Posted on Friday, 5th January 2024 by Dennis Damp

Print This Post

Print This Post

It’s the beginning of a new year and a good time for those planning their retirement to assess where they are financially, long before filing their retirement paperwork. Federal employees received a significant pay increase this year, 5.2% on average after factoring in locality pay. The 2024 pay charts are available for your review.

COLA 2024

More than 71 million Americans will see a 3.2% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2024. Social Security retirement benefits will increase on average more than $50 per month starting in January.

Federal retiree’s annuities under the Civil Service Retirement System (CSRS) receive the full 3.2% COLA increase while those under the Federal Employees Retirement System (FERS) receive 2.2%.

Thrift Savings Plan Considerations

Contributions

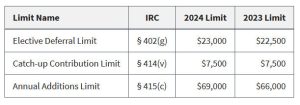

The Thrift Savings Plan (TSP) elective deferred contribution limit increased to $23,000 for FERS employees with an additional $7,500 catch-up contribution for those age 50. The annual additions limit is $69,900.

These limits define the contributions that can be made to defined contribution accounts like the Thrift Savings Plan (TSP) for the calendar year. Please note, this is a personal limit that applies to an individual’s aggregated contributions across all such accounts in a calendar year.

If you aren’t currently contributing up to these limits, consider increasing your TSP contributions this year by at least one or two percent of your pay. Now is the time to invest prudently for your future. Your take home pay will still increase year to year with this modest contribution increase.

Your contributions are tax deferred until you withdraw them in retirement and they will reduce your annual income tax while still working.

1099-R Update – TSP and Annuity

Our TSP 1099-R tax forms are issued for all plan withdrawals and typically arrive by late January. If you don’t receive your 1099-R Form in the mail by mid-February, call the TSP to request a replacement.

According to their website, it should be available in your “Secure Mailbox” by end of January. To get to your secure mailbox click on the circled bell in the upper right corner of the website

Annuity & Social Security 1099-Rs

Federal annuitants typically receive their updated Annuity Statement, with the COLA increase added, in late December. OPM’s 1099 R Tax Forms aren’t available until the end of January by regular mail while Social Security’s SSA 1099 forms arrive early to mid-January!

Registered users of OPM’s Retirement Services Website can download their January Annual Annuity Statement mid-December while the 1099R forms are available as early as mid-January.

Social Security Tax Limit and Medicare Premiums

Higher earners will pay Social Security taxes in 2024 on earnings up to $168,600, an increase from last year’s maximum amount of $160,200.

The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

BLUE Book (Benefits Summary Booklet)

Request an updated retirement benefits booklet through https://www.servicesonline.opm.gov late January to early February. This will ensure they include your 2024 FEHB and FEDVIP premiums. All retirees receive a comprehensive multi page booklet titled, “Your Federal Retirement Benefits” from OPM when they retire.

My booklet is 28 pages long. Request your updated copy by selecting the Document Section, the last item listed on the Dashboard’s main menu and click on “Request Booklet.”

Many annuitants order a copy each year with their updated benefits information and place the booklet in their retirement or estate planning file. You can also request a copy of the original booklet you received when first retired if you lost your copy and compare it to the most current version.

This booklet is a wealth of information and includes your personal retirement information: CSA number, annuity breakdown, survivor elections, benefit elections, etc.

If you haven’t signed up for OPM’s Online Services, follow the sign on guidance in my article titled, “OPM Services Online Access Changes.” This website’s document section also provides quick access to your 1099-R forms for the past 5 years, and a downloadable annual and monthly annuity statements.

You can also request a copy by calling OPM at 1-888-767-6738 or send a written request to the U.S. Office of Personnel Management, 1900 E Street, NW, Washington, DC 20415-1000.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- Annuity Expectations – Before and After

- TSP Guide

- Budget Work Sheet

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

- UPDATE - Deferred Resignations and VERAs Return - April 11th, 2025

Tags: 2024 COLA, Annuity, Medicare Premiums, Retirement Account Limits, TSP 1099-Rs

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (0)

Print This Post

Print This Post