Posted on Friday, 8th February 2019 by Dennis Damp

Print This Post

Print This Post

I received my TSP 2018 Annual Statement this week and there was a short announcement about the Lifecycle (L) Fund changes on the backside of the Highlights sheet. The statement includes your total contributions, projected lifetime monthly annuity amount, fund and account performance statistics and more.

The TSP has begun adjusting the L Fund allocations differently with the intention of improving investment outcomes. Effective in January 2019 the L Funds will increase exposure to international stocks (the I Fund) from 30% to 35% of the overall stock allocation. Vanguard suggests, “To get the full diversification benefits, we recommend that you consider investing about 40% of your stock allocation in international stocks and about 30% of your bond allocation in international bonds.”

Furthermore, the L 2030, L 2040, and L 2050 overall stock allocations will hold steady for a period of years before resuming their transitions from stocks to bonds. In addition to improving investment outcomes, this pause is intended to align the L 2030, L 2040, and L 2050 Funds with the L 2060 Fund, which will be introduced in 2020 with an initial stock allocation of 99%. You can track the quarterly allocation changes on the TSP site.

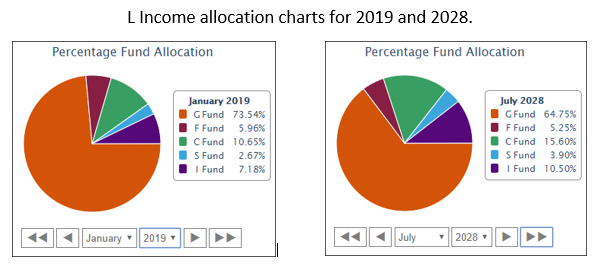

Many retirees move to the L Income Fund to keep up with inflation with less risk. The L Income Fund stock allocation (C, S, and I Funds combined) will increase from 20% to 30% over a period of up to 10 years with a greater emphasis on international stock exposure. A financial adviser can recommend fund allocations that would best suit your personal situation.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

The L Income Fund’s allocations prior to this change were 74% G, 6% F, 11.20% C, 2.8% S, and 6% I. This mix provided an 80% bond to 20% stock ratio. The L Income Fund allocations were fixed at these levels until the January 2019 change.

The shift started in January of 2019, the total bonds from the G and F fund decreasing below 80% and gradually move to 70% by 2028 as shown in the above chart. This move increased the stock funds to a total of 30% of fund assets.

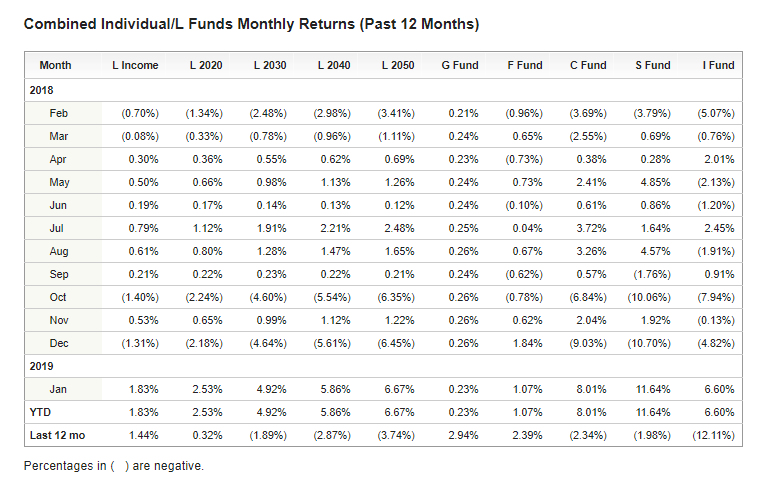

Fund performance figures for the previous 12 months are listed in the TSP chart presented below. The only funds that increased in value were the L Income, L 2020, G and F funds. The G fund was the best performer during this period with a 2.94% gain followed by the F Fund with 2.39%. The L Income had a 1.44% gain followed by a .32% gain in the L 2020 fund. All others lost from 1.89% for the L 2030 Fund to a high of 12.11% for the International I Fund.

There are more TSP changes coming, including new withdrawal options and a major website makeover later this year. Many new employees along with uniformed service members that elected the new Blended Retirement System (BRS) are participating in the program this year. We will keep you informed of these changes as they are implemented. This is a good time to assess your TSP allocations and contributions. If you are invested in the L Life Cycle Funds review how the new allocations will impact your investments.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

- TSP Information

- Financial Planning Guide

- Retirement Planning Guide

- Budget Work Sheet

- Master Retiree Contact List (Important contact numbers and information)

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP | Comments (0)

Print This Post

Print This Post