Posted on Friday, 7th January 2022 by Dennis Damp

Print This Post

Print This Post

It’s been quite a year, COVID, life disrupted across the board, and so much more to distract us day to day. Thankfully, we are surviving and life is getting back to the new normal; whatever that might be. I’m still trying to figure that out.

All Americans are impacted by the Covid epidemic, lawlessness and gun violence, open borders, inflation, out of control government spending, and so much more. Hopefully, common sense will prevail and things will return to some semblance of normal soon.

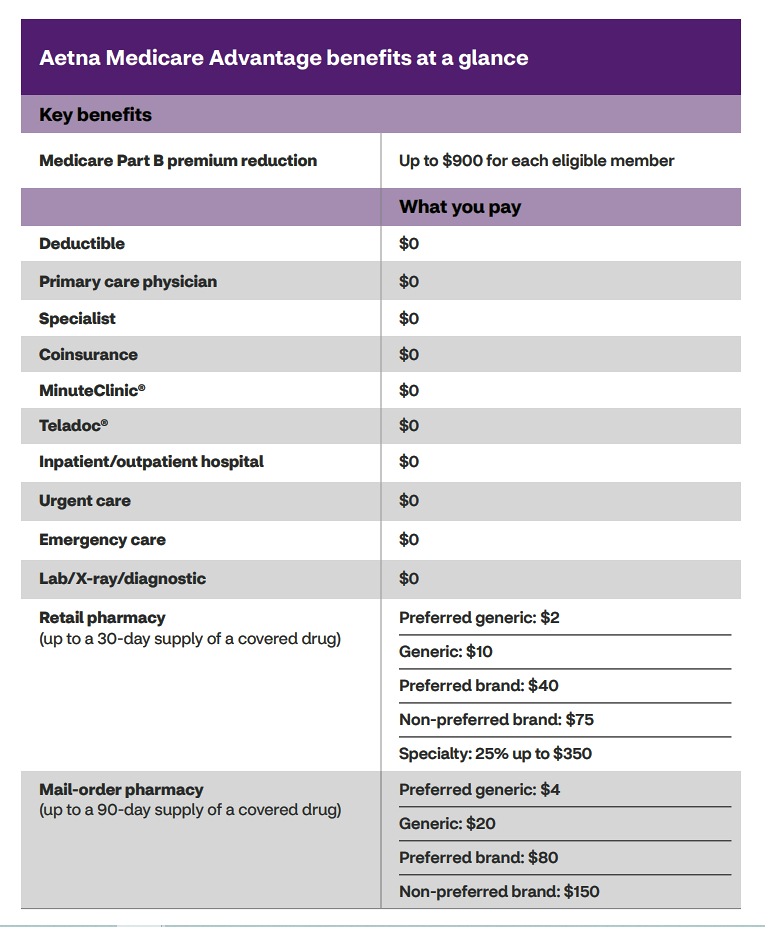

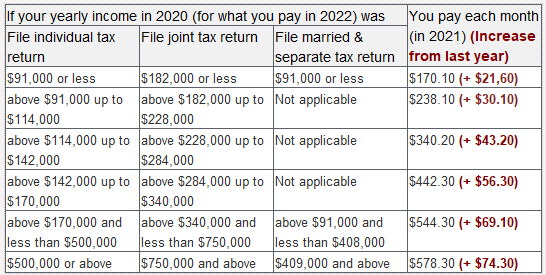

The Inflation we are experiencing isn’t transitory. Yes, prices of goods change frequently due to supply and demand. However, certain fixed costs, once increased, rarely allow the end products to retreat to their former lows. Medicare Part B Premiums increased 14.7% this year; the average FEHB health care plan premium rose another 2.4% and wages have increased dramatically for many including entry level jobs.

If inflation was transitory, we wouldn’t be paying considerably more for the same goods we purchased years ago. A commonsense analysis, nothing more. We don’t need an economist to reveal the obvious, we see the impact firsthand every time we go out the door.

Enough of life’s challenges, all are aware of the chaos around us. No need to repeat it here

On a personal note, I sold my career and jobs websites, one that I launched in 1994! The new owners, Federal Media Network, LLC will be a good steward; I’ll remain involved as a consultant and editor for several years. I retained our federal employee’s retirement planning web properties and will continue writing this newsletter and blog, hopefully for years to come. It’s time to start turning the reins over to the younger generation.

I completed several major items on my bucket list, my memoir early last year, and garage remodeling project this past summer. The only other major item on my list is to visit England, Austria, and Ireland, Mary’s and my ancestral stomping grounds.

My father’s side came from England; mother’s family from Austria and Mary’s from County Cork Ireland, all migrating to America through Ellis Island in the very early 1900s! Our DNA tests confirmed all of the above with a little Scandinavian and western European mixed in.

The Early Years, A Road Less Traveled, my 28th book and more than likely my last, was something I had on the back burner for years. During these past 7 decades I kept most everything related to family history: check book registers and tax records back to the 1960s, family correspondence, tickets from many of the events my wife and I attended, military and work records, thousands of pictures, and much more.

This was a reflective and enjoyable two-year journey. The most satisfying aspect of writing a memoir is that our children, grandchildren and future generations will have a glimpse into their family’s past. Hopefully, a journey worth remembering. The Preface, Table of Contents, and Chapter One are available online for anyone to read.

I mention my memoir here not to promote this title but to encourage others to capture their story while you still have the time and energy to do so. This is a limited production; by publishing and copyrighting the work it now resides in the Library of Congress. I consider this the culmination of my 36-year publishing career and I’ve given away far more than were sold.

You don’t have to write a formal book to preserve your story. Start a handwritten journal or use a word processor to capture your earliest recollections and proceed on from there. Interview your relatives while you still have the opportunity. Knowing what transpired in the past helps us understand the why and wherefore of a singular life interrupted by time and circumstance. A life story reveals the rhyme and reason for our existence and how we ended up where we are today.

My daughter wrote the following on her Facebook page after reading my book:

“My Dad wrote this beautiful memoir of his life and I absolutely loved it! I felt like I lived those times with him. I’ve gotten to know family members I never met such as his beautiful mother. I am in awe how my Dad is such a beautiful writer! This book shows you how you can do anything if you work for it! He lived with perseverance rather than focusing on misfortunes… Dad, you are amazing! I love you! “

This is payment in full, I need nothing more.

Garage Remodeling Project

My wife cringed when I started the garage remodeling project several years ago and completed it this past July. I always wanted a pristine garage to work in and simply enjoy.

I painted the three-car garage walls light gray from the floor to the one-foot-wide blue racing stripe; the area above is a bright white. The wall cabinets and a work bench were added several years before. The blue racing stripe is the same color as our first car, a light blue 4 door 1963 Chevy Impala that has a story of and in itself. I upgraded the lighting to daylight LEDs; when turned on it’s as bright as a sunny midsummer day. I keep everything off the floor either in cabinets, on shelves or wall organizers. I have mostly reproductions of auto memorabilia on the walls while I search for originals on forays to local flea markets and garage sales next spring and summer.

The floor and baseboards were the last tasks. A local contractor applied a flaked multi colored polyaspartic floor coating. The flooring application was completed in 7 hours and I was able to walk on it 2 hours after they left. Regular epoxy applications take up to three days to apply and cure and the fumes are more pervasive.

Any garage floor application gases out fumes; it took 3 months of airing out with fans going 24/7 to eliminate the odor. If you have respiratory health issues, proceed with caution before applying any floor coating. Thoroughly seal your garage to keep the fumes from entering your home. I spent a week sealing every crack and crevice and installed the baseboards myself after the floor cured. Several contractors quoted over $700 to install just 80 linear feet of baseboard! The materials only cost $120 at Lowes. Also, floor coatings are slippery when wet, even with a slip retardant applied (fine sand to the final coat).

The project took its toll on my back and arthritic joints. Before it was completed, for several weeks I could barely straighten up when standing. In hindsight, I should have contracted the work out, I’m not a spring chicken anymore. However, I still enjoy working in and around the house. In my youth I worked sunup to sunset tackling every remodeling job possible plus car repairs and maintenance, not anymore!

The Past Lives On

I often listened to “60s on 6” during trips, the XM radio station that played the popular songs of the 1960s, my generation. The other day I discovered that it was gone! Did XM radio cancel my generation? After mentioning this on the Wilkinsburg High School Alumni (1940-1977) Facebook page, I discovered it was moved to channel 73 and retitled 60s Gold. What a relief, I enjoy this interlude that resurrects fond memoirs of my youth.

When I tuned in the new channel, they were playing “The Rain, the Park and Other Things” by the Cowsills. My girlfriend and I listened to this on my car radio on many of our dates. Love songs back then, when times were not as complicated, were simple and sweet compared to today’s venues. This song keeps playing in my head as I write this.

I saw her sitting in the rain

Raindrops falling on her

She didn’t seem to care

She sat there and smiled at me

Then I knew (I knew, I knew, I knew, I knew)

She could make me happy (happy, happy, she could make me very happy)

Flowers in her hair

Flowers everywhere (everywhere)

(I love the flower girl)

Oh I don’t know just why, she simply caught my eye

(I love the flower girl)

She seemed so sweet and kind, she crept into my mind

(To my mind, to my mind)

Here is an excerpt from my memoir describing when I first met Mary, my girlfriend back then. We’ve been married 52 years!

“Once I met Mary, little else mattered. I was head over heels for her and devoted most of my time and energy getting to know her. This was the fall of 1966; I was seventeen and Mary sixteen. She was a tomboy growing up and flowered into this radiant Irish lass with a fair complexion, long red hair, bright-blue eyes, and a smile that could melt any man’s heart. She was athletic and shy, and I loved being around her.”

Conclusion

Reflections are just that, a fleeting glimpse into the past. Reality unavoidably rose to the surface just for a short while towards the beginning of this piece.

I sincerely want to thank my site visitors, newsletter subscribers, and blog followers again this year. I appreciate your patronage and thank you for following me all of these years, some for several decades.

My best to you and yours always and may you have a healthy, safe and prosperous New Year.

Helpful Retirement Planning Tools

- Retirement Planning For Federal Employees & Annuitant

- GS Pay Scales

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

- Master Retiree Contact List (Important contact numbers and information)

- 2021 Leave and Schedule Chart (Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in LIFESTYLE / TRAVEL, RETIREMENT CONCERNS

Comments (0)|  Print This Post

Print This Post