Posted on Friday, 15th March 2019 by Dennis Damp

Print This Post

Print This Post

Jodi recently emailed me suggesting that most Life Insurance companies emphasize what coverage they provide including accidental death and dismemberment. She was searching for a general policy statement other than simply the costs associated with each type of coverage. She wanted to know about dismemberment and accidental death coverage, the exact coverage she was paying for, and a copy of her policy. She closed with, “I don’t need another formula for how much money it provides. I have looked for 30 minutes. If you could just email the likely one to two-page insurance policy it would be great.”

I received a “Federal Employees Group Life Insurance Program Certificate” when I first started working for government. It explained much of what Jodi wants except for the insurance options and amounts that you elect when you enter federal service. You need a copy of your election forms for that information and those still working can review their electronic Official Personnel File (eOPF) to obtain a copy.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Federal annuitants can request a copy of their FEGLI Insurance Coverage, FEGLI Verification, by calling OPM at 1-888-767-6738 or printing a copy of this document from OPM Services Online. I printed out a copy of my FEGLI coverage from the online service for my records. The FEGLI Verification of coverage document states, “Using the information given, you can determine the amount payable at any time in the future. The insurance issued under the Group policy is term insurance. It builds no cash or loan value.”

The Certificate I received years ago lists accidental death and dismemberment coverage, the cost at the time of basic coverage, conditions, how to file a claim, and much more. It looks like a standard folded policy without your specific coverage listed. I’ve kept this certificate all of these years in my insurance file with a copy of the elections I originally made and updated the information when I retired. With this information, my heirs will know the amount of my coverage and who to contact when the time comes to collect; hopefully, many years down the road.

Unfortunately, the certificate, Form G. 3385-G – Feb 1969, isn’t available. However, OPM provides two printable pamphlets, a booklet for retirees and the FEGLI program Handbook, and other resources like FAQs that you can review and download for your home insurance file. These documents cover anything and everything you need to know about your FEGLI coverage.

There is a contact number on our free Retiree’s Master Contact List for the FEGLI administrator’s office. They only process claims and can not provide a summary of your coverage. Active employees must contact their HR office to review their eOPM for this information, retirees must contact OPM or download their insurance coverage from OPM’s Online Services as noted above.

FEGLI Fundamentals

FEGLI coverage provides group term life insurance. Term insurance doesn’t build cash value or paid-up value. It consists of Basic life insurance coverage with three options. In most cases, if you are a new Federal employee, you are automatically covered by Basic life insurance and your payroll office deducts premiums from your paycheck unless you waive the coverage. In addition to the Basic, there are three forms of Optional insurance you can elect. You must have Basic insurance in order to elect any of the options. Unlike Basic, enrollment in Optional insurance is not automatic — you must take action to elect the options.

Accidental Death and Dismemberment (AD&D) Benefits

AD&D coverage is an automatic part of Basic and Option A insurance for employees at no additional cost. Complete details of this coverage begin on page 35 of the FEGLI Handbook.

There is no AD&D coverage:

- With Options B and C;

- For annuitants or persons insured as compensationers; and

- During the 31-day extension following termination of coverage.

Accidental death benefits are paid to your beneficiaries; accidental dismemberment benefits are paid to you, the insured.

Accidental death and dismemberment (AD&D) benefits are payable when you sustain bodily injury solely through violent, external, and accidental means, and as a direct result of the bodily injury, independently of all other causes, and within one year afterwards, you lose your life, limb (hand or foot), or eyesight.

- Loss of hand means loss by severance at or above the wrist joint, or equivalent loss, as determined by OFEGLI.

- Loss of foot means loss by severance at or above the ankle joint, or equivalent loss, as determined by OFEGLI.

- Loss of eyesight means total and permanent absence of any usable vision in one eye.

Accidental Cost Benefits

Accidental death benefits, if payable, are payable in addition to “regular” FEGLI benefits. Under Basic insurance, accidental death benefits are equal to your Basic Insurance Amount (BIA), but without the age multiplication factor. These benefits are payable in addition to your Basic insurance and any Optional insurance payable.

Under Basic insurance, accidental dismemberment benefits for the loss of one hand, one foot, or eyesight in one eye are equal to one-half of your BIA. For the loss of two or more of these in the same accident, benefits are equal to your full BIA.

Note: Total AD&D benefits for a single accident, no matter how many losses occur, cannot be more than your full BIA.

Extra Benefit/Age Multiplication Factor

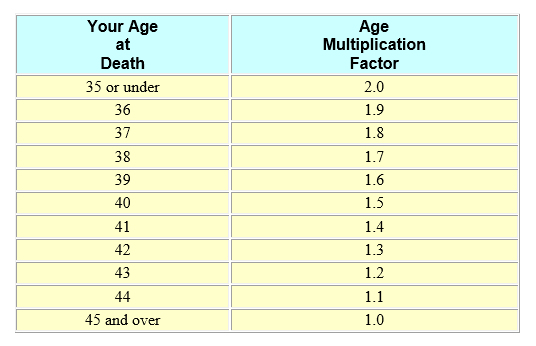

If you are under age 45 and covered under Basic insurance, you automatically have extra coverage without paying additional premium. This Extra Benefit increases the amount of Basic insurance payable at the time of your death, if you die before age 45.

To determine the amount of the Extra Benefit, multiply your Basic Insurance Amount (BIA) by the appropriate age multiplication factor as follows:

Living Benefits

Living benefits are life insurance benefits paid to you while you are still living, rather than paid to a beneficiary or survivor when you die. You can elect a living benefit if you are diagnosed as terminally ill with a life expectancy of nine months or less, and you have not assigned your insurance. If you are physically or mentally incapable of electing living benefits, an individual having power of attorney can apply for living benefits on your behalf.

Only Basic insurance is available for a living benefit. Optional insurance cannot be paid as a living benefit. If you are an employee, you can elect either a full living benefit (all of your Basic insurance) or a partial living benefit (expressed as a multiple of $1,000). Annuitants and compensationers can elect only a full living benefit.

Life Event Changes for Employees

FEGLI life events are:

- Marriage

- Divorce

- Death of a spouse and

- Acquiring an eligible child

If an employee has a life event under FEGLI, he/she may elect Basic insurance and any and all Optional insurance coverage, including up to the maximum number of multiples of Option B and/or Option C coverage. For the FEHB program there are more situations where life events permit changes to your health care coverage between open seasons. There are time limits for these changes that you must adhere to or lose the opportunity to make the changes you desire.

The time limit for making a FEGLI life event election is 60 days after the date of the qualifying event. You must file the election with your employing office using the Life Insurance Election (SF 2817-or is electronic equivalent) along with proof of the event.

You can either file the election before the event, to be followed up with the necessary proof within 60 days after the event has taken place, or you can file the election and provide the necessary proof no later than 60 days after the date of the event.

Annuitants also can take advantage of certain life events. Life events covered include you move, divorce, marry, have a baby, step-child, or foster child, your child reaches age 26, you reach age 65, your spouse dies, your former spouse dies or remarries before age 55, your child dies, you can’t handle your own money, or when you die Review OPM’s “Life Events and Your Retirement and Insurance Benefits (For Annuitants).”Generally, annuitants can only decrease their FEGLI benefits after retiring.

Here are a series of articles about FEGLI coverage that you may find helpful:

- Understanding FEGLI Coverage

- Three

Part Series (FEGLI Option)

- FEGLI Retirement Options (Part 1)

- FEGLI Insurance Options (Part 2) Options A, B and C

- FEGLI Insurance Life Event Changes (Part 3)

It’s wise to Evaluating Your Insurance Needs prior to making any changes. Your insurance needs change with age and circumstance over time.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

- TSP Information

- Financial Planning Guide

- Retirement Planning Guide

- Budget Work Sheet

- Master Retiree Contact List (Important contact numbers and information)

- 2019 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer:Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Posted in UNCATEGORIZED | Comments (0)

Print This Post

Print This Post