Posted on Friday, 2nd December 2022 by Dennis Damp

Print This Post

Print This Post

For most federal annuitants, FEHB Medicare Advantage (MA) plans will be the cheapest option next year. They combine low out-of-pocket healthcare expenses—sometimes $0 besides prescription drugs— with a Part B premium reduction. We’ll cover how they work, how much money you can save switching from popular FEHB plans, and who shouldn’t join an FEHB MA plan.

How They Work

FEHB MA plans require you to be enrolled in both an FEHB plan and Medicare Parts A and B. Most of these plans have $0 out-of-pocket costs for approved healthcare services from providers that accept Medicare, except for prescription drugs. All reimburse or reduce some or all the Medicare Part B premium.

Because prescription drugs will be the only significant out-of-pocket expense you’ll have, it’s important to carefully check each plan’s prescription drug formulary to see how much you’ll pay.

These FEHB MA plans offer advantages because you have dual FEHB/MA enrollment. For example, a married couple with one spouse younger than 65 could join one of the plans and rely on FEHB benefits for the younger spouse until they turn 65, with the older spouse enjoying the enhanced MA benefits from the beginning of the new plan year.

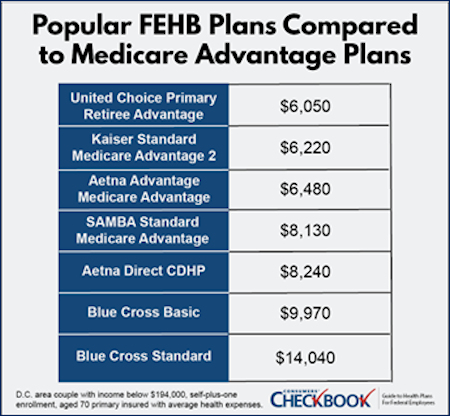

These plans’ benefit structure produces major cost savings compared to other popular FEHB plans.

Traditional Medicare Verses Medicare Advantage Part C

You can get your Medicare benefits through Original Medicare (parts A and B), or a Medicare Advantage Plan (Part C). If you have Original Medicare, the government becomes your primary health care provider and pays for most medical costs when you get hospital or physician services covered by Medicare. Your FEHB plan becomes your secondary provider and pays most of what Medicare doesn’t.

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. Medicare pays these companies to cover your Medicare benefits.

For most beneficiaries, the government pays a substantial portion—about 75 percent—of the Part B premium, and the beneficiary pays the remaining 25 percent. When you enroll in a Medicare Advantage plan, the provider receives the 75% Medicare pays plus the FEHB premium, the MA plan becomes the primary provider.

These plans are able to profit and return a part of your part B premiums through efficiency improvements, requiring pre authorizations for certain procedures, and many plans limit care to their provider network.

How Much Money You Can Save

Checkbook’s Guide to Health Plans ranks all FEHB plan options, including FEHB MA, based on a total cost estimate that’s a combination of for-sure expense (premium) plus likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

For example, the Checkbook Guide estimates that a D.C.-area couple enrolled in Medicare Parts A & B with income below $194,000 could save $7,990 in estimated total costs next year by switching from BCBS Standard to United Choice Primary Retiree Advantage.

The Consumers’ Checkbook Guide is available in print and online formats. Federal Retirement site visitors and newsletter subscribers can order the Consumers’ Checkbook Guide and save 20% by entering promo code FEDRETIRE at checkout. Online access is $13.95, the hard copy version is $16.95, or pay only $20.95 for both online and hard copy, less 20% with promo code.

OPM’s Plan Comparison Tool is another option you can use. It compares up to three plans side by side, however it isn’t as comprehensive as Checkbook’s Guide.

Where Are the Plans Available?

It depends where you live. Aetna Advantage Medicare Advantage is a PPO plan available nationwide, United Choice Retiree Advantage plans are in about half the country, and Kaiser Medicare Advantage plans are available on the West Coast, Hawaii, Colorado, Georgia, and Mid-Atlantic states. There are also MA plans offered nationwide by APWU and MHBP, and restricted-enrollment MA plans offered by Rural Carrier and Compass Rose.

There are additional FEHB MA plans for annuitants to consider in 2023. SAMBA High and Standard, NALC High, and Foreign Service are national PPO options, and UPMC Standard, Kaiser Standard Mid-Atlantic, and Kaiser Standard Georgia are HMOs.

How to Enroll

Enrollment in MA plans requires three steps that should be completed in the following order:

- If you’re not already enrolled in Medicare Part B, apply at gov. You won’t be able to join an MA plan without first being enrolled in Part B. That takes the longest, so start here.

- Enroll with OPM in the FEHB plan that corresponds to the MA plan you want to join.

- After you’ve enrolled in the FEHB plan with OPM, wait a few days for OPM to update the insurance plan and then call the MA plan directly to enroll.

Who Shouldn’t Consider FEHB MA Plans

If you fall into one of the high-income categories—more than $97,000 for individuals or $194,000 for couples—Part B is of limited financial value due to the higher premium. With FEHB MA plans, you’ll get hit twice with Income Related Monthly Adjustment Amounts (IRMAA), which means you’ll be paying both a higher Part B and Part D premium.

Additionally, if you spend a large portion of time overseas, only one FEHB MA plan (UnitedHealthcare) provides reimbursement for routine overseas care. Of course, since you stay enrolled in an FEHB plan with any FEHB MA plan, you’ll always have the emergency overseas care coverage that every FEHB plan provides.

Other things to consider are the medical benefits and coverage associated with the plan, if pre-authorizations are needed for certain tests, and are providers in your area. Review the articles I wrote about issues that our newsletter subscribers encountered with their MA plans last year before:

- Medicare Advantage Plans (Heads Up for Upcoming Open Season)

- FEHB-Medicare Advantage Plans – Proceed with Caution

The Final Word

Unless you’re subject to higher Part B premiums due to your Modified Adjusted Gross Income (MAGI), FEHB MA plans are likely the least expensive plan option in 2023.

If you’re a higher-income beneficiary, you’ll be subject to higher Part B premiums equal to 35, 50, 65, or 80 percent of the total cost and may be required to pay Part D premiums.

The savings available to annuitants who join low-cost FEHB MA plans are significant. Even if you’re relatively satisfied with your existing FEHB plan, consider whether joining an FEHB affiliated MA plan will offer you comparable or better benefits than you’re currently receiving at a lower cost.

This article is a collaboration between Kevin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net. Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s

Helpful Retirement Planning Tools

- 2023 FEHB Plan Selection Guide

- Blue Cross Blue Shield Basic to GEHA Standard Plan Comparison – 2023

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Medicare Guide

- Budget Work Sheet

- Social Security Guide

- Retiree Master Contact List

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Posted in BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION, WELLNESS / HEALTH | Comments (0)

Print This Post

Print This Post