Posted on Friday, 23rd November 2018 by Dennis Damp

Print This Post

Print This Post

Updated 8/12/2025

We provide extensive financial planning guidance to help anyone from a new hire to a retired annuitant evaluate and assess their economic strength. I mentioned in last year’s article, “few evaluate their finances until their checks start to bounce or they are so much in debt they can’t dig themselves out.” One of the leading causes of divorce today is financial issues and not living within one’s means.

Updated Budget Worksheet

Our 8-page Budget Work Sheet helps individuals and couples determine where they stand pre- and post-retirement. The worksheet guides you through listing your income from all sources, loans and debts, utility costs, insurance premiums, monthly savings and investment contributions, and miscellaneous expenses. An individual or couple will know what they are bringing in each month, their total costs, and where they stand financially.

This worksheet is a downloadable PDF file that you can print out. Just lay it out on the table for you and your spouse/partner to fill out together with a pen or pencil. It evokes discussions and doesn’t require sitting at a computer to complete. This way, everyone knows firsthand where the household money is being spent and how much is needed each month to make ends meet.

Working couples often neglect to balance the books so that each party equitably supports the household to the degree possible. When this happens, it places an unfair burden on whoever is paying the bills and can lead to marital discord.

Making Ends Meet

This worksheet includes a Common Expense column for working couples that reveals how much is needed monthly to support the family. Many newlyweds enter marriage without sufficient financial planning; they are in love and neglect to address the elephant in the room, making ends meet. Of course, this is natural to a certain extent, especially for the very young.

My wife and I are a prime example. We married young; my wife was 19, and I was barely 20, while I was in the military earning a measly $98 a month! That was about one-third of the minimum wage back then. We flew to Biloxi, Mississippi, with a few hundred dollars in our pockets, no car, and not knowing what lay ahead. Yet, we persevered and flourished. Most who start like this end up divorced early on.

Fortunately, federal employees have significant benefits, good pay, and are generally older and wiser than the very young at heart. Yet, they often enter a relationship with blinders on, neglecting to take the necessary steps early on to right the ship and balance the financial load placed upon them.

Getting Started

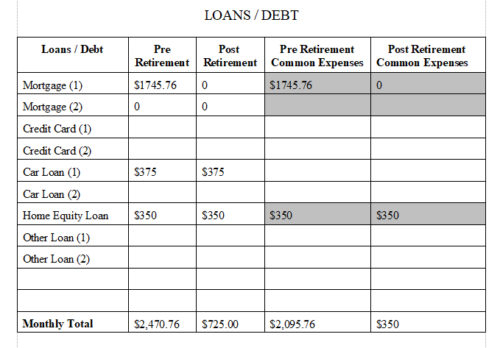

Individuals and couples can easily evaluate pre- and post-retirement expenses; there are columns for both entries. For example, under LOANS / DEBT, there are four columns as noted on the excerpted table below. If you pay off your mortgage when you retire, the post-retirement column would show zero dollars for your monthly mortgage payment. We extend that to everyday expenses, both pre- and post-retirement, for couples to determine what expenses to share when both have income. In this case, the mortgage would be a common expense pre-retirement and zero dollars post-retirement.

A car loan could be considered an individual expense if both have a car and income. Tailor the chart and add additional standard charges if relevant. I highlighted the expenses that most would consider to be shared by working couples. A single person wouldn’t need the common charges identified because there would not be anyone to share the costs with. This process works for everyone.

Download Worksheet (PDF Version)

Common Expenses

These expenses show the amount needed each month from working couples to pay the household bills, save for a rainy day, and how much is spent on each line item. If you are a married couple and one is a stay-at-home mom or dad, the working spouse generally earns enough to cover household expenses and keep things running. Married working couples, each earning about the same, could equally split the common costs. When one partner is still working and another is a retired annuitant, the division would be decided by the pair as to what each can contribute based on all income sources: salary, pension, Social Security, 401 (k) distributions, etc.

This exercise helps working couples share expenses equitably when both have sufficient income to contribute. At the very minimum, it effectively reveals total income to costs so that you can see if you have anything left after paying the monthly bills.

Another key benefit of completing the worksheet is to discover where all of your money is going each month. Many young people today struggle to balance a checkbook. They use their debit cards until they are rejected for insufficient funds. Then, they go online to check their balance and wait for the next paycheck or transfer money from a savings account if they have one.

The End Result

After completing the worksheet, you will know where and what you are spending your money on and be able to evaluate ways to trim costs. Consider dropping unnecessary cable options, programming your HVAC thermostat to reduce utility expenses, replacing incandescent bulbs with LEDs, cutting down on your trips to Starbucks, and switching to a lower-cost cell phone service, among other cost-saving measures. There are many ways to economize today.

It’s a good idea for couples to open a joint checking account in addition to their checking accounts. If both are working, each would deposit their share of the common expenses in the joint account each payday for the bills. The excess in the joint account would accumulate for emergencies and discretionary items, or you can set aside emergency or vacation savings in a separate account. This way, the person paying the bills should have sufficient funds each month to pay the bills. Even if only one person is working, a joint account is necessary so both can pay bills and sign checks.

This is a dynamic process; expenses and income change over time. It’s imperative to revisit your worksheet at least once a year or whenever there is a major change, such as a pay raise, someone retires, or for younger couples when a child is born.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

- TSP Information

- Financial Planning Guide

- How to be Financially Prepared When You Retire (Free Report)

- Retirement Planning Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2026 & 2025 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspects of unique or special circumstances. Federal regulations, medical procedures, investment information, and benefit details are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance, including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

Tags: CSRS, FERS, Retirement Budget Worksheet, Retirement Savings

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post