Posted on Friday, 27th June 2025 by Dennis Damp

Print This Post

Print This Post

Last week’s article announced the launch of OPM’s retirement application (ORA) service. The process mimics the paper application process. FERS employees must fill out the SF 3107 form, and CSRS employees must complete the SF 2801 online. Only those with a .gov email address can access the new application portal.

I tried to log in using my AOL email address, and OPM replied with this notice: “It looks like you logged in with a personal email address. If you’re an HR or Payroll specialist, log back in with your .gov email address. Otherwise, we’re working on adding support for retirees. Check back soon!”

The login screen cautions, “First time here from retire.opm.gov? Your old retire.opm.gov username and password won’t work. Create a Login.gov account with the same email used previously.”

Your online applications are submitted to your agency’s HR department for processing. I suggest downloading and printing the appropriate form for detailed guidance, including the four pages of instructions. They will also help you gather the required information and documents when completing your online submission. This will save you time when applying online.

Here are the form links:

Streamlined Service

Starting June 3, 2025, federal employees’ retirement applications must be submitted online through OPM’s new Online Retirement Portal. This system replaces paper-based submissions. For security purposes, this service is only available through your Login.gov account.

You only have to register once for a Login.gov ID, and then you can use it for all federal sites, including OPM’s Services Online and Social Security. You also have the option to log in using your government ID.

The one caveat is that you must use your official agency email address to enter this system. Federal employees must register again using their agency’s email address if you used a non-government email address to join other sites, such as Social Security.

Applying for Retirement

The application requires detailed information about the employee’s service history, retirement system (CSRS or FERS), benefit elections, and survivor annuity elections. When you are ready to retire, you will receive an email with instructions on completing your application using ORA. You will enter your information and complete the entire process online.

Here are the steps required to use this service:

- Create or Link to your Login.gov Account:

If you don’t have a Login.gov account, follow this guidance to create one. This is separate from the OPM Services Online account, which lets annuitants (federal retirees or their spouses, ex-spouses, and children) manage their accounts online.

- Access the Retirement Application:

Go to the OPM Online Retirement Application portal.

- Complete Forms Online:

Fill out the required forms, including the primary retirement application forms (SF 2801 for CSRS or SF 3107 for FERS) and any supplemental forms.

- Collect Supporting Documents:

You must provide supporting documents, such as marriage certificates, divorce decrees, or military service records, as needed.

- Send the Application:

Once the application is complete, submit it electronically through the portal.

- Agency Review and Certification:

Your employing agency will review and certify your application, including completing the SF 3107-1 (FERS) or SF 2801-1 (CSRS), and forward it to OPM. They will contact you if additional information or clarification is needed, such as military service or benefit election questions.

- Follow up with your HR Department

After submitting your application, you should receive a confirmation of receipt via the email address you used for the submission. Call HR to confirm receipt if you don’t receive a timely response.

Join other federal workers on the FedWork Network.

Sign up for this Free Service to get started.

Stay Involved with the Process

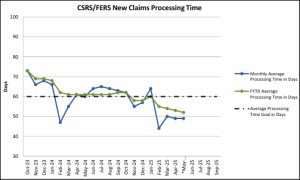

Time will tell how efficient the new system is and whether or not it speeds up processing. OPM has provided training and support for agencies to utilize the new system. The key is for your HR department to have the same ability to fast-track and send your application electronically to OPM. They will need the staff to do this, just because it is online now, applications still require detailed reviews before sending them to OPM.

Issues around military service time often arise that the applicant and HR must resolve using the employee’s eOPF and other documentation. You should download your eOPF and review it for inconsistencies before submitting your application, especially when employed by different agencies, working part-time, or having military service to add to your annuity calculation.

Effective July 15, 2025, OPM will no longer accept paper retirement applications. Any paper submissions created on or after June 2, 2025, will be returned to the agency for digital resubmission.

when employees notify their HR office of their intent to retire, they will receive an email with detailed instructions for completing their application using ORA.

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Budget Work Sheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2025 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

Over time, various dynamic economic factors relied upon as a basis for this article may change. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: CSRS, Daily Brief, Federal Employees, FERS, OPM Retirement Application, ORA, SF-2801, SF-3107

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post