Posted on Friday, 4th October 2024 by Dennis Damp

Print This Post

Print This Post

The Federal Reserve lowered its benchmark interest rate September 18th by .5 percent (50 basis points), the first rate cut in four years! This rate cut lowers the Fed’s benchmark short-term rate to 4.75% to 5% from a 23-year high of 5.25% to 5.5%. The cut slightly eased borrowing costs for consumers across the board.

Click on this banner to sign up for a complimentary retirement planning

session and a FREE retirement planning report

Even with this rate cut, fixed income continues to hold its attraction for retirees and those who want to earn a fair rate of return on their cash and savings. While the stock market does offer the potential for higher gains, it doesn’t come without risks for those approaching retirement and retirees alike.

Treasury Bill and Note Rates Still Attractive

The national average savings account yield is 0.61 percent APY, according to Bankrate’s survey of institutions as of September 16, 2024. Higher rates are available from many online banks if you look around or negotiate a better rate with your bank. The average savings account yield would earn you a measly $61 per $10,000 of savings for the entire year!

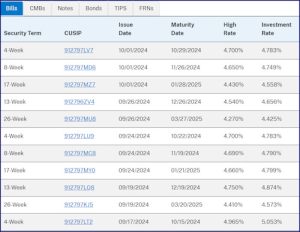

The 26-week Treasury Bills are currently earning 4.25 percent. You can select auto reinvestments for up to two years and they can be canceled at any time if the funds are needed. The rates change for each new issue. However, the shorter-term (4, 8, and 13-week) Treasury Bill yields have averaged just above 5 percent over the past year.

Although the Federal Reserve intends to further reduce rates over the next 18 months, Treasury Bills continue to earn attractive yields. Treasury interest payments aren’t subject to State taxes, another tax savings for all.

Treasury Bill Investment Rates

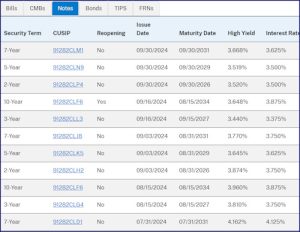

Treasury Notes are currently offering anywhere from 3.3 to 4.3%. With these notes there is also the potential for capital gains if interest rates continue to decline and you decide to sell them on the secondary market before maturity.

Treasury Note Interest Rates

Purchasing Treasury Bills, Notes, and Bonds

Visit TreasuryDirect.gov to register, explore the options, and start purchasing Treasury bills, notes, and bonds, TIPS, and savings bonds. You are buying direct from the government and eliminating the middle man; there aren’t any fees charged for purchases.

Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; they can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

CDs and Savings Bonds

Many online banks, credit unions, and some regional banks are offering competitive rates for savings accounts and CDs from 3.5 percent and higher in many cases. With rates falling I’m looking for longer term CDs or 2, 3, 5, 7, or 10-year Treasury Notes to lock in higher rates.

I purchased 15-month CDs at two local credit unions last December for 5.75% and my primary credit union matched their offer!

CDs have no market risk if you stay under their insured FDIC limits. I moved some of the funds I was cycling through the Treasury to this attractive yielding investment. In hindsight, I could have moved more.

I-Savings Bond Rates

I Bonds issued May 1, 2024, to October 31, 2024, are earning 4.28%. This includes a 1.3% fixed rate. Still a great rate for one of the safest investments available. You can’t cash them in for one year. Plus, if you redeem them within the first five years you lose three months’ interest.

If the I Bonds you purchased previously didn’t have a fixed rate, you will only earn the inflation rate when the new rates are announced for the next six months. I Bonds with a high fixed rate are a great buy, some of my early I Bonds have a 3% fixed rate.

If you purchase an I-Bond by no later than October 31, 2024, you’ll receive the 4.28% for six months from the date of purchase. The rate will change after that to the new inflation rate announced this coming October plus any fixed rate your previously purchased bonds may have.

Federal employees who are retiring soon and recent retirees with security clearances

can search thousands of high-paying defense and government contractor jobs.

Market Observations

The stock market continues to soar and 401K balances have risen dramatically for the most part. Election years are typically a positive indicator for the broader market. Nineteen of the past 23 presidential election years (83%) resulted in positive S&P 500 gains.

This election year one candidate has proposed taxing unrealized gains that could upend the market. Yet, there are so many variables to factor in with both candidates: tariff impacts, raising or lowering corporate taxes and capital gains, the border crisis, law and order issues, numerous overseas conflicts that are overflowing into America, and so much more.

The fact of the matter is that both candidate’s proposals must pass through Congress. Consequently, much of what is proposed will either be modified or go by the wayside as reality sets in. Who knows what will end up driving the market one way or the other after the election.

Neither candidate is addressing the excessive national debt or insisting that any new spending must be offset with cuts elsewhere. The current administration is borrowing a trillion dollars every 3 months! All of these excesses add further instability to our fragile free market system.

Summary

As a retiree, I still prefer to invest in the safety of Treasuries, CDs, and conservative stocks, mutual funds, and market leaders that have been around for many decades, pay dividends, and have sound fundamentals. Many retirees set aside a small portion of their investments for the more aggressive growth stocks, mutual funds and ETFs of the day.

Now that the Federal Reserve is starting to cut rates, it may be time to add longer term CDs and Treasury Notes to your fixed income investment portfolio. CD rates are dropping as the Fed continues to lower rates for the foreseeable future.

(NEW) Sign Up for a FREE Retirement Report and Consultation

If you can lock up your discretionary savings and investments for 12 months or longer, CDs are a viable option. They can be cashed in before maturity, however the penalties can be significant. Treasury Bill rates are moderating down a bit as noted on the first chart in this article.

Short term T-Bills continue to provide impressive yields considering many banks still low ball their savings rates for established accounts. These banks are betting on the reluctance of many to move funds from their savings and checking accounts elsewhere.

Correction

In my last article titled “2025 Health Care Premiums Announced, Hold on to Your Hat!” I misquoted the BCBS Self-Plus-One (113) plan premium increase incorrectly at 8.7%, it was actually a 12.95% increase. Here is how the comparison should have been written:

Premiums for the Self-Plus-One BCBS basic (113) plan and Government Employee’s Health Association (GEHA) Standard (316) plan follow: BCBS’s monthly premium increased $76.94 to $593.97, a 12.95% increase, while GEHA’s premium increased $47.39 to $374.18, a 12.7% increase. The annual increases are $923.28 for BCBS Basic and $568.68 for GEHA Standard!

Chris, one of our subscribers brought this to my attention and the input was greatly appreciated. This was corrected on the blog posting. We simultaneously publish the articles we send out to our newsletter subscribers on our blog.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- 2024 Pay Tables

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2024 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

- Retirement Investments - Down but Not Out - April 4th, 2025

Tags: CD Rates, Fed Rate Cuts, Fixed Income Options, Treasury Bill Yields, Treasury Note Yields

Posted in ANNUITIES / ELIGIBILITY, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post