Posted on Friday, 29th November 2019 by Dennis Damp

Print This Post

Print This Post

Prior to Medicare eligibility, when you are under age 65, many elect high option plans to reduce their exposure to deductibles, coinsurance, and copayments. However, when you turn 65 and enroll in the traditional Medicare A & B options, it often makes sense to switch to a lower cost plan. Most Federal Employee Health Benefit (FEHB) plans pick up these fees.

2020 FEHB Plan Selection Guide

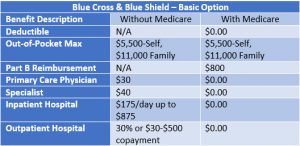

Section 9 of all plan brochures, titled Coordinated Benefits with Medicare & Other Coverage, provides charts that clearly state what you would pay with and without Medicare. I reviewed the Blue Cross Blue Shield (BCBS) Basic and the GEHA Standard 2020 Plans for this article. It should be noted that similar savings are available with most FEHB plan providers when enrolled in Medicare A & B.

When I review plans, I always discover features that I wasn’t aware of, this article highlights one from Blue Cross and Blue Shield, a potential $1,600 bonus for a family Basic Plan enrollment. The GEHA Standard Plan no longer requires preauthorization for physical, occupational, and speech therapy plus they now provide four pairs of compression stockings per calendar year without a preauthorization requirement. Their High Option Plan now offers a Medicare reimbursement of $600.

Federal Employee Retirement Benefits Seminars – Check Availability

Blue Cross & Blue Shield Basic Plan

Note: The Blue Cross & Blue Shield Basic Plan cost-share when Medicare is your primary payer and your provider is in their network.

- Monthly Cost – Basic Option Self + 1 = $386.99

- Limited to in-network providers. If you are treated by an out-of-network provider or facility you are responsible for all costs that Medicare doesn’t cover including Medicare deductibles. Many if not most of the physicians and medical facilities are in their network. However, to avoid extra charges, you should always check with medical providers before services are rendered if you enroll in this plan.

- Review the Blue Cross Blue Shield Medicare & You Booklet for specifics.

- Offers a $800 reimbursement for their Basic Option Plan participants. Up to $1,600 under a Self Plus One or Family Plan enrollment.

Reimbursement Clarification: Blue Cross & Blue Shield states, “Each eligible member on a contract has their own $800 benefit in 2020.” I called to confirm this. If you are enrolled in a Self + One or Family BCBS Basic plan, and you and your spouse are enrolled in parts A and B, and paying Medicare premiums, both annuitant and spouse receive up to $800 per year, $1,600 combined.

You have to apply for the reimbursement and provide specific documentation that you made Part B premiums for the year. Reimbursement details are available online and you must apply after accumulating $800 in Medicare Part B premiums, not before.

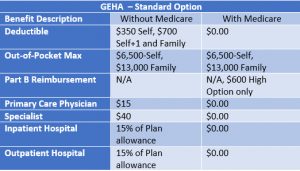

GEHA Standard Plan

Note: GEHA Plan cost-share. Deductibles, copays and coinsurance are waived whether your provider is in- or out-of-network.

- Monthly Cost – Standard Option Self + 1 = $282.05

- Provides coverage for in and out-of-network providers

- The GEHA Standard Plan includes vision care services, a separate plan isn’t needed.

- No Part B reimbursement for their Standard Plan, $600 reimbursement for High Option Plan participants.

- Review the GEHA Medicare & You Booklet for specifics.

Both plans provide traditional coverage at affordable costs and coverage extends nationwide and overseas. There are differences in coverage in general and prescription coverage that you need to evaluate depending on the costs of your current medications and whether or not they are generic, name brand, or non-preferred brand-names. Both prescription plans are comprehensive. Blue Cross and Blue Shield Basic has a 5 Tier system with copays ranging from $10 for Tier 1 to as high as $90 for Tier 5 at preferred retail pharmacies. You can use in an out-of-network pharmacies with both plans.

GEHA Standard has three prescription drug levels; Generic, Preferred brand-name, and non-preferred brand-name groups. Copays range from $10 for generic to 50% for preferred and non-preferred. They have max limits set for both. If you have high cost prescriptions it often pays to shop around and compare pricing at several pharmacies in your area. One study found that the same prescription cost between pharmacies varied by as much as 75%. What I typically do before filling a high cost new drug prescription is visit the manufacturer’s website and search for coupons. We reduced our copayments dramatically using this method. The copayment for one of my prescriptions, Asmanex Twisthaler, was orignally $150. The maufacture’s coupon reduced my copay to $65.

For those not on Medicare GEHA Standard has a deductible of $350 for Self and $700 for the Self Plus One Plan for the calendar year. BCBS has no deductible for their Basic Plan.

Comparing costs is not always what it seems. You have to weigh all factors. GEHA’s Self Plus One Standard plan costs annuitants $282.05 per month. BCBS Basic charges $386.99. However, BCBS Basic offers up to $800 a year Medicare premium reimbursement, $1,600 for a married couple if both are enrolled in Medicare A and B. GEHA only offers Medicare reimbursement for their High Option Plan. That reimbursement will offset your annual costs but you still pay the full amount each month and apply for reimbursement after you paid at least $800 during the year to Medicare. Other costs also have to be considered such as prescription costs and BCBS Basic doesn’t cover any out-of-network costs that could be substantial.

There are many areas to compare before deciding on the plan that is right for you. Use our 2020 FEHB Plan Selection Guide to help you make an informed decision this open season.

Request a Federal Retirement Report

Retirement planning specialists provide a comprehensive Federal Retirement Report™ including annuity projections, expenditures verses income, with a complete benefits analysis. This comprehensive 27-page benefits summary will help you plan your retirement.

Request Your Personalized Federal Retirement Report™ Today

Find answers to your questions: The best time to retire, retirement income vs expenditures, FEGLI options and costs, TSP risks and withdrawal strategies, and other relevant topics. Determine what benefits to carry into retirement and their advantages. You will also have the opportunity to set up a personal one-on-one meeting with a CERTIFIED FINANCIAL PLANNER.

Helpful Retirement Planning Tools / Resources

Federal Employee Retirement Benefits Seminars – Check Availability

- The Ultimate Retirement Planning Guide

- FEHB Information

- Budget Work Sheet

- Medicare Guide

- Master Retiree Contact List (Important contact numbers and information)

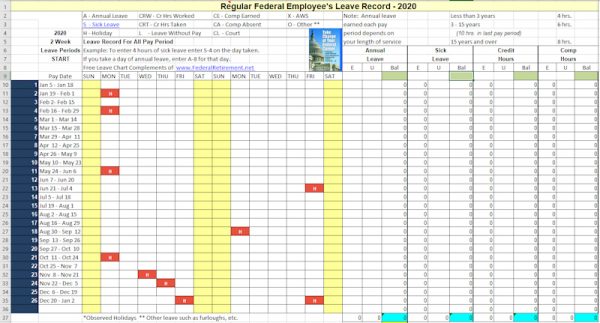

- 2020 Leave and Schedule Chart (Excel chart tracks all leave balances. Use this chart to set target retirement dates.)

- Annuity Calculator (FREE Excel chart estimates annuity growth)

Disclaimer:Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post