Posted on Friday, 10th March 2023 by Dennis Damp

Print This Post

Print This Post

Savings bonds received a boost in popularity last year due to their inflation indexed I-Bond’s exceptional interest rates, currently 6.89%. Far exceeding what most investments are paying today. Their previous six-month yield was 9.62%!

A former associate reviewed savings bond interest rates for his payroll deduction purchases from 2001 to 2007. His 2001 bonds are paying 10.23%. Most were yielding 8 to 9.5% in the other years, with a few at 4.5 to 5.5 percent.

The I-Bonds issued in the late 1990s and early 2000s had a 3% fixed rate, today’s fixed rate is .4%, the reason for the much higher yield at the beginning of the 21st century. My I-Bonds during this period are earning from 8.54% to 13.08%!

Paper Verses Online Bond Purchases

The Treasury stopped issuing paper bonds on January 1, 2012 and savings bonds soon fell out of favor. Most were skeptical of the new online book entry system, myself included. The only way to purchase paper I-Bonds today is with your IRS tax return. They allow those receiving a tax refund to use up to $5,000 of their refund to purchase paper I-bonds. All other savings bond purchases must be processed online at www.TreasuryDirect.gov.

Once you get familiar with Treasury Direct (TD) and understand the process, it isn’t all that difficult and there are advantages to having the bonds in a book entry system.

Advantages of the Online System

- Savings bonds mature after 30 years. If you hold paper bonds and don’t cash them in, they stop earing interest. When bonds are held in your Treasury Direct account, they automatically cash them in at maturity and return the funds to your designated bank account.

- You can easily manage your online bonds including changing registration, beneficiaries, and track your bond portfolio’s basis and interest for all bonds and individually.

- You can buy and cash in your savings bonds whenever desired as long as you hold them for at least a year. Funds are electronically withdrawn or deposited to your designated bank account.

- The Treasury issues a downloadable 1099 INT form for redeemed bonds; you don’t have to claim the interest until they are cashed in, the same with paper bonds that you may have.

- Once you open your TD account you will be able to purchase Treasury Bills, Notes and Bonds. Short term Treasury Bills are paying around 5% today.

- You can send your paper bonds to the Treasury and they will add them to your online account.

- Paper bonds can easily be lost and forgotten. Once in an online TD account, and you include your account information in our estate plans, heirs would be able to access them.

- The process to cash-in paper bonds can be cumbersome. You must retrieve them from your safety deposit box, then to a teller to cash them in or deposit the money in your account. Online, just a few key strokes and you’re done; the next day the funds are deposited to your account.

On the flip side, paper bonds were ideal for gifting to our children, grandchildren and others. Today, each person you gift to must have an online TD account. Most forgo the process and give cash to their parents for the child’s 529 or bank savings account. Also, one in the hand is worth two in the bush. A paper bond is tangible, you can take bonds to most local banks, as I did last week, and cash them in.

The Registration Dilemma

The Treasury allows registration as an owner WITH another party or as a primary owner with one designated beneficiary. I don’t know why they limit the number of beneficiaries.

Co-owner & Beneficiary Registration

You can register your bonds in your name WITH your spouse or any other person. The bond can be cashed by either party.

It’s recommended to leave instructions for your executors, after one of the co-owners dies, to change the registrations for the joint account to the survivor and change bond registrations to whatever beneficiaries are desired for the remaining bonds in the account.

To get around not having the ability to select more than one beneficiary, you can register the bonds in your name with different beneficiaries for each of your online bonds as desired.

It’s easy to change registration online with your Treasury Direct Account. All you do is add the registrations you want and then change your current bonds to the new registration. For paper bonds, you have to send them into the Treasury and they will put them into your Treasury Direct Account with the desired registration.

Featured Job

Looking for federal retirees with logistics and travel experience

EE Savings Bonds

Today EE bonds are yielding 2.10% and they are purchased at half their face value and there is a $10,000 yearly purchase limit. The Treasury guarantees the EE bonds will double to face value in 20 years for an effective yield of 3 percent.

You must hold them for at least one full year before cashing them in; if you cash them in before 5 years, you lose 3 months of interest.

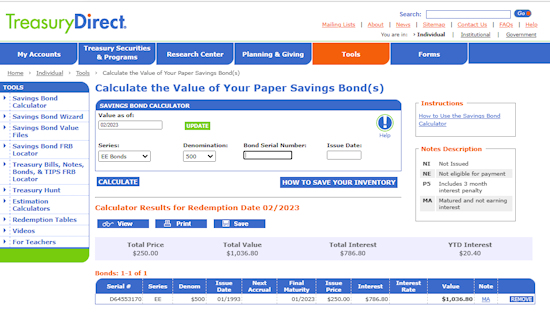

I recently cashed in several matured 30-year EE paper bonds. One of the bonds I turned in cost $250; I received $1,036.80 for a compounded yield of 4.8%. Interest compounds semiannually. The following screen shot shows one of the EE bonds I cashed in; I used the Treasury’s Savings Bond Calculator to confirm the amount I would receive before going to the bank. It was spot on to the penny.

30 Year EE Bond Interest

I-bonds earn interest monthly. Interest is compounded semiannually; every 6 months the Treasury applies the bond’s interest rate to a new principal value. The new principal is the sum of the prior principal and the interest earned in the previous 6 months.

A $200 denomination I-Bond I purchased in July of 1999 is now worth $774.40 today providing a compounded yield of approximately 5.85%. This bond is now earning 9.89% and this July the yield will drop to 6.89% for the next six months.

I Bond purchases are limited to $10,000 yearly per account holder through Treasury Direct. Both you and your spouse can purchase up to this limit if you have individual accounts. At tax time, you can elect to buy up to an additional $5,000 in paper I-bonds with your tax return.

You can cash in (redeem) your I bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example, if you cash in the bond after 22 months, you get the first 19 months of interest.

Cashing in Your Bonds

A newsletter subscriber had a problem cashing in a deceased relative’s savings bond. If the bond holder didn’t designate a beneficiary or that person died, it can be a problem. Also, his son’s bank and credit union wouldn’t redeem paper bonds. This is becoming more common these days.

My local bank and credit union still redeem savings bonds. They gave me a detailed receipt for the matured bonds I cashed in last week showing the redemption amount and total interest earned. They will send 1099-INT forms for 2023 early next year. Savings bonds redeemed through your online TD account produce a downloadable 1099-INT form.

If you can’t find a local financial institution to take your paper bonds you will have to send them to the Treasury to redeem.

Buying Your First Classic Car

Tracking Your Bonds

I use the Treasury’s Savings Bond Calculator to track EE and I-Bonds, paper and online purchases even though the Treasury advises users not to add online bonds to the calculator. Actually, you don’t have to track bonds you purchased online since they are already accounted for within your account; you should print out a copy of all of your bonds for your records.

I added my online bonds so that I have a complete central list of all savings bonds we own. You can only add an I-Bond up to $5,000 on the calculator. If you purchase the maximum amount break it down into two lots and label them the savings bond serial number 1 and 2. For example, if your serial number is IABBA, enter $5,000 with serial number IABBA-1 and IABBA-2. The data base file works fine with these designations.

Once you added all of your bonds you must save the file and only a few browsers actually work. I use Firefox since Microsoft stopped supporting Internet Explore. The program does not work with Google Chrome or Microsoft Edge. Firefox is a free download if needed.

An image of the calculator is located above under EE Savings Bonds. To save your compiled file click on “How to Save Your Inventory” and follow the guidance for your browser. It’s easy to do, it just takes a few times doing it to get accustom to the routine. Every time I buy or sell bonds I add or remove them from my list and save the new file under my desktop so it is always there to review monthly.

Another nice feature of this calculator, when new rates are announced in November and May you can go six months out to determine what your account is worth to those dates.

Summary

Savings bonds aren’t glamorous like the high-flying stocks of today and may not earn you the most long-term, but they are safe, simple, and affordable. When an investment is out of sight and mind, it will be there when needed to bail you out during hard times.

The compounded yield of my matured 30 year EE bonds, that I just cashed in, was 4.8%. One of my oldest I-Bonds compounded yield from 1999 to the present was 5.85%. Not bad considering that the average annualized S&P 500 return for the past 30 years, 1993 through 2022, was 7.52%. Another advantage is tax deferred earnings until cashed and your earnings aren’t subject to state taxes.

I encourage those still employed and planning their retirement to consider purchasing savings bonds through payroll deduction as I did throughout my career. It will make a difference later in life and you can start small and watch it grow. Retirees that can afford to purchase I-bonds, now is a good time to invest in them as well, you just can’t cash them in for the first year.

When the market is gyrating, as it is now, you will sleep better at night knowing a portion of your savings are stored safely away. Here are two articles that you may find helpful;

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Tags: EE Bonds, I Bonds, Savings Bond Purchasing Limits, Savings Bonds

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post