Posted on Friday, 15th September 2023 by Dennis Damp

Print This Post

Print This Post

According to Wilbert J Morell III, a retired Navy Engineering Project manager, “based on the September economic outlook, the CPI-W is expected to increase above 0.6%, Wilbert predicts the Social Security & CSRS COLA will be 3.4% and the FERS COLA 2.4%.”

The estimates increased about a half of a percent since our first article on this subject last April. Wilbert tracks this data monthly and compiles a comprehensive spreadsheet for these statistics.

USA Today estimates a 3.0% COLA next year and Kiplinger is in the same range. Inflation increased by 0.6% in August to 3.8% for the past 12 months and the CPI increased by 0.4%. The COLAs issued from 1999 to the present are available for your review.

Rising Prices

Inflation has moderated a bit, yet I believe it isn’t going away anytime soon. Prices are driven higher across the board due to continuing supply chain issues, higher oil prices, insurance costs, contract negotiations within major industries that are driving salaries up dramatically, and escalating housing and rental costs for example.

According to CNBC, “UPS CEO said drivers will average $170,000 in pay and benefits such as health care and pensions at the end of a five-year contract that the delivery giant struck with the Teamsters Union last month.”

They also state, “But that isn’t the only job at UPS that doesn’t require a bachelor’s degree and pays six figures; tractor-trailer drivers earn $162,000 on average ($112,000 plus $50,000 in benefits) and long-haul drivers earn $172,000 on average ($122,000 plus $50,000 in benefits).”

The United Auto Workers are asking for a mid 30s percent pay raise with a 32 hour workweek and pay for 40 hours. American Airlines pilots negotiated a 46 percent increase earlier this year and other unions have won or are seeking similar increases across the board.

The costs of everything will be higher considering inflation still rages and these pay increases must be offset with higher prices. For retirees, “hanging on to what we got” may be harder than you think as our buying power evaporates. We have to maximize our returns as best we can to keep up. COLAs alone won’t do the job for us.

Treasury Bill Yields Continue to Rise

In my article titled “Ditch your Bank’s Low Savings Rates” I described the advantages of Treasury bills (T Bills) and in a subsequent article I outlined how to ladder them to take advantage of the rising rates. What continues to astound me is that my local bank has kept their standard savings rate of .04% up to 1% for what they call a relationship APY!

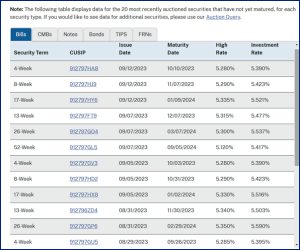

When I started purchasing T-Bills in February of 2022 they were yielding slightly more than my local bank and credit union savings rate. The 4-week bill rate has increased to 5.390% as of September 9, 2023, 8-week bills now yield 5.423%; the 13-week bill is 5.477%. The rate chart below lists Treasury Bill performance for September of this year.

TREASURY NOTE RATE CHART

Late September the Federal Reserve is expected to announce whether or not more rate hikes are planned this year. Some expect at least one more increase this November.

Many banks continue to take advantage of their depositors knowing they are reluctant to move funds from their savings to higher earning options. A person with $50,000 in his or her bank savings account earning .04% interest receives $20 a year for keeping those funds in the bank. Moving that same amount to a 52-week T-Bill currently earning 5.417% would earn the depositor $2,708.50, or $2,688.50 more than their bank would pay them!

Treasury Bill Purchases

Treasuries bills are purchased direct from the government at www.treasurydirect.gov or through your stock broker. Generally, I purchase short term bills direct from the government. Longer term notes, bonds, and TIPs are best suited for your brokerage account.

If you are holding long term notes, bonds and TIPs, they can only be sold, before maturity, through the secondary market. Treasury Direct canceled their sell direct program some time ago. Owners must transfer Treasuries they want to sell before maturity to their private brokerage account to sell them on the secondary market; it can take months for the government to complete the transfer.

I elect the new issue auction option when purchasing Treasuries through my brokerage account. If you buy previously issued Treasuries you could end up paying a high premium if the newer issued notes and bonds are paying a higher coupon rate.

Earnings Returned to Your Savings Account

Treasury Bills are purchased at discount. In other words, if you buy a $10,000 (26-Week T Bill) earning 5.537%, the Treasury withdraws $9,723.15 from your account. At maturity, 26 weeks later they deposit $10,000 back to your account. If you choose to reinvest, the Treasury deposits the earnings back to your account until the final maturity date when the full amount is returned.

This is confusing to some, in the above example the $10,000 would earn 5.537% or $553.70 if held for one year. When you buy a T-Bill for less than a year the earnings are prorated. In this case you would receive half a year’s interest, $276.85.

Conclusion

I’ll keep 8, and 13-week T-Bills reinvesting for the near term until the rates plateau; then I plan to convert them to either 52-week bills, longer-term notes, or purchase CDs depending on how high the rates move.

Certificates of deposit (CDs) earning close to the T-Bill yields are available if you take time to seek them out. A local bank recently offered 5.25% for a one-year certificate.

Interest rates reached 16.63% in 1981 and many locked in longer term Treasury Notes and bonds at very high rates, in the low to mid-teens! I’m not sure if those days are coming back but with the cost of most things increases and as of a result of the dynamics mentioned above, who knows how high rates will go.

You can elect to reinvest your T-Bills for up to two years. A 13-week T-Bill can reinvest 7 times and when they renew you pick up the new bond the same day the previous bond matures so you don’t lose any earnings. You buy them at discount so they deposit the difference direct to your designated bank or credit union account and you can watch it grow throughout the year.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- TSP Guide

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Tags: 2024 COLA, COLA, Inflation, T-Bills, Treasury Bill Yields

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (4)

Print This Post

Print This Post

September 16th, 2023 at 11:19 am

Hi Dennis. I purchased 2 TBills that will be maturing in the near future. How do I pay income tax on the earnings from these TBills? Thanks.

September 17th, 2023 at 8:08 am

You will need to download the 1099-INT form from Treasury Direct early next year for your taxes. The Form 1099 may be accessed through the ManageDirect tab in your TreasuryDirect account. Click on Manage Taxes and select the year, then you will see the 1099 prompt at the top of the form that states, “View your 1099 of tax year 2023.” Clivk on this link and download your forms. A Form 1099 will NOT be mailed to you.

September 18th, 2023 at 3:04 pm

Thank you, Dennis. I have made a copy of your instructions.

September 29th, 2023 at 6:51 am

Great I’m glad you found my article helpful.