Posted on Saturday, 6th March 2021 by Dennis Damp

Print This Post

Print This Post

Planning for retirement and life in general requires organization and much thought. Long before we retire our significant others require our assistance and this goes both ways. In most relationships, one person takes responsibility for certain aspects of the couple’s life. Whoever pays the bills and manages financial affairs must have clear and concise instructions prepared for the other party in case of an emergency, illness or untimely death.

When I prepared our estate plans years ago, I developed Account Access Instruction sheets for all accounts: banks, brokerage, IRA/401K retirement accounts, credit unions, social security and others. Coincident with these, I competed a comprehensive Care giver and Survivor’s package. Actually, both of these are a must have at any stage of life, not just for retirement. As the title of this article states, “Life Goes On’ and when it does others need this information, especially young families and the retired.

Click here to download this sample WORD document if you would like to use this format, just type over the sample data with your personal information. I also prepared a PDF file for those who don’t use WORD, you won’t be able to change the data with a PDF however you can use it as a sample for other word processors.

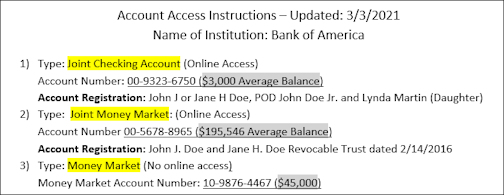

The first part of my Account Access Instruction sheet lists each account at an institution and provides the account number, balance, and how the account is registered. They can be registered as joint, individual or trust. Then I added either the Transfer on death (TOD) beneficiaries or trust. If it is a trust, successor trustees take over control of the account and other trust assets.

I know this sounds like a lot of work; it really isn’t if you take it one step at a time in logical order. Last week’s column titled, The State of YOUR Affairs – Exposing the Obvious provided the first step; a way to evaluate where you are at financially and what your significant other will have to live on when one partner leaves this realm. It does take time to locate the data, fill out the forms, and then add up the figures. Yet, if you did this last week, you will now have time to compile the information needed for your Account Access Instructions.

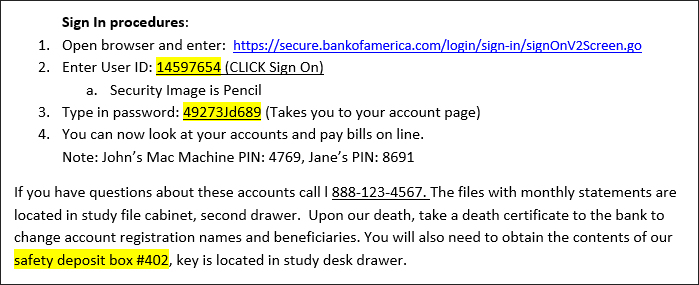

In the second part of the form, I list website sign in procedures to include the web address, user ID, security image if appropriate, and the password for your account. You should also provide a phone number for the institution with other specific guidance. After a death the beneficiary or successor trustee must provide the institution with a death certificate to take over the account. It is also essential to grant an attorney-in-fact specific powers to administer digital assets through a written and signed Power of Attorney document. I need to revise my wife’s and my Powers of Attorney to include this.

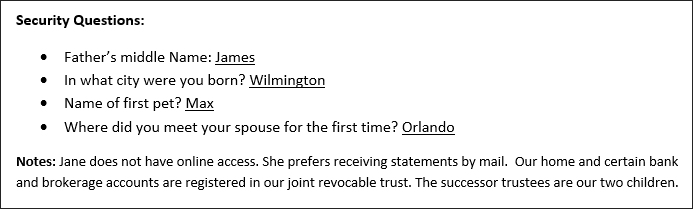

Finally, I list other pertinent data including security questions and answers in case the password expires and provide other relevant information. It is beneficial to add the document file location at the bottom of the form. When you go back to update the access information, you will know exactly where to find it.

The information collected on these sheets can also be included in the estate Caregiver and Survivor Report. I chose to use individual sheets so they are handy and easy for my wife and assigned successor trustees to use if I’m unable to manage our affairs. Plus, my wife uses them in my absence when she accesses accounts.

I plan to outline the Caregiver and Survivor report later this month. There are programs that will help you compile this information or you can prepare it with any word process as long as you have an outline of what is needed.

Please forward this article to others that may benefit from this information. Anyone can sign up to receive my FREE newsletter. We don’t advertise this service; others learn about our Retirement Planning newsletter and website through subscriber referrals.

Request a Federal Retirement Report

Retirement planning specialists provide a comprehensive Federal Retirement Report™ including annuity projections, expenditures verses income, with a complete benefits analysis. This comprehensive 27-page benefits summary will help you plan your retirement.

Request Your Personalized Federal Retirement Report™ Today

Find answers to your questions: The best time to retire, retirement income vs expenditures, FEGLI options and costs, TSP risks and withdrawal strategies, and other relevant topics. Determine what benefits to carry into retirement and their advantages. You will also have the opportunity to set up a personal one-on-one meeting with a CERTIFIED FINANCIAL PLANNER.

Helpful Retirement Planning Tools

- Retirement Planning For Federal Employees & Annuitant

- GS Pay Scales

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2021 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Retirement Planning Assistance – Finding Help (2025 Update) - July 17th, 2025

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post