Posted on Friday, 24th November 2023 by Dennis Damp

Print This Post

Print This Post

This article compares the Government Employees Health Association (GEHA) Standard Plan to their new MA Option. You will have to review the specific plan of interest to ensure it covers the services you need for the upcoming year.

Open season closes December 11, we have less than two weeks to decide whether to stay the course or move to another potentially lower cost plan with the benefits and services needed. Today, with the rising cost of everything, it is an essential and time-consuming task.

The FEHB Medicare Advantage Conundrum

Many Federal Employee’s Health Benefit (FEHB) plans offer a Medicare Advantage (MA) option that appears to provide considerable savings and expanded benefits for federal employees and annuitants. I’ve been a GEHA Standard plan subscriber for the past 10 years; they provided exceptional services and low-cost benefits without fail all these years.

What can their MA Standard and High option provide that I don’t already have? Much to my surprise, their MA options appear to provide considerably more benefits than I had imagined and decided to outline them here for our newsletter subscribers and website visitors.

Who is on First and What is on Second (Abbott and Costello)

There are two GEHA MA plans this year, a standard and high option both managed by United Healthcare, one of the largest healthcare providers nationwide. I’ll focus on the Self Plus One Standard option for this review. The standard monthly premium is $326.79 and the High option costs $540.95.

Actually, GEHA’s standard premium is one of the lowest available and they provide comprehensive coverage and great service overall. There aren’t any additional premiums required when you opt for their Medicare Advantage offerings. Stange but true. Plus, both plans provide a Part B subsidy, $75 for the Standard Plan and $100 for their High Option.

Just the Facts Please

There aren’t any additional premiums for the MA options PLUS your Part B premiums withheld by Social Security decrease by either $75 or $100 for both you and your spouse.

In other words, if you file a joint tax return with a modified adjusted gross income of less than or equal to $206,000 your Part B premium would be $174.70 for each of you. If you are enrolled in the Standard GEHA plan, Social Security will reduce your Party B premium by $75 to $99.70 and your Social Security check will increase by $75 for both you and your spouse!

According to GEHA’s letter sent October 4, 2023. “Enrollment is voluntary. Annuitants (and/or their eligible dependents) may opt in or out of the enhanced level of benefits at any time throughout the year.” You don’t need to wait until the next open season to move back to your original plan.

With that cavate, there seems to be little risk. If you aren’t satisfied you can opt out and return to your original GEHA plan and revert back to traditional Medicare Part A and B.

GEHA Standard MA Advantages

The following list highlights some of the major benefits of the FEHB MA Standard option:

- The MA plan provides a $75 Part B premium subsidy

- Free gym membership

- Over-the-counter item allowance of $40

- No need to coordinate benefits between Medicare and GEHA

- Eliminates the annual Medical out-of-pocket maximum of $6,500 / $13,000

- Provides 30 additional acupuncture visits per year

- Unlimited speech and occupational therapy visits

- No copayment for durable medical equipment

- Zero copay for routine podiatry

- $2,500 hearing aid allowance, limited to UnitedHealthcare hearing network providers

To clarify, the GEHA MA option is a national PPO plan and enrollees pay $0 deductibles, copays, and coinsurance as you currently have under the Standard GEHA plan. This includes $0 for preventative services, physician office visits (primary and specialists), hospital visits, emergency room or urgent care, and ambulance service.

Medicare advantage enrollees will receive a new medical card that you must provide to your doctor’s receptionist during your next visit, and to the pharmacy where your prescriptions are filled. Keep your GEHA card as well, you must remain a GEHA member to enroll in their UnitedHealthcare managed MA plans.

Prescription Drug Tiers (A Significant Advantage)

Once you elect a MA plan, a Medicare Part C Plan, you are automatically enrolled in Medicare Part D drug coverage. Those over 65 and new enrollees in the GEHA Medicare Advantage plan may receive a Late Enrollment Penalty Letter for Part D from Social Security. If you receive this notice, call the plan to let them know it was received. You will not be penalized for a late Part D enrollment when sighing up for a FEHB sponsored MA plan.

Secondly, if you decide to opt out of the program you will not be penalized for Part D late enrollment if you should decide to reenroll down the road.

Significant prescription cost savings

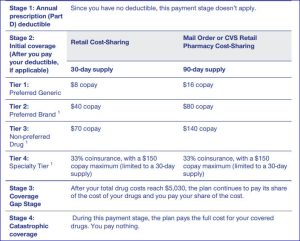

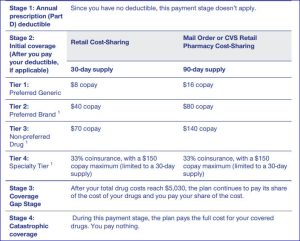

If the actual cost of a drug is less than the normal cost-sharing amount shown on the following chart for that drug, you only pay the actual cost, not the higher cost-sharing amount. I’ve paid less than a dollar for some generic prescriptions.

GEHA provides supplemental drug coverage in addition to your Part D prescription drug benefit when you sign up for their MA plans. The drug copays in this section are for drugs that are covered by both your Part D prescription drug benefit and your supplemental drug coverage.

The Standard GEHA plan cost for a Tier 2 drug is 40% ($250 max) compared to a straight $40 copay under their MA option. I researched two prescriptions that my wife and I were prescribed recently and was amazed at the savings.

Drug Cost Comparisons

- Jardiance TAB 10MG, $80 for a 90-day supply for the MA plan compared to $500 with GEHA Standard

- Advair HFA AER 115/21, $40 MA, $157 per month under the GEHA Standard Plan

Check the cost of your prescriptions under the GEHA Standard MA plan. Compare them to the GEHA Standard non-MA plan costs or call GEHA and they will provide the costs for you.

GEHA Standard MA Plan Prescription Drug Costs

Pharmacy out-of-pocket maximum

When your total out-of-pocket costs (what you pay) reach $3,500 you will not pay any copay or coinsurance.

Cost Savings Analysis

You may run into difficulties if you’re required to pay a higher Part B and D premium based on your income due to the income-related monthly adjustment amount (IRMAA). The increased premium payments are based on your Modified Adjusted Gross Income (MAGI).

Only 7% of those on Medicare pay an income adjusted amount for their part B and D premiums.

Most required to pay an IRMAA will be in the first bracket, those filing an individual tax return with a MAGI of greater than $103,000 but less than or equal to $129,000, or those filing a joint return with a MAGI greater than $206,000 but less than or equal to $258,000.

Once you move to a bracket that requires an IRMAA, those enrolled in an MA plan would also pay Part D IRMAA premiums as well. However, for those in the first bracket, that would only amount to $12.90. Let’s work up the numbers.

The Numbers Game

For this analysis a couple is filing a joint return with a MAGI of $212,000. They are in the first IRMAA bracket and their premiums will be as follows:

- $326.79 – GEHA Standard FEHB for Self Plus One

- $489.20 – Part B premium $174.70 plus an IRMAA of $69.90 ($244.60). Each person will pay $244.60. After the Part B subsidy of $75 is applied, $169.60 would be deducted from each of your Social Security checks monthly.

- $25.80 – Part D premium, the IRMAA, $12.90 times two, for each person. The $12.90 will also be deducted from each of your Social Security checks every month.

The couple’s total premiums will be $841.79. This is adjusted down by the Medicare Part B subsidy of $75 per month for each member, two in this case. Social Security will reduce your part B premium by this subsidy therefore increasing each of your Social Security checks by $75.

Essentially, this reduces your total monthly premium by $150 to $691.79. Then factor in your lower prescription drug costs and the additional benefits such the $40 over-the-counter item allowance and the elimination of the annual medical out-of-pocket maximum. Lots to consider.

Dental and Eye Care Potential Savings

You will also find generous dental and eyecare benefits that may allow you to drop or reduce your FEDVIP coverage. Compare you FEDVIP plan coverage to the GEHA Standard MA plan benefits to see if that is feasible for you. I would reduce my healthcare benefit costs by another $75 if I dropped my FEDVIP coverage. Here is a link to additional services provided under this MA Plan:

Compare Plans

Use OPM’s FEHB Plan Comparison Tool and Consumers’ Checkbook 2024 Guide to Health Plans to find the best FEHB plan for your needs. The Consumers’ Checkbook Guide is available in print and online formats.

Checkbook’s Guide helps active and retired federal employees find a FEHB plan that meets their needs at a cost they can afford. By answering a few questions, a personalized cost estimate is provided for each plan that includes the premium plus expected out-of-pocket costs.

For retirees, Checkbook’s Guide provides a yearly cost estimate for every FEHB plan with Medicare Part A only and a separate estimate with Medicare parts A and B. This allows users to see which plans coordinate best with Medicare, the cost reduction of adding Medicare Part B, and whether the FEHB plan offers Medicare Part B premium rebates.

Federal Retirement readers can order Checkbook’s guide at Guidetohealthplans.org and save 20% by entering promo code FEDRETIRE at checkout. The online and print Guide is available now.

Use these two excellent tools to drill down to and find the plan best suited for your personal situation. Review individual FEHB brochures, they provide the plan’s official statement of benefits.

Precautions

I wrote an article earlier this month that talked about issues hospitals, especially in rural areas were having with certain MA plans. If you missed the article, click on the link below to review it, and read the Caution Section.

There are always exceptions and it is best to talk with your primary providers to ensure they accept the MA plan you are enrolling in. According to one article I read, “a growing number of hospitals and health systems nationwide are pushing back and dropping some or all contracts with the private plans altogether.”

Use the following link to see if your providers are in their network:

The FEHB MA plans appear to be more robust and hopefully less susceptible to these issues, more research on my part is needed to confirm this. If anyone reading this has experienced problems with their FEHB MA plans, please let me know so that I can relay them to our subscribers and blog readers.

Summary

I’ve been hesitant to switch to a MA plan since they were first introduced under the FEHB umbrella several years ago. Knowing that you can opt out of the GEHA MA program at any time, and revert back to a standard GEHA Self Plus One plan with Medicare A and B is one of the major deciding factors for me. After a little more research on my part, I may sign up before open season ends on December 11th.

The only reservation is the potential for referrals that may be required under the MA plan for services such as MRIs and various tests that are needed as we age.

Another consideration is that retiree’s income can change each year due to retirement plan RMDs, increased interest and dividend income, and unanticipated capital gains, that could increase your IRMAA in the out years. If that is the case you can always opt out and return to the Standard GEHA plan. Those in higher IRMAA tiers could end up paying more for their coverage even with Part B subsidies.

I talked with Camille Hemmerich, one of the GEHA UnitedHealthcare Customer Service Advocates this week to verify a number of issues. She was very helpful and we discussed most of the above to one degree or another.

Call their help line at 1-844-491-9898 for clarification that you may need and to sign up. They are available from 8 a.m. to 8 p.m. local times, 7 days a week or visit www.geha.com/MedicareAdvantage.

When you call, be prepared to answer questions to confirm your identity and determine which MA plan you are eligible to enroll in. Camille was able to answer all of my questions to my satisfaction and backed up her replies with references.

Helpful Retirement Planning Tools

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change.

The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: FEHB, FEHB MA, FEHB Open Season, MA and Part B, Medicare Advantage Plans

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION, UNCATEGORIZED, WELLNESS / HEALTH

Comments (10)|  Print This Post

Print This Post

Print This Post

Print This Post

Print This Post

Print This Post