Posted on Friday, 9th October 2020 by Dennis Damp

Print This Post

Print This Post

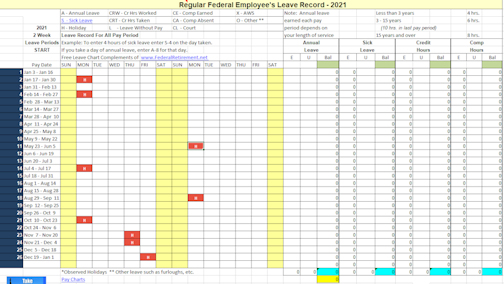

Each year we publish a comprehensive leave record that federal employees can use to track their annual and sick leave, comp, and credit hours used. Our updated 2021 Excel Leave Chart is designed for active federal employees that are planning their retirement and need to establish realistic target retirement dates. The new Excel 2021 Leave Record Spreadsheet also helps federal employees maximize their annuity through prudent management of their leave balances.

Please share our 2021 leave chart with everyone in your organization. The chart tracks all leave balances and you are able to annotate your work schedule on the chart as well. Simply download the spreadsheet to your desk top for easy availability.

Download the 2021 Leave Record Chart

A few leave chart users reported a problem with opening the leave spreadsheet last year, the Excel chart was opening in protected mode and they were not able to enter data. If your spreadsheet opens in protected view click the “enable editing” button in the yellow bar at the top of the form. However, if you don’t see the enable editing button you may have an older version of Excel or your IT department may have to allow the form to pass without restrictions. We also included a newer slsx workbook version that you can use if you have problems with the earlier version.

A Microsoft Office consulting firm advised us that If the spreadsheet only opens in the protected view status and the newer slsx version doesn’t correct the problem talk with your IT staff. Some agencies increase their security settings to lock out certain documents based on set parameters. We include several hyperlinks in our spreadsheet to link users to additional supporting information such as our sick leave conversion chart and that may be the cause.

Request a Federal Retirement Report

Retirement planning specialists provide a comprehensive Federal Retirement Report™ including annuity projections, expenditures verses income, with a complete benefits analysis. This comprehensive 27-page benefits summary will help you plan your retirement.

Request Your Personalized Federal Retirement Report™ Today

Find answers to your questions: The best time to retire, retirement income vs expenditures, FEGLI options and costs, TSP risks and withdrawal strategies, and other relevant topics. Determine what benefits to carry into retirement and their advantages. You will also have the opportunity to set up a personal one-on-one meeting with a CERTIFIED FINANCIAL PLANNER.

Helpful Retirement Planning Tools

Schedule A Retirement Benefits Seminar in Your Area

- Retirement Planning For Federal Employees & Annuitant

- GS Pay Scales

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2021 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in ANNUITIES / ELIGIBILITY, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS

Comments (0)|  Print This Post

Print This Post