Posted on Friday, 24th January 2025 by Dennis Damp

Print This Post

Print This Post

For those planning their retirement, it’s a good time to assess where you are financially long before filing your retirement paperwork. Federal employees received an overall 2 percent pay raise, factoring in locality pay. The 2025 pay charts are available for your review.

Sign up for a complimentary retirement planning session

and a FREE retirement planning report

COLA

More than 71 million Americans will see a 2.5% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2025. Starting in January, Social Security retirement benefits will increase on average by $45 per month.

Federal retiree’s annuities under the Civil Service Retirement System (CSRS) receive the full 2.5% COLA increase, while those under the Federal Employees Retirement System (FERS) receive 2%.

Thrift Savings Plan Considerations

Contributions

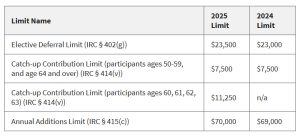

The Thrift Savings Plan (TSP) elective deferred contribution limit increased to $23,500 for FERS employees with an additional $7,500 catch-up contribution for those age 50. The annual additions limit is $70,000.

These contribution limits can be made to defined contribution accounts like the Thrift Savings Plan (TSP) for the calendar year. Please note that this personal limit applies to an individual’s aggregated contributions across all such accounts in a calendar year.

If you aren’t contributing to these limits, consider increasing your TSP contributions this year by at least one percent of your pay. Your take-home pay will still increase yearly with this modest contribution increase.

Your contributions are tax-deferred until you withdraw them in retirement, and they will reduce your annual income tax while you are still working.

TSP 1099-R

Our TSP 1099-R tax forms are issued for all plan withdrawals and typically arrive by late January. If you don’t receive your 1099-R Form in the mail by mid-February, call the TSP to request a replacement.

They are currently available in your “Secure Mailbox.” I downloaded mine mid January. To get to your secure mailbox, click on the circled bell in the upper right corner of the website

Annuity & Social Security 1099-Rs

Federal annuitants typically receive their updated Annuity Statement in late December, with the COLA increase added. OPM’s 1099 R Tax Forms aren’t available by regular mail until the end of January, while Social Security’s SSA 1099 forms arrive early to mid-January.

Registered users of OPM’s Retirement Services Website can download their January Annual Annuity Statement in mid-December, and the 1099R forms are available now.

Social Security Tax Limit and Medicare Premiums

Higher earners will pay Social Security taxes in 2025 on earnings up to $176,100, an increase from last year’s maximum amount of $168,600.

The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, an increase of $17 from the annual deductible of $240 in 2024.

BLUE Book (Benefits Summary Booklet)

Request an updated retirement benefits booklet through OPM’s Services Online from late January to early February. This will ensure they include your 2025 FEHB and FEDVIP premiums. All retirees receive a comprehensive multi-page booklet titled “Your Federal Retirement Benefits” from OPM when they retire. My booklet is 28 pages long.

Many annuitants order a copy yearly with updated benefits information and place the booklet in their retirement or estate planning file. You can also request a copy of the original booklet you received when you first retired if you lost your copy and compare it to the most current version.

Summary

I typically download my 1099-R tax forms as soon as they are available and enter them into Turbo Tax which I buy at Sam Club or Costco in late December. If you haven’t signed up for OPM’s Online Services, follow the sign-on guidance in my article titled “OPM Services Online Access Changes.”

The Blue Book is a wealth of information and includes your personal retirement information: CSA number, annuity breakdown, survivor elections, benefit elections, etc. This website’s document section provides quick access to your 1099-R forms for the past 5 years and downloadable annual and monthly annuity statements.

If you can’t access their services online, call OPM at 1-888-767-6738. You can also email them at retire@opm.gov or send a written request to the U.S. Office of Personnel Management, 1900 E Street, NW, Washington, DC 20415-1000.

Federal employees who are retiring soon and recent retirees with security clearances

can search thousands of high-paying defense and government contractor jobs.

Helpful Retirement Planning Tools

- Federal Employee’s Retirement Planning Guide

- Complimentary Retirement Planning Session

- TSP Guide

- Budget Work Sheet

- 2025 Federal Employees Leave Record

- Medicare Guide

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center.

Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Protecting Your Retirement Nest Egg – Fixed Income Update - February 26th, 2026

- Your 2026 Step-by-Step Federal Retirement Planning Guide - February 19th, 2026

- Online Retirement Application (ORA) Update - February 13th, 2026

- The End to the Silver Script Madness – News Flash - February 7th, 2026

- Reflections 2025 – Marvin Gaye (What’s Going On) - January 30th, 2026

- The Federal Workforce Data (FWD) Release – OPM Update - January 23rd, 2026

- Savings Bond Calculator & Treasury Direct Inefficiencies! - January 15th, 2026

- Tax Forms Availability – What to Expect This Year - January 9th, 2026

- The 2026 Landscape: What to Expect and Outlook - January 1st, 2026

- Long Term Care Insurance - Future Purchase Option - December 12th, 2025

- Open Season Coming to a Close – Last-Minute Checkup - December 2nd, 2025

- I Rolled Over My TSP Account to an IRA – Should You? - November 21st, 2025

Tags: 1099 R Forms, Annuity Statements, Benefits Blue Book, COLA, Medicare Premiums, Social Security

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION | Comments (1)

Print This Post

Print This Post

January 31st, 2025 at 4:16 pm

[…] My last article on taxable earnings included transposed numbers. The statement should have read, “Higher earners will pay Social Security taxes in 2025 on earnings up to $176,100, an increase from last year’s maximum amount of $168,600.” I corrected this on the blog article. […]