Posted on Friday, 21st June 2019 by Dennis Damp

Print This Post

Print This Post

I receive many queries from FERS employees asking the question; When can I retire? They aren’t sure what they would be entitled to and when they can start collecting their pension. A number of options are available depending on your years of service and age at the time you wish to leave.

- Request a Personalized 27-page Retirement Planning Report. Federal retirement specialists may be able to answer all of your questions and concerns. A one hour session with a Certified Financial Planner is included.

Essentially, you will be able to collect a pension from Uncle Sam as long as you have a minimum of 5 years of creditable service. For those who leave federal service with at last 5 years of creditable service, and don’t withdraw their FERS contributions, can collect a deferred pension at age 62 with less than 20 years of service or at age 60 with at least 20 years of service. Benefits don’t increase if you delay applying for a deferred annuity beyond age 60 or 62 as noted above. Your federal annuity payment doesn’t increase like Social Security does when you wait to apply at age 70.

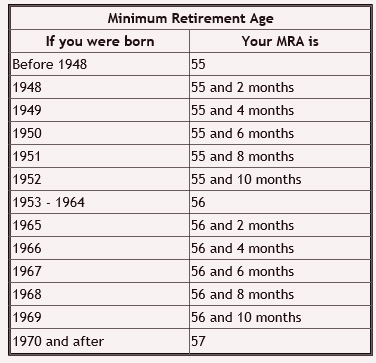

FERS immediate retirement eligibility is determined by your Minimum Retirement Age (MRA) and years of service. The FERS retirement system is comprised of three parts:

- Social Security

- Annuity (Basic Benefit Plan)

- Thrift Savings Plan

FERS Annuity Eligibility

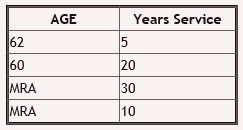

Use the following chart to determine when you will be eligible for immediate retirement.

Immediate retirement benefits start within 30 days from the date you stop working if you meet one of the following sets of age and service requirements:

Federal Employee Retirement Benefit Seminars – Check Availability

Referencing the above charts, a FERS employees that was born between 1953 to 1964 and has 30 or more years of creditable service at age 56 is eligible for an immediate unreduced annuity. Many hold off applying for retirement to collect a higher monthly benefit. FERS employees receive 1% of their high-3 years average salary times years of creditable service if they retire under age 62. At 62 or later your high three average income is multiplied by a factor of 1.1% with at least 20 years of service, effectively increasing your annuity by 10%.

Those selecting an immediate retirement benefit under the MRA + 10 rule must have at least 10 but less than 30 years of service when they reach their MRA. If you retire under this rule, and select an immediate benefit, your annuity will be reduced by 5 percent a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

You can avoid this penalty and postpone receipt of your benefit until you reach either 62 with between 5 and 19 years of service or as early as age 60 with 20 years or more of service. If you postpone your benefit, you must contact OPM at least 2 months before you wish to start your benefit and complete their “Application for Deferred or Postponed Retirement” Form R1 92-19.

There are exceptions to these rules for Special Categories of employees with early retirement plans such as Fire Fighters (FF), Law Enforcement Officers (LEO) Air Traffic Controllers (ATC), Nuclear Weapons Couriers (NWC) and for those on FERS Disability. Employees that accept an early retirement under the VERA program or discontinued service retirements are not subject to early age reductions.

When you retire before age 62 FERS annuitants may also be eligible for a Social Security Supplement. You can use our FERS Annuity Calculator to estimate your monthly benefit online or call your HR office and request estimates for several target retirement dates. HR must provide estimates if requested.

CSRS employees can determine their eligibility and estimated annuity payment using the information provided on our Retirement Planning Guide. There are many things to consider before turning in your retirement application. Research all aspects of your benefits when planning your exit.

Helpful Retirement Planning Tools / Resources

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections

- Retirement Planning Guide

- Social Security Guidance (FERS & CSRS)

- Federal Employee Retirement Benefits Seminars – Check Availability

- Financial Planning Guide

- Master Retiree Contact List (Contact numbers and information)

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer:Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Posted in UNCATEGORIZED | Comments (0)

Print This Post

Print This Post