Posted on Friday, 28th June 2024 by Dennis Damp

Print This Post

Print This Post

Last year’s 3.2% COLA for Social Security and the Civil Service Retirement System (CSRS), and 2.4% for Federal Employees Retirement System (FERS) dropped considerably from the 2023 COLA of 8.7% CSRS and 7.7% FERS. The highest in over 40 years. Costs continue to increase for most essentials.

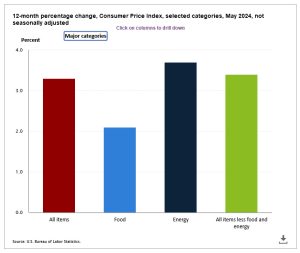

The costs of all items have increased around 3.3 percent for the 12-month period ending in May of this year according to the Bureau of Labor Statistics. The chart shows a 2 percent increase for food, but I find that hard to believe since my wife and I shop together, and the cost of many items keep creeping up.

This year our real estate taxes continued their upward climb along with our homeowner’s insurance that was almost half as much two years ago. Gasoline in Pittsburgh is averaging $3.71 a gallon, and this is the catalyst that is driving up costs of everything.

2025 COLA Estimated Increase

The 2025 COLA is calculated over the 12-month period from October 1, 2023, through September 30, 2024. The next three month’s CPI data will determine the amount of the next COLA and depends on the reported monthly inflation rates for these months, the last three months of this fiscal year.

If the US Inflation trend continues to decrease by -0.1% per month through 30 September 2024, Inflation will be at 2.9%, and at 2.6% by the end of 2024 according to Wilbert J Morell III, a retired Navy Engineering Project manager, that tracks these statistics.

Willbert predicts a 3.3% Inflation rate and the 2025 Social Security COLA to be from 2.3% to 2.9%: more likely 2.9%. He provided two other scenarios based on the path of inflation:

- If the CPI-W remains constant through 30 September 2024, the 2025 COLA for Social Security and CSRS is predicted to be 2.2% and 2.0% for FERS.

- If the CPI-W continues to decrease at the same -0.1% trend through 30 September 2024, the 2025 COLA for Social Security, CSRS, and FERS is predicted to be 2.0%.

If inflation increases due to any number of reasons, the 2025 COLA will be higher. Most media outlets are currently reporting anywhere from 2.2% to USA Today’s 3%. All projections are based on what the pundits perceive to be the rate of inflation over this period.

Retirement Processing Delays

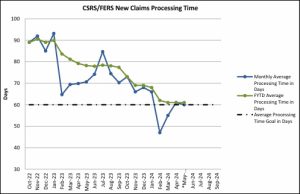

OPM, as of May 2024, has an inventory of just over 14,000 claims to process. They received 6,751 claims in May and processed 8,793.

The good news is that OPM’s retirement claims processing times have steadily declined since 2022 from over 90 days to 60 days today.

Common Mistakes That Cause Delays

Any mistakes or omissions in your retirement application often cause delays. Common errors include:

- Unsigned forms

- Check that all forms are complete before submitting them.

- Provide the correct contact information, not your work email and phone numbers.

- Fill out a new one if you make a mistake, application forms with corrections such as cross-outs or white-out can cause delays.

- Incomplete or incorrect SF 2818 FEGLI (Continuation of Life Insurance)

- Missing health benefit information

- Missing or incorrect marriage and spousal consent information

- Missing or incorrect military service documentation

NOTE: Keep a copy of all forms submitted, you never know when one will come up missing or gets lost in the process. Plus, you’ll have a copy for your retirement folder that you can use to confirm assigned beneficiaries, and other insurance and benefit selections. Keep these copies with “Your Retirement Benefits (Blue Book)” that OPM sends you when your claim’s process is completed.

Preparing for Retirement, Start NOW!

The following list of articles will help anyone planning their exit to take the appropriate actions necessary to submit a timely retirement application:

- The Ultimate Retirement Planning Guide

- Deciding When to Retire – A 7-Step Guide

- Which Way is Up – A Retiree’s Conundrum

- What to Expect the First Three Months After Retiring

- The Impact of A Divorce on Your Annuity

Summary

A COLA around 3% is much better than the ZERO COLAs we received in 2010, 2011, and 2016. Yet, the cost-of-living adjustment is based on the previous year’s statistics; in effect we start out at a loss each year.

That being said, my annuity has almost doubled since I retired 20 years ago. Many in the private sector find themselves hard pressed to make ends meet 10 or 20 years after they retire.

When it comes to retirement planning, it’s best to start your plan long before you walk out the door. I attended several agency-sponsored retirement planning seminars before retiring that prompted more questions than answers. That’s why I developed and launched the Federal Employees Retirement Planning Guide website in 2004.

A site visitor remarked, “I spent 3 hours on the web looking for answers to questions concerning federal retirement. After a Google search yielded your address, it took only 20 minutes to find all of my answers! Thank you!!”

If you are contemplating retirement, start researching your benefit options early. There are many decisions to make, and most are irreversible after you leave. One example is life insurance, several low-cost options are well worth carrying into retirement even if NOW you think the coverage isn’t needed.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- 2024 Pay Tables

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2024 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center.

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Tags: 2025 COLA, COLA Projections, CSRS Retiremenyt, FERS Retirement, Retirement Processing Delays

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post