Posted on Friday, 12th December 2025 by Dennis Damp

Print This Post

Print This Post

My wife and I enrolled in the Federal Long Term Care Insurance Program’s Future Purchase Option when it was first offered in the early 2000s. Our monthly premium for Mary was $35.59, and I was paying $37.98 for 5 years of coverage with a maximum lifetime benefit of $228,125. The daily benefit amount was $125.

When I first enrolled in this program, I knew the insurance amount wouldn’t cover the entire cost of our care, or that we might need coverage for the entire benefit period. However, it would cover about 60-70 percent, and we would cover the remainder with savings.

Long Term Care Basics

Long-term care insurance kicks in when an individual is no longer able to perform at least two of the six Activities of Daily Living (ADLs) or has a severe cognitive impairment. There is typically a waiting period, known as an elimination period, which can range from 30 to 90 days or more.

The ADLs are as follows:

- Bathing

- Dressing

- Eating

- Toileting

- Transferring (e.g., moving from a bed to a chair)

- Continence

Long-term care also includes the supervision you might require due to a severe cognitive impairment, such as Alzheimer’s disease. Your doctor must certify that long-term care is medically necessary.

Inside the Genesis Mission:

America’s Bold Plan to Win the AI and Quantum Future

The Future Purchase Option

This option was the lowest cost for us at the time and allowed us to increase our coverage periodically without undergoing medical underwriting. Every two years, we received offers to expand our coverage, and we agreed to the premium and coverage increases until the offer we received last month.

Our benefit period was reduced from 5 to 3 years over the years, and premiums have increased substantially since we first signed up. In the last offer we received, my monthly premium increased from $163.06 to $ 193.59, with a corresponding increase in the maximum lifetime benefit from $260,434 to $277,779. Mary’s monthly premium increased from $153.23 to $184.54 with the same corresponding maximum lifetime benefit.

We declined the offer, and our premiums and coverage will remain at the current level for another two years. The increase of approximately $30 each, or $720 a year, for the two of us seemed high for a $17,000 increase in total lifetime benefits and only a $16-a-day benefit increase. Our daily benefit amount will remain at $237.84 or $7,135 per month.

Opting Out of a Future Price Offer (FPO)

We selected Option 2 to decline the FPO increase. With this option, your premium, daily benefit amount, maximum lifetime benefit, and benefits remain the same for the next two years. If you decline a total of three FPO offers, you must provide evidence of your good health by completing a full underwriting application to receive future FPO offers.

At our age, my wife and I didn’t feel their offer was worth the additional costs. In two years, we will receive another offer and two years after that a third. We can take advantage of future coverage increases if desired or remain at the current levels and premiums for the remainder of our lives.

If you agree to the additional coverage, you do nothing, and the increases will take effect on January 1, 2026. To decline, you must submit the 2026 Future Purchase Option Selection Form, fill in the oval for option 2 to decline the offer, sign the form, and send it to the FLTCIP offices in Portsmouth, NH.

Final Words

Many private insurers canceled their long-term care programs due to rising healthcare costs across the board. The premiums we are paying are only as low as they are because we signed up in 2002 when the program first started, and we didn’t opt into the higher coverage options. The younger you are, the lower your long-term care premiums will be, so it’s best to sign up while in your mid-career or earlier.

That being said, when we add up all the insurance premiums we pay for literally everything, insurance costs are one area where we can realize significant savings by shopping around. We recently received three homeowner’s insurance quotes in another state. The cost for comparable coverage from three providers ranged from $545 a year to close to $3,000! It does pay to shop around.

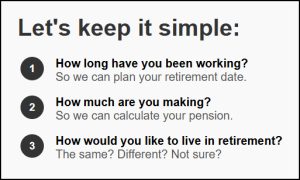

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Free Retirement Planning Report

- Budget Worksheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

- 2026 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: Daily Brief, FLTCIP, FPO, FPO Options, Future Price Option, Insurance, Long Term Care Insurance, Opting Out of Increase

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION, WELLNESS / HEALTH

Comments (2)|  Print This Post

Print This Post