Posted on Friday, 17th March 2023 by Dennis Damp

Print This Post

Print This Post

Savings bonds as featured in my article titled, “I and EE Savings Bonds – Safe, Simple, and Affordable” can be used to finance children’s education, supplement future retirement income, or save for a rainy day, all are backed by the full faith and credit of the United States.

Many are unaware of the tax-free components of Savings Bonds. The Interest earned is tax deferred until you cash them in. If used for education, the tax is waived in certain situations, and they aren’t subject to State taxes.

Tax Deferred Earnings

You can defer reporting the interest until you file a federal income tax return for the year in which you cash them in. Another option is to report the interest yearly even though you don’t receive the interest until the bond is redeemed.

Most defer reporting the interest until they cash in their savings bonds. A Form 1099-INT form will be sent by the financial institution that cashed your bonds. This form is downloadable from your Treasury Direct account for bonds held in your online account.

Reporting interest annually

I defer reporting earned interest until I cash in my bonds to avoid the additional paperwork involved. If you pay the tax annually on the interest earned for that year, you have to look up the year’s interest for each of your bonds and report it on your tax return. You’ll only receive a 1099 INT for the total amount of interest when you eventually redeem the bond.

Your tax return must be annotated the year you redeem the bond to reflect that you already paid most of the taxes and don’t owe tax on the full amount. Keep all of your old tax returns to prove the taxes were paid.

Treasury Direct account holders can view the interest earned each year in their account. Those with paper savings bonds can use the Savings Bond Calculator to determine the interest earned in any given year. Use IRS publication 550 instructions for reporting savings bond interest annually.

Another consideration, if you decide to change from one method to the other you have to file IRS Form 3115 to make the change.

Advantages of Paying Interest Annually

Paying the tax at maturity or cashing in a number of bonds for a specific purpose before maturity will increase your Adjusted Gross Income for that year if you go the tax deferred route, which most do. The maximum you can purchase in I or EE bonds each year is $10,000, if you wait until maturity the bonds will more than double in value.

This increased income for savings bonds that interest was deferred could push you into a higher tax bracket or potentially increase your (MAGI) Medicare Part B and D premiums in the upcoming year. The additional income could possibly make you ineligible for certain income-based benefits.

Education Exclusion

You may be able to exclude from income all or part of the interest you receive on the redemption of qualified U.S. savings bonds during the year if you pay qualified higher education expenses during the same year. This exclusion is known as the Education Savings Bond Program.

Qualified U.S. savings bonds

A qualified U.S. savings bond is a Series EE bond issued after 1989 or a Series I bond. The bond must be issued either in your name (sole owner) or in your and your spouse’s names (co-owners). You must be at least 24 years old before the bond’s issue date.

Qualified Expenses

Parents may be able to pay some or all of their child’s higher education tuition with their savings bonds without paying taxes on the earnings.

Qualified higher educational expenses are tuition and fees required for you, your spouse, or your dependent to attend an eligible educational institution. Qualified expenses include any contribution you make to a qualified tuition program or to a Coverdell education savings account.

Qualified expenses do not include expenses for room and board or for courses involving sports, games, or hobbies that are not part of a degree or certificate granting program.

When I first realized you could do this, I thought it also applied to non-dependent grandchildren as well. Unfortunately, it doesn’t.

Recovering Lost or Missing Savings Bonds & Treasuries

According to the U.S. Treasury Department there is $29 billion in unredeemed savings bonds! They are just waiting to be found by their owners or heirs and the Treasury will help you with your search.

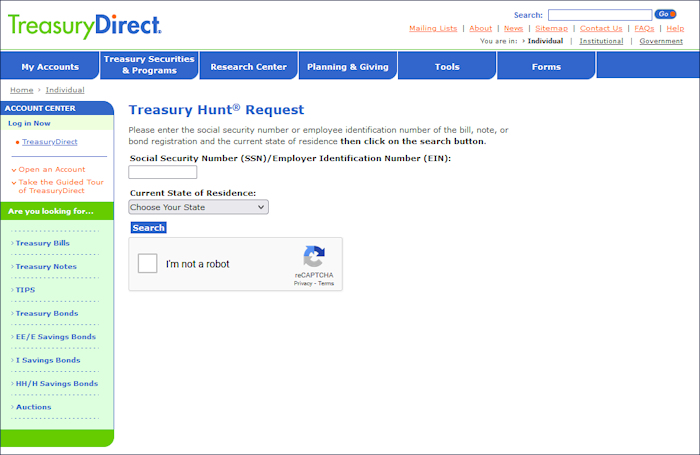

Treasury Hunt is the Treasury’s online search tool for finding matured savings bonds or missing interest. You can use this service if you or a loved one who died had savings bonds or other Treasury securities that are no longer earning interest, but haven’t been cashed.

It also covers missing interest or other payments on HH savings bonds or other Treasury securities. Just enter the person’s Social Security Number and state of residence. Dots will show on the form for the Social Security Number to protect your privacy.

Visit https://www.treasurydirect.gov/savings-bonds/treasury-hunt/ to use this form. If you find bonds or other securities that match your information, you’ll get instructions on how to proceed.

Another option to recover lost savings bonds is to visit the Treasury Direct website and fill out Form 1048: Claim for Lost, Stolen, or Destroyed United States Savings Bonds.

The more information such as the serial numbers, bond face values, the name and social security number of the person on the bond, the greater chance of success.

More than likely, you won’t have all of the details unless written records are available. The Treasury can likely find the bond records as long as you know some of the details.

Summary

Interest deferral along with no state taxes, and the possibility of using your bonds for education to eliminate taxes on your bonds, all make savings bonds a compelling investment option. The current 6.8% yield on I Bonds is exceptional and EE bonds, currently yielding 2.1%, are guaranteed to double to face value after 20 years.

Many 529 college funds are invested in the stock market and subject to losses during recessions and uncertain times. My EE bonds averaged 4.8%, and my I bonds averaged 5.85% over the past 30 years. The S&P 500 return from 1993 through 2022 was 7.52%. Savings bonds are not subject to market volatility and will be there when you need them.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Tags: EE Bonds, I Bonds, Lost Savings Bonds, Savings Bonds, Tax Free Interest

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post