Posted on Thursday, 12th November 2020 by Dennis Damp

Print This Post

Print This Post

The 2021 FEHB Open Season runs from Monday, November 9th through December 14th and now is a good time to look at the changes facing retirees this year and to share some important advice to help you select the plan that’s right for you, which could possibly save you thousands of dollars.

Request Your Personalized Federal Retirement Report™ Today

- Premium Increase – The enrollee share for premiums will increase on average 4.9% in 2021. Some plans will be below the average and some above, make sure to check to see how your plan has changed.

- New FEHB Plans – There is one new national plan in 2021, UnitedHealthcare Advantage Plan, and five new regional plans, Kaiser Permanente Northwest (Washington/Oregon) Basic, Kaiser Permanente Northwest (Washington/Idaho) Basic, Geisinger Health Plan (Pennsylvania) Basic, Dean Health Plan (Wisconsin) Basic, and Group Health Cooperative (Wisconsin) Standard.

- New FEDVIP Plans –UnitedHealthCare Dental and HealthPartners Dental (Upper Midwest) are two of a half-dozen new FEDVIP dental plans and MetLife Federal Vision is a new FEDVIP vision plan.

- Benefit Changes – Section 2 of the official plan brochure will tell you how your plan has changed for the upcoming year. If you do nothing else this Open Season, you should at least check this part of the plan brochure to make sure the benefits of your existing plan are still a good fit for you. Here’s a small sample of some of the benefit changes for 2021:

Catastrophic Out-of-Pocket Maximum – Blue Cross FEP Blue Focus increased self only limits on what you might have to spend from $6,500 to $7,500 and increased self plus one and family limits from $13,000 to $15,000. SAMBA High lowered self only limits from $6000 to $5000 and self plus one and family from $12,000 to $10,000.

Deductible – HIP HMO (New York) Standard increased the self only deductible from $2,500 to $3,000 and the self plus one and family deductible from $5,000 to $6,000. Kaiser Permanente Northwest (Washington) decreased the self only deductible from $250 to $150 and the self plus one and family deductible from $500 to $300.

- Telemedicine – The COVID crisis has brought about major changes in FEHB, Medicare, and other health insurance to provide Telehealth services to enrollees. There are two broad categories: telehealth appointments with your own doctors in place of physical appointments, and advice from a panel of doctors chosen to deal with many circumstances online. Quite apart from protecting against the virus, these consultations offer major conveniences in many circumstances, such as when physical travel to your physician is inconvenient or impossible. The online version of Checkbook’s Guide to Health Plans will show the type of telehealth coverage available by plan and the cost sharing, if any, for the service.

Other changes can be subtle yet end up costing you considerably more than you originally contemplated if you don’t review each plan’s brochure carefully. For example, in 2021 Blue Cross Blue Shield Basic changed their hearing aid replacement cycle to 5 years from three, while GEHA Standard retained a three-year replacement cycle. My hearing continues to worsen with age and hearing aid technology improves each year, the three-year cycle works great for me. Both plans offer up to a $2,500 reimbursement. I’m due a new pair this January and by staying with the GEHA I won’t have a problem.

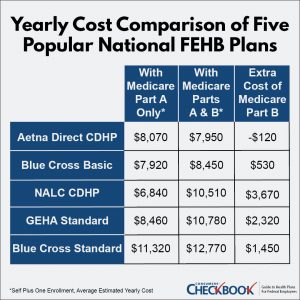

It’s important every Open Season to see if there might be a plan that’s a better buy and covers your specific health care needs. The best, and only, way to do this is to consider the total cost of the plan to you. Total cost is the for sure expense you’ll pay, premium, plus the expected out-of-pocket expenses you’ll face for copays, coinsurance, and the plan deductible. For retirees, the job is even more complicated as there is an additional question of whether the potential advantages of joining Medicare Part B outweigh the expense of the additional premium expense ($1,840 per person in 2021, and more for high-income people).

To simplify the decision-making process and help consumers understand how plans cover the combinations of predicted and unpredicted expenses, Checkbook’s Guide offers an estimated yearly cost for each FEHB plan. These estimates cover good, average and bad health care years, and include premium plus out-of-pocket costs for households similar to yours in age, family size, and expected health care usage. For retirees, their Guide provides yearly cost estimates for all FEHB plans with either Medicare Part A only, or with Medicare Parts A and B. They show the cost reduction size and the extra cost of adding Part B and whether the plan offers any Part B reimbursement.

The results of their analysis show big plan-to-plan differences. Consider the following five popular national plans.

As you can see, making the right plan choice can save or cost you thousands of dollars. There are over 20 national plans that you’re eligible to join in 2021 and, depending on where you live, many additional HMO options. Make sure you’re comparing the total cost of your existing plan with other options.

Checkbook’s Guide to Health Plans for Federal Employees can be purchased at GuidetoHealthPlans.org. Federal Retirement readers can save 20% by entering the promo code FEDRETIRE at checkout.

Medicare Part A covers hospitals stays for plans that charge coinsurance (a percentage of charges) and pays for the cost of stays in a skilled nursing facility. Part A is automatic for retirees at age 65 and is premium free.

Whether or not it makes sense to take Medicare Part B depends in large part on the plan that you’re considering. Some plans waive their hospital and medical deductibles, copays, and coinsurance for members enrolled in both Medicare Parts A and B. In effect, they “wrap around” Medicare. There is also a small but growing list of FEHB plans that offer partial Part B premium reimbursements. Some feel that Medicare Part B won’t save you nearly as much as you spend on the Part B premium because the cost-sharing for physician visits and tests in almost all FEHB plans is already so low. However, there are many variables and depending on your health, Part B does offer considerable benefits especially when the FEHB plan waives all copayments, coinsurance and deductibles. Medicare Part B also allows you to use doctors who are not in the plan network but do participate in Medicare. When using these doctors, savings can be hundreds of dollars a visit if you have Part B.

My wife’s recent surgeries cost over $50,000. With Part B we paid no additional out-of-pocket costs.

Review the following articles before deciding on Part B enrollment:

- Should I enroll in Medicare

- Medicare and FEHB Options – What Will You Do When You Turn 65?

- What to Consider Before Enrolling in Medicare B

- Should You Change to a Lower Cost FEHB Plan When You Sign Up For Medicare

- Caution – Don’t Lose Your FEHB Coverage

- How to Delay Part B Premiums

This article is a collaboration between Kenvin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net.

Helpful Retirement Planning Tools

Schedule A Retirement Benefits Seminar in Your Area

- Retirement Planning For Federal Employees & Annuitant

- Budget Work Sheet

- Social Security Guide

- Medicare Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post