Posted on Friday, 19th November 2021 by Dennis Damp

Print This Post

Print This Post

Transitory inflation is a myth that is unsustainable. Yes, the COLA this year was 5.9%; since it was announced, the Bureau of Labor Statistics reported prices climbed 6.2% year-over-year, the largest increase since November 1990. Everything we buy or the services we use with few exceptions are increasing at an alarming rate. Medicare premiums were announced last Friday and are increasing 14.5%; the largest dollar increase in Medicare’s history! The Social Security wage base for taxes is increasing approximately 3% for 2022 and wage earners must pay taxes on incomes up to $147, 000 a year up from $142,800 in 2021.

Government reports claim that wages increased, sometimes dramatically, over the past year or so. However, real wages are actually down over 2% when you factor in inflation! Many mixed messages across the board.

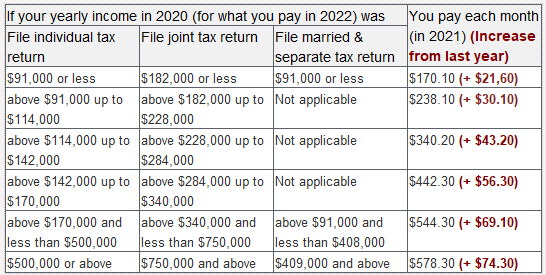

I was disappointed to hear of the Medicare increase when you consider that the average Federal Employees Health Benefits (FEHB) premiums increased only 2.4% for 2022. A 14.5% increase is huge and wipes out much of the COLA increase for those on fixed incomes. I highlighted the increase in red on the following chart.

Couples earning less than $182,000 a year will pay $4,082.40 ($170.10 each per month times 12) a year for Part B coverage while a couple in the highest income group pays $13,879.20 a year for the same Medicare Part B Coverage! Most people pay the standard Part B premium amount.

2022 Medicare Part B Premiums

Part B premiums are determined annually from income statistics that the IRS provides to Medicare. If your 2020 Modified Adjusted Gross Income (MAGI) is above a certain amount as indicated above, you will pay a higher Part B premium. Review tax returns to determine what your adjusted gross income was and then add in any tax-free interest you earned to determine (MAGI) and what your monthly premium will be.

Modified Adjusted Gross Income includes capital gains, taxable interest, tax-exempt interest, dividends, annuity income, wages, business income, and IRA distributions. When you start drawing from your THRIFT account, take a one-time lump sum withdrawal, cash in stocks or bonds that have appreciated in value, or convert to a ROTH you may end up with a higher part B premium payment the following year.

Those in the lowest income bracket may end up with a Medicare Part B premium increase the following year when taking a Required Minimum Distribution (RMD) from your TSP and other retirement accounts, realize capital gains from taxable accounts or cash in those long held Savings Bonds that many federal employees accumulated over the year.

For those still working take advantage of the Flexible Spending Accounts offered under the FSAFEDS program. You can save pre-tax dollars and spend them on health care, child care, dental, vision and other expenses. Review Shawn McCoys 2022 FSA article that provides guidance for this open season selections.

Helpful Retirement Planning Tools

- Retirement Planning For Federal Employees & Annuitant

- The Ultimate Retirement Planning Guide – Start Now

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

- The 2026 FEHB & PSHB Open Season Selection Guide - November 6th, 2025

- Medicare & You 2026 – Significant Changes on the Way - October 31st, 2025

- A 30-second Check Could Change Your Retirement Plan - October 20th, 2025

- Prescription Drug Costs – Major Price Cuts Coming - October 17th, 2025

- Government Shutdown Continues – Suffering the Consequences - October 15th, 2025

- Health Care Premiums Announced for 2026 – Hold on to your Hat! - October 13th, 2025

- Inflation Concerns and High Prices Persist – What’s Next - October 10th, 2025

- Roth Conversion Article Update and Income Tax Impact - September 25th, 2025

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post