Posted on Friday, 17th June 2022 by Dennis Damp

Print This Post

Print This Post

I described the advantages of Treasury bills in “Ditch your Bank’s Low Savings Rates” last March. They provide higher yields for savers; if you ladder your investments a portion of your savings will be available at set intervals throughout the year. I’ve gone through several reinvestment cycles since starting treasury bill ladders earlier this year. The yield is increasing dramatically as funds are reinvested at higher rates.

When I started purchasing 4 and 8-Week bills last February they were yielding slightly more than my local bank and credit union savings rate of .04%. The 4-week bill rate has increased to 1.055% as of June 14, 2022, just 3 months later, while my local bank and credit union rates remain unchanged.

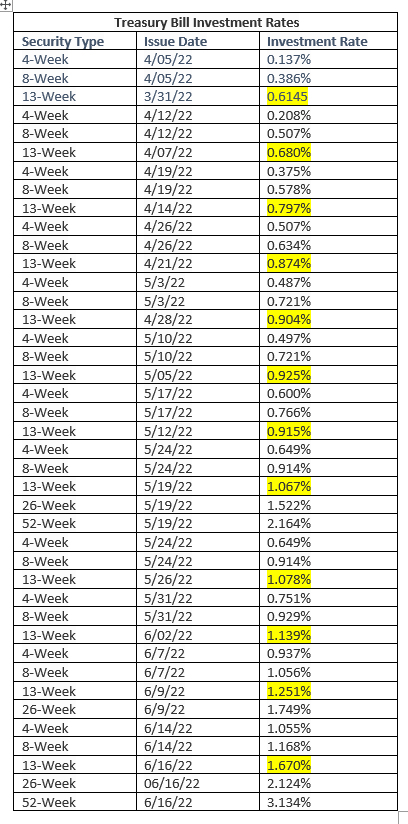

TREASURY BILL INVESTEMENT RATES

The chart below shows the interest rate increases for 4, 8, 13, 26 and 52-week bills during this period. The 52-week bill issued on June 16,2022 yields 3.134% and on June 14th the 2-year note yield was 3.324%! These rates far exceed my local bank and credit union’s .04% rate.

It’s easy to move savings that include funds previously invested in certificates of Deposit (CDs) to the Treasury for better yields. When rates level off, it will be a good time to lock in higher rates with Treasury notes of 2,3,5,7, and 10-year maturities. You may also find attractive CD rates at that time.

If rates go through the roof, like they did in the early 80s, it could be possible to pick up Notes and Bonds with very high yields. In 1981 the 30-year Treasury bond paid as high as 15.21%!

On the flip side, I relocated in the early 1980s under Permanent Change of Station (PCS) orders; our mortgage interest rate was 11%! The sellers laughed at the closing when they saw the 30-year total cost with financing.

If you are planning your retirement, learn an easy technique to retire mortgage free and other ways to economize before submitting your retirement application.

COMMON SENSE FIXED INCOME ALTERNATIVE

Treasury bills are sold at discount (below face value); when the bill matures the investor receives face value. These rates may seem insignificant to some. I can assure you the results are worth the effort.

Put another way, if you are fortunate enough to have $50,000 in combined savings earning .04%, your bank would pay you a grand total of $20 a year to keep these funds in their institution! A 1% yield would pay out $500 or $480 more than your bank is willing to pay you. Short term Treasury yields increase each reinvestment cycle and interest compounds as the Federal Reserve continues to raise rates.

If you invested the same amount in a 52-week bill, currently yielding 3.134%, you would earn $1,567. Essentially you would pay $48,433 for the 52-week note and at the end of the 12-month term the Treasury will deposit $50,000 back into your account.

CDs, Bank, and credit union interest rates will eventually rise to entice customers back to the fold. Right now, they are flush with cash and have no incentive to payout more. They are also aware of the fact that most depositors are unwilling to change and stay regardless.

TREASURYDIRECT.GOV

Visit TreasuryDirect.gov to register, explore the options, and start purchasing Treasury bills, notes, and bonds, TIPS, and savings bonds. You are buying direct from the government and eliminating the middle man; there aren’t any fees charged for purchases. Most brokerage accounts offer clients access to Treasury auctions and will purchase them for your account; the longer-term notes and bonds can be sold on the secondary market if needed. Here is more information on the Treasury’s programs:

COLA UPDATES

According to Wilbert J Morell III, a retired Navy Engineering Project manager, if inflation remains constant at 8.6% and the CPI-W at 288.012 the Social Security and CSRS COLAs will be 7.3% and the FERS COLA will be 6.3%.

If Inflation continues growing at the same monthly trend of 1% per month and the CPI-W monthly trend of 1.2% per month as reported in the 10 June CPI Report, the Social Security and CSRS COLAs will be 11.2% and the FERS COLA will be 10.2%.

US inflation by the end of the year could be as high as 12.6%.

Wilbert tracks these statistics monthly, volunteers to help seniors in his community, and is highly knowledgeable about our federal retirement benefits.

I-Bonds yields should also rise again this November in this invironment, they already pay 9.62%!

SUMMARY

Is the stock market keeping you up at night? With inflation on the rise and costs increasing across the board, a recession is surely on the horizon. As the Fed raises rates, Treasury yields will follow suit and provide viable options for our cash.

Financial analysts on the major networks suggest a recession is coming our way in 2023 or beyond. It may be much sooner than they think.

A recession is defined as a significant decline in activity across the economy, lasting longer than a few months. Two consecutive quarters of negative economic growth, measured by a country’s gross domestic product (GDP), is the technical indicator of a recession. The country isn’t fighting on one front in this battle, we are surrounded with conflicts, all with significant negatives for our economy and well being.

The DOW and S&P are down more than 20% signaling a bear market. Many issues are driving this trend: skyrocketing inflation along with the highest gas prices in history, supply chain problems, food shortages including baby formula, COVID lockdowns in China, rising interest rates, out of control spending, the war in Ukraine, lawlessness, and the open borders and fentanyl drug crisis that killed 108,000 Americans last year, to name a few. We’ve lost more people to fentanyl overdoes than guns, suicides and traffic accidents combined last year!

Adding to our problems, electric utilities are warning of rolling blackouts this summer across the country. The early retirement of fossil fuel plants has accelerated the destabilization of the grid. Ten coal fired power plants closed in Pennsylvania in the past ten years; two more are scheduled to close this year. Maybe, just maybe we should restart a few of those plants until we have sufficient alternate power sources available!

Hopefully our leaders will wake up, rise to the occasion, and not end up like Nero, Rome’s emperor who fiddled while Rome burned.

Helpful Retirement Planning Tools

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- TSP Guide

- TSP Considerations

- Medicare Guide

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- Budget Work Sheet

- Social Security Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, investment, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The information contained herein should not be considered investment advice and may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Last 5 posts by Dennis Damp

- Bits and Pieces – Updates, and Subscriber Feedback - July 11th, 2025

- Social Security Tax Relief for Millions of Senior Citizens - July 4th, 2025

- Apply for Retirement on OPM’s Online Application Service - June 27th, 2025

- New Retirement Application Portal Launched - June 20th, 2025

- 2026 COLA Estimates & Retirement Processing Update - June 12th, 2025

- Electronic Official Personnel Folder Platform Launched - June 5th, 2025

- Electronic Retirement Application Submissions - May 30th, 2025

- Powerless, Keeping the Lights On - May 22nd, 2025

- Request Your 2025 Retirement Benefits Booklet from OPM - May 16th, 2025

- Projected Annuity Calculator Updates for FERS and CSRS - May 9th, 2025

- Hiring Freeze, Schedule F, and Social Security Benefits - April 25th, 2025

- Potential Benefit Cuts - It's Not Time to Panic - April 17th, 2025

Posted in ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SURVIVOR INFORMATION | Comments (2)

Print This Post

Print This Post

June 18th, 2022 at 11:48 am

What are the pros and cons of T-Bills vs. I Bonds?

June 23rd, 2022 at 7:04 am

T-bills are short term investments: 4,8,13,24 and 52 weeks in duration. You buy them at discount, below face value and receive full face value upon maturity. The income derived from them is taxable in the year earned. The discount is the bill’s yiield. If ithe yield is 1%, you purchase the bills at a 1% discount and receive full face at maturity. I-Bonds are long term and mature in 30 years, you can’t redeem them for the first year and if you cash them in the first five years you own them you loose 3 months interest. They currently are paying 9.62%! Every 6 months, May and November of each year the yield is changed to the current inflation rate and the interest compounds. Taxes on your gains are deferred until you cash them in. Here is a link to an artilce I wrote on I-Bonds that explains more about them, go to https://fedretire.net/earn-3-54-with-series-i-savings-bonds-tax-deferred-income/. This was the first article I wrote about them in May of 2021 when the yield was 3.54%.