic Bank’s deposits were uninsured in March of this year and account holders withdrew $100 billion in deposits in the first quarter of 2023. First Republic’s deposits dropped by more than 40 percent. The Wall Street Journal reported this as the second largest bank failure in the United States!

With this latest bank failure, depositors with accounts over their FDIC limit will lose out. The FDIC stated, “customers do not need to change their banking relationship in order to retain their deposit insurance coverage up to applicable limits.”

Many aren’t aware of the extent of their FDIC coverage. It can be substantially more than $250,000 depending on how the account it registered.

FDIC Coverage Overview

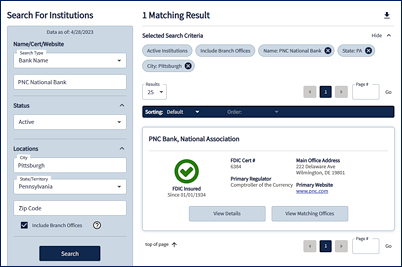

To determine if your bank is covered by the FDIC, use their Bank Find online tool to verify your banks participation.

All single accounts owned by the same person at the same bank are added together and insured up to $250,000. Accounts with one or more owners that name beneficiaries are insured as Revocable Trust deposits.

Each co-owner’s shares of every joint account at the same insured bank are added together and insured up to $250,000. Basically, if there are two joint owners each is covered up to $250,000. Therefore, their joint deposits at the bank are insured for up to $500,000.

The FDIC also covers retirement accounts including IRAs for up to $250,000 per owner.

Beneficiary Accounts

There are formal and informal revocable trusts. Informal trusts include Pay on Death (POD) designations used when a single or joint owners specify beneficiaries that inherit the funds after the account owner dies. A formal revocable trust is known as living or family trusts. They are written agreements created for estate planning purposes.

All revocable trust accounts owned by the same person at the same bank are added together, and the owners and beneficiaries are each insured for up to $250,000. A revocable trust can be revoked, terminated, or changed at any time at the discretion of the owner(s). The account title must disclose the trust relationship with phrases such as Living/Family Trust, POD, or In Trust For (ITF).

If the trust account is jointly held with two beneficiaries, that account would be insured for up to $1,000,000!

Beneficiaries must be people, charities, or non-profit organizations, and must either be named in the bank records or identified in the trust document.

Review the FDIC’s Deposit Insurance at a Glance brochure for additional guidance.

Note: The rules for revocable trust accounts (including formal trusts, ITF/POD), irrevocable trust accounts and mortgage servicing accounts will change on April 1, 2024. You can learn more about all the new changes by visiting www.fdic.gov/resources/deposit-insurance/.

I discovered that our FDIC coverage drops considerably without designating our successor trustees as beneficiaries in our joint trust. According to the FDIC, successor trustees aren’t considered beneficiaries. They state, “with formal revocable trusts, the owner is commonly referred to as a Grantor, Trustor or Settlor. Trustee and successor trustee designations are irrelevant in the determination of deposit insurance coverage.”

I need to determine if it is acceptable to restate the successor trustee clause when I review my estate documents with my attorney this month. Currently, it lists our children as successor trustees with no mention of beneficiaries. Hopefully, we can change the statement to our children, “and the survivor of them shall be the beneficiaries and become the successor trustees.” Without this change, I believe our FDIC coverage is half of what I originally thought it was.

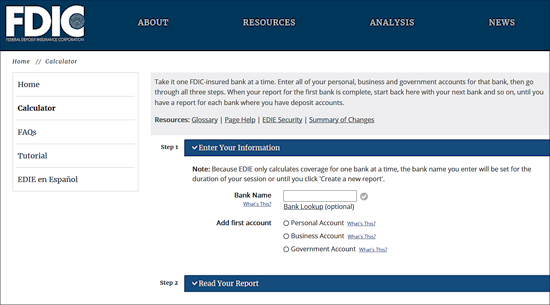

Electronic Deposit Insurance Estimator (EDIE)

Use the FDIC’s Electronic Deposit Insurance Estimator (EDIE) to determine the level of protection you have for each of your bank accounts. According to their website, “EDIE lets consumers and bankers know, on a per-bank basis, how the insurance rules and limits apply to a depositor’s specific group of deposit accounts—what’s insured and what portion (if any) exceeds coverage limits at that bank. EDIE also allows the user to print the report for their records.”

The calculations provided by EDIE are current through March 31, 2024.

National Credit Union Administration NCUA Insurance Coverage

The NCUA provides all members of federally insured credit unions with $250,000 in coverage for their single ownership accounts. Joint accounts are owned by two or more people who have equal rights to withdraw money from the account and no beneficiaries are named. These accounts can include regular shares, share drafts (similar to checking), money market accounts, and share certificates. The NCUSIF provides each joint account holder with $250,000 coverage for their aggregate interests at each federally insured credit union.

Retirement account insurance protection is separate and apart from insurance coverage on other credit union accounts. For example, if you have a regular share account, an IRA, and a KEOGH at the same credit union, the NCUSIF insures the regular share account for up to $250,000, the IRA for up to an additional $250,000, and the KEOGH for up to an additional $250,000.

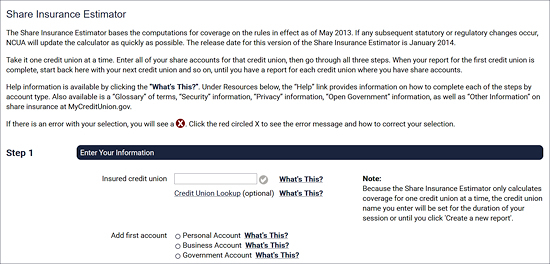

NCUA Insurance Estimator

The NCUA Electronic Share Insurance Estimator is available to help members better understand the protection offered by the NCUSIF. This interactive site allows users to input data to compute the amount of NCUSIF coverage available under different account scenarios. This resource is available at www.MyCreditUnion.gov/estimator.

Summary

Check your accounts to ensure they are properly registered with updated beneficiary designations and validate the level of insurance you have with each account.

Use the FDIC and NCAU Insurance Estimators to verify all of your accounts. If you exceed your coverage move the excess to differently registered account at the same bank or move it to another bank or credit union.

Fidelity brokerage accounts offer a program that avoids the potential problems with FDIC coverage. You can elect to have your cash allocated to multiple banks to avoid exceeding the FDIC limit. They do this automatically.

Investors must also be aware of the coverage they have through the Securities Investor Protection Corporation (SIPC) for their brokerage accounts. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. Visit their site for specifics.

Summary

Part 2 will explain the weak link in the system, ways to reduce the delays as much as possible, and how to report a death to the Thrift Savings Plan (TSP.) I suggest printing this article and part-2 next week and place the copies in your estate or retirement binder for your heirs to use when needed. Review my 11-part Estate Planning Guide to help you take care of this essential task while still able to do so.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Financial Planning Guide

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- TSP Guide

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Retirement Planning Assistance – Finding Help (2025 Update) - July 17th, 2025

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

Posted in ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post