Posted on Friday, 8th April 2022 by Dennis Damp

Print This Post

Print This Post

It’s impossible to time the market. One of the financial advisers I talked with years ago asked me this question: “Who are you investing for?” He suggested being more aggressive if you don’t require your investments to live on in retirement or investing primarily for your heirs. The market ultimately increases over time.

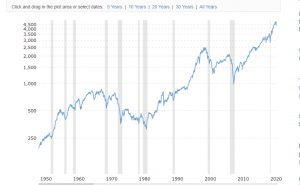

The S&P 500 index has returned a historic annualized average return of approximately 10.67% from 1957 through 2021. THRIFT Plan participants that held the C fund (S&P 500 index fund) from its inception did very well to say the least. Yet, retirees must weigh the risk associated with continuing an aggressive investment strategy in retirement.

Over the past 120 years there were many recessions and the great depression that started in 1929. From the early 1900s on there were four major recessions with the longest recovery period from 1929 to 1955, 25 years. The average recovery period was 16.5 years! The shortest recovery period until the Corona Virus recession of 2020 was six years from 2009 to 2015.

What most have experienced since 1985 is a bull market interrupted with two recessions, one running six years from 2009 to 2015, and the Corona Virus recession that lasted only two months in early 2020. The following charts show how long it took to recover to former levels.

S&P 500 1957 – 2021

DOW 1900-2021

Many would see their retirement nest egg decrease dramatically during an extended recession, panic, and sell. It doesn’t matter whether or not they need their savings to live on, it’s human nature. We’re elated when markets rise and despondent during downturns. It takes a steadfast disposition to stay the course and ignore severe market gyrations no matter what the age.

Retirees can’t dollar cost average on the way down like those still employed and contributing to their retirement account. Plus, they don’t have time on their side.

Regardless of who we are investing for, it makes sense for many retirees to protect what they’ve worked a lifetime accumulating. I’d rather have one in the hand than two in the bush, my former boss related this sage advice when I was contemplating his job offer.

It’s impossible to predict when the next major market correction or recession is coming. Yet, they are inevitable after extended periods of excesses. Our national debt now exceeds this country’s GDP for the first time since WW II, considering seven proposed Federal Reserve interest rate hikes this year, skyrocketing inflation, world unrest, excessive government spending, chaos at our southern border, pandemic related supply chain issues, fuel and potential pending food shortages, how much will it take to tip the scales one way or the other?

I’m not a clairvoyant, alarmist, or a financial planner, just a casual observer and seasoned conservative investor.

It may be a good time for retirees and those approaching retirement to assess their risk tolerance and portfolios. Federal annuitants often have more latitude with their investment choices. Even though many live comfortably off their monthly annuity, Social Security, and TSP withdrawals: inflation, health issues, and other factors could require additional retirement savings withdrawals down the road. Will the funds be there when needed?

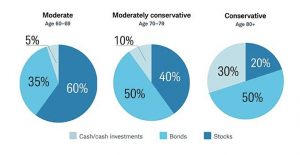

According to Charles Schwab, “The conservative allocation is composed of 15% large-cap stocks, 5% international stocks, 50% bonds and 30% cash investments. The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds and 10% cash investments. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments.”

THRIFT plan participants can mirror these allocations with existing funds. A mutual fund window will soon be offered by the TSP that allows us to purchase thousands of mutual funds including one-decision and balanced funds. The L Income Fund allocations are between the moderately conservative to conservative portfolios listed above with an annual return of 2.99% as of February 2022, the 10-year average return is 4.71%.

The Vanguard Wellesley Income Fund (VWINX) allocation is moderately conservative and it achieved an 8.5% total return in 2021 with a 10-year average total return of 7 percent. The target allocation is two-thirds bonds and one-third stocks. It has a 5-Star Morningstar rating and their management fee is only .22%. They focus on value dividend paying stocks and investment grade bonds. VWINX seeks to provide long-term growth of income and a high and sustainable level of current income, along with moderate long-term capital appreciation. This fund fully recovered in less than one year during the 2008 to 2015 recession.

Another conservative balanced fund is Vanguard’s Wellington Fund (VWELX). It invests approximately two-thirds in stocks and one-third bonds. It has a moderate allocation and a 10.49% total return in 2021 with a 10-year average total return of 9.55% percent. This 5-Star (GOLD) Morningstar rating fund’s management fee is only .24%. VWELX has been around since 1929 and seeks to provide long-term capital appreciation and reasonable current income. It dropped 22% in 2008 and recovered eighteen months later to its previous high.

These funds may be available when the TSP’s mutual fund window becomes available this June.

With conservative portfolios, the challenge is to find a decent rate of return on your fixed income. Treasury Bills and notes are now offering decent returns as interest rates scontinue to rise. The balanced funds mentioned above manage their equities and bond investments to maximize yield and capital gains. They are professional money managers; their past performance is a measure of just how effective they have been over the years. There are many one decision conservative funds; it takes research and time to find the one right for you.

Professionally managed bond funds are also available such as the Dodge and Cox Income Fund (DODIX) and Fidelity’s (FTBFX), both have a Morningstar GOLD 4-star ratings. However, as interest rates increase bond funds generally go in the opposite direction; the shorter duration the bond fund has the less downside risk. Individual bonds held to maturity don’t have the market risk bond funds have.

If you purchase a Treasury, corporate or municipal bond of any duration, and don’t sell it on the secondary market before maturity, you will receive the principal and all interest due. You can buy individual bonds through your broker and Treasuries at TreasuryDirect.gov. There is minimal market risk with investment grade bonds. The TSP G Fund is one of the only bond funds that I’m aware of that is guaranteed not to decrease in value, it yielded 1.52% last year with a 10-year average yield of 1.94%.

I-Bonds are now paying 9.62% interest and the ones issued back in 1999 pay over 13%. Even EE Savings bonds offer a 3% yield if you hold them for at least 20 years. Currently short-term treasuries are paying considerably more than most bank savings accounts and CDs.

Conservative portfolios usually seek to provide both capital appreciation and income for the investor. Could I miss out if the market continues to power ahead? Certainly, but that is a tenable outcome that I can easily live with and preferable to experiencing a dramatic decrease during an extended recession. Here are several articles that may help you perform your assessment:

- Is the Stock Market Keeping You Up at Night?

- I Bonds Yield 9.62% While the Sky is Falling!

- How to Keep What You Worked a Lifetime Accumulating

- Have You Considered Hiring A Financial Advisor

All portfolios that include stocks, mutual funds, ETFs, and bonds are impacted by market volatility. The more conservative the mix the less downside risk.

The information contained herein should not be considered investment advice and may not be suitable for your situation.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

Posted in ANNUITIES / ELIGIBILITY, EMPLOYMENT OPTIONS, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post