Posted on Friday, 19th January 2024 by Dennis Damp

Print This Post

Print This Post

I was required to take my first RMD at age 70 ½ several years ago before the laws were changed. Under the SECURE 2.0 Act in 2023 the required withdrawal age increased to 73. Several newsletter subscribers asked for an update on TSP annuities, RMDs, and withdrawals in general.

Rachel stated, “While the new TSP site is nice – I was very use to the old system and get lost in the new one, so many more options I get lost.” She wanted to know more about annuities. Jaynee wanted to know if it would be best to wait until late December to withdraw her first RMD and how to withdraw the funds.

RMDs, the Basics

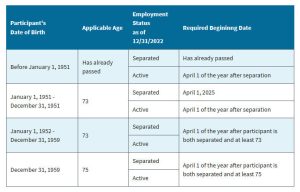

The IRS Code requires that you receive a portion of your TSP account (your “required minimum distribution” or “RMD”) beginning when you reach a specific age as noted on the following chart and are separated from service.

If you are a beneficiary participant, your deadline for beginning to receive RMDs depends on whether your spouse died before or after your spouse’s required beginning date for RMD payments.

Find your applicable age and required beginning date:

If the total amount of your withdrawals and distributions doesn’t satisfy your RMD, the TSP will issue a supplemental payment for the remaining amount before the deadline each year.

Other financial institutions including brokerage houses typically notify you on their website and/or in writing of the amount to be withdrawn each year. You will have to initiate the withdrawals to avoid the IRS excise tax of 25% of every dollar not withdrawn. This penalty is reduced to 10% if you file a timely correction with payment within two years.

Required Withdrawal Amount

The TSP calculates the amount you’re required to receive using your age, your traditional balance at the end of the previous year and the IRS Uniform Lifetime Table. Your RMD calculation includes only your traditional balance, and only distributions from your traditional balance will count toward satisfying the RMD amount.

With traditional TSP, your contributions go into the TSP before tax withholding, which can potentially lower your current income tax rate. But when you take money from your traditional TSP, you’ll pay taxes on both your contributions and earnings at the income tax rate of the year you make the withdrawal.

To determine your RMD, log-in to your TSP account and click on “Withdrawals and Rollovers.” You can initiate a withdrawal of any type, including an annuity, in this section. A “Minimum Distribution Notice,” providing the withdrawal amount for the current year, is sent out in early January to all particiants that are required to take a RMD, mine arrived January 11.

The Security and Exchange Commission provides an online RMD calculator if you want to run the numbers yourself.

Your First RMD

The first year you are separated from service and reached your applicable age or older is called your first distribution calendar year. If you don’t withdraw your RMD from your traditional balance during your first distribution calendar year, the TSP is required to disburse your first RMD to you by April 1 of the following year. That date is called your required beginning date.

If you receive TSP installments, your installments from your traditional balance will count toward satisfying your RMD. If your installments, combined with any subsequent distributions you might make, do not meet the required amount from your traditional balance, the TSP will send a supplemental payment from your traditional balance in March of the following year to satisfy your RMD before the April 1 deadline.

For those who wait until the following April to take their first RMD, you will be required to take a second RMD by December 31st of that same year. Taking two RMDs in one year may increase your Part B and D Medicare premiums if your Modifed Adjusted Gross Income (MAGI) requires an Income Related Monthly Adjustment Amount (IRMAA).

Distributions

There are three basic methods of withdrawing money from your TSP account as a separated or beneficiary participant: installments, partial/total distributions, and annuity purchases.

The TSP suggests, “Before you decide to take money out of your TSP account, we recommend that you consider how your decision may affect your future needs. If you are retiring or retired, you should think about when you will actually need the money in your TSP account and whether the distribution choices you make will provide enough income throughout your retirement years.”

TSP Installments

You can choose to receive installments from your account monthly, quarterly (every three months), or annually. You may schedule a date up to six months in the future for these installments to begin. Your payments will continue, unless you stop them, until your total account balance equals zero. (The minimum duration is one year.)

This is true even if you choose to have the installments come from your traditional balance first or from your Roth balance first. When you run out of money in your chosen source (traditional or Roth), payments will continue from the source you didn’t choose.

There are two ways of setting the installment amount: installments of a fixed dollar amount and installments based on life expectancy.

Partial or Total Distribution

You can receive a distribution of all or part of your TSP account. Partial distributions must be at least $1,000. There is no limit on the number of partial distributions you can take, but we will not process more than one in any 30-day period. You are allowed to take a partial distribution of part of your account even if you’re currently receiving installments. (Taking a total distribution will stop your installments.)

Purchase an Annuity

You can use all or part of your TSP account to purchase a life annuity through their outside vendor. Purchasing an annuity means that you pay now to receive monthly payments that last for the rest of your life (or, if you choose a joint life annuity, the lives of you and your joint annuitant).

The money you use to purchase a life annuity is no longer managed by you. It’s not like your TSP account, an IRA, a CD, or a bank account. You give up your money and the control of it in exchange for guaranteed lifetime monthly payments.

If you choose this option, the TSP will purchase an annuity for you from their annuity provider. Once purchased, your annuity is not part of your TSP account, and you cannot change or cancel the purchase. The minimum for an annuity purchase is $3,500. The minimum applies to your traditional balance and your Roth balance separately.

- Review the TSP Annuity Fact Sheet for additional information.

Find the TSP Information You Need

The new TSP website offers considerable guidance. However, until you understand how their website is structured, it is difficult finding the information you need. Unfortunately, the only way to get to the general information about anything and everything to do with your retirement savings account is to search for that information on their site – BEFORE SIGINING IN! It’s a two-tiered system with a comprehensive account section integrated into the main site.

Use the search box in the upper right corner, just to the left of the Log-in button, on www.tsp.gov to locate the specific information you need. The search box located on the site after signing in will only search your personal account information.

- There is also a “Chat with AVA” feature on every page in the lower right hand corner as presented below. It is a typcial chat bot where you enter a key word or term and it replies with canned answers. It isn’t as comprehensive as the search box on the main site and provides snippits of information without many links to the detailed reports you need. You can experiment with it as well.

Chat with AVA Logo

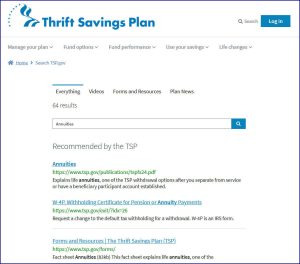

Rachel wanted information on annuities, a search for that title on the main site presented the listing as noted below:

The above screen shot only shows three of the fifty plus entries for you to review. The same search after log-in shows no results.

Helpful TSP Links

Here are links to helpful guidance that you can review for various situations that you may encounter. Bookmark or print them out for your retirement and estate plans.

- TSP Annuities Fact Sheet

- Taking Money from Your Account, Including RMDs

- Tax Rules About TSP Payments

- TSP Distributions

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- 2024 Pay Tables

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- 2024 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Tags: TSP Annuities, TSP RMDs, TSP Site Search Tip, TSP Withdrawals

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post