Posted on Thursday, 12th June 2025 by Dennis Damp

Print This Post

Print This Post

This year’s 2.5% COLA for Social Security and the Civil Service Retirement System (CSRS) and 2.0% for Federal Employees Retirement System (FERS) decreased from the 2024 COLA of 3.2% % CSRS and 3% FERS.

The 2023 COLA was the highest in over 40 years at 8.8% for CSRS and 7.7% for FERS employees. Even though costs remain high for many segments of the economy, inflation is moderating as noted in the following charts.

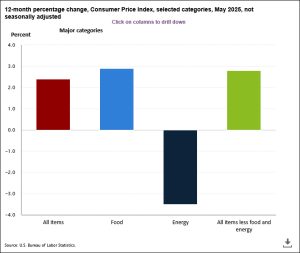

May 2025 CPI Chart

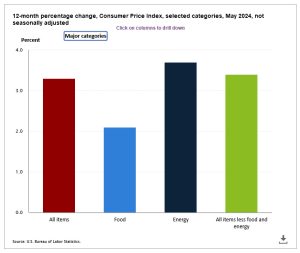

I published the following 2024 CPI inflation chart in last year’s COLA update article; you can see the significant drop in inflation year to year, especially in the energy sector.

May 2024 CPI Chart

According to the Bureau of Labor Statistics, the costs of all items increased by around 2.4% in the current 12-month period ending in May, compared to 3.3% last year. The one area that didn’t show improvement year to year is food; it increased to almost 3 percent, and we all can attest to that fact: food prices at the grocery store and restaurant meals are still through the roof.

Our real estate taxes continued their upward climb again this year. Allegheny County real estate taxes increased 36% in just one year. Gasoline in the Pittsburgh area averages $3.34 a gallon, but at Sam’s Club or Costco, it is $3.15 a gallon, which is still one of the major catalysts driving up the costs of everything we use.

2026 COLA Estimated Increase

The 2026 COLA is calculated over the 12-month period from October 1, 2024, through September 30, 2025. The next three months’ CPI data will determine the amount of the next COLA, and it depends on the reported monthly inflation rates for these months, the last three months of this fiscal year.

Wilbert J Morell III, a retired Navy Engineering Project manager, tracks these statistics monthly and generates a comprehensive report on our COLAs under specific scenarios.

His research concludes that if there aren’t significant changes to the last quarter’s CPI, we can expect the following 2026 COLAs:

- 2026 Social Security COLA: 2.6%

- 2026 CSRS COLA: 2.6%

- 2026 FERS COLA: 2.0%

As of June 11, 2025, the Senior Citizens League (TSCL) projects the Social Security Cost-of-Living Adjustment (COLA) for 2026 to be 2.5%. This is an increase from their previous forecast of 2.4%.

Review all COLAs from 1999 to the present with detail on how they are prorated for FERS employees and annuitants.

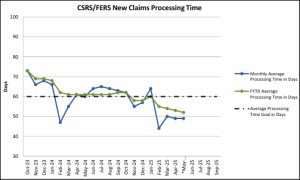

Retirement Processing Delays

As of May 2025, OPM has an inventory of over 24,000 claims to process. They received 15,040 claims in May and processed 9,739.

The good news is that OPM’s retirement claims processing times have steadily declined since 2022, from over 90 days to 52 days today. Now that retirement applications are submitted online, the days it takes to process a claim should be reduced further.

Significant Changes Impacting Federal Employees

Common Mistakes That Cause Delays

Any mistakes or omissions in your retirement application often cause delays. Common errors include:

- Unsigned forms, online forms require an electronic signature (Guidance Provided)

- Check that all forms are complete before submitting them.

- Provide the correct contact information, not your work email and phone numbers.

- Incomplete or incorrect SF 2818 FEGLI (Continuation of Life Insurance)

- Missing health benefit information

- Missing or incorrect marriage and spousal consent information

- Missing or incorrect military service documentation

Preparing for Retirement, Start NOW!

The following list of articles will help anyone planning their exit to take the appropriate actions necessary to submit a timely retirement application:

- The Ultimate Retirement Planning Guide

- Deciding When to Retire – A 7-Step Guide

- Which Way is Up – A Retiree’s Conundrum

- What to Expect the First Three Months After Retiring

- The Impact of a Divorce on Your Annuity

- OPM’s Retirement Planning Overview

Summary

The 2026 projected 2.6% COLA is much better than the ZERO COLAs we received in 2010, 2011, and 2016. Yet, the cost-of-living adjustment is based on the previous year’s statistics; we start at a yearly loss. My annuity has almost doubled since I retired 20 years ago. Many private-sector annuities aren’t COLA-adjusted, and private-sector retirees often find themselves hard-pressed to make ends meet 10 or 20 years after retirement.

Regarding retirement planning, it’s best to start long before you walk out the door. I started five years before my target date and attended several agency-sponsored retirement planning seminars that created more questions than answers. That’s why I developed and launched the Federal Employees Retirement Planning Guide in 2004.

One of our site visitors stated, “I spent 3 hours on the web looking for answers to questions concerning federal retirement. After a Google search yielded your address, it took only 20 minutes to find all of my answers! Thank you!!”

If you are contemplating retirement, start researching your benefit options early. There are many decisions to make, and most are irreversible after you leave. One example is life insurance. Several low-cost options are worth carrying into retirement, even if you think the coverage isn’t needed now.

Helpful Retirement Planning Tools

Join other federal workers on the FedWork Network.

Sign up for this Free Service to get started.

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2025 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

Tags: 2026 COLA Projections, COLA, CSRS, Daily Brief, Federal Retirement Projections, FERS, Social Security

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post