Posted on Monday, 7th December 2020 by Dennis Damp

Print This Post

Print This Post

As the 2021 FEHB Open Season draws to a close Monday, December 14th, there’s still time to look for a new plan or confirm your existing plan is the right choice. Here are a few things to consider.

- Enrollment status – 90% of the time self-plus-one enrollment is cheaper than self-family enrollment, but not always. Check your plan’s premiums to confirm you’re enrolled in the less costly enrollment option. For example, if you happen to be in NALC High, you can save $726 switching from self-plus-one to self-family enrollment

- Plan changes – The enrollee share of the premium increased 4.9% in 2021. Many plans had no benefit changes, but some did. Will your doctors still be in your plan next year? Will your prescription drugs still be on the formulary? Even if you’re not considering switching plans, there’s still homework to be done this Open Season to make sure there won’t be any significant changes to your existing plan.

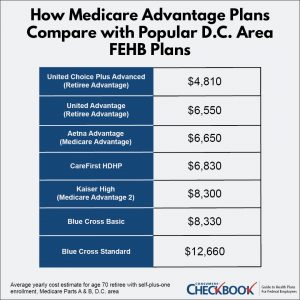

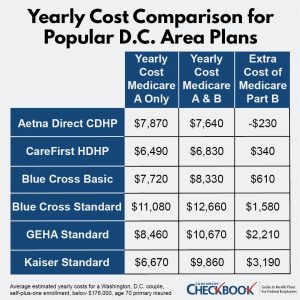

- Medicare Advantage – Several Medicare Advantage plans have the lowest estimated yearly costs in Checkbook’s Guide to Health Plans for Federal Employees for all available FEHB plans in low, average, and high health care expense years. United Advantage Retiree Advantage and Aetna Advantage Medicare Advantage are both available in the lower 48 states. Both have partial Medicare Part B premium reimbursement and have $0 cost sharing for most health-care expenses, except prescription drugs. Both allow you to see out-of-network doctors if the provider participates with Medicare. A couple in Charleston, SC, with average health-care expenses could save $1780 in estimated yearly costs with United Advantage Retiree Advantage compared to Blue Cross Basic. If you live in one of the 15 states with a United Choice plan, the savings can be even more dramatic. The United Choice plans have the same $0 cost sharing except for prescription drugs, but they reimburse almost the entire Medicare Part B premium. A couple in the Washington, D.C. area could save $3000 with United Choice Primary Retiree Advantage compared to Blue Cross Basic. To enroll in any of these Medicare Advantage plans you must first enroll in the regular FEHB plan version, have Medicare Parts A and B, and then sign up with either UnitedHealthcare (844-481-8821) or Aetna (866-241-0262).

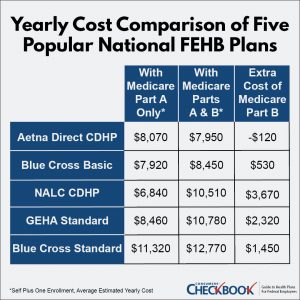

- Medicare Part B – Whether to sign up for Medicare Part B depends on a few things. First, if you fall into one of the high-income categories (more than $88,000 individual or $176,000 couple), Medicare Part B is of limited value due to the increase in the Part B premium. Second, some plans have better Medicare coordination benefits than others, including some plans that have partial Part B premium reimbursement. If you’re with a plan that doesn’t coordinate well with Medicare, you might reconsider whether having Part B is the right choice for you.

Checkbook’s Guide to Health Plans for Federal Employees can be purchased at GuidetoHealthPlans.org. Save 20% by entering promo code FEDRETIRE at checkout.

Several of our previous articles compared the new FEHB MA plans to GEHA Standard and Blue Cross Blue Shield Basic Self-Plus-One plans and another provides a comprehensive guide to this years Open Sesason. Review these for additional assistance with making your choices:

- Plan Comparisons – Aetna MA to GEHA Standard and BCBS Basic

- New Medicare Advantage Options Available to Federal Retirees

- 2021 FEHB Plan Selection Guide

Medicare Impact on FEHB Plans

Review the following articles that describe the impact Medicare has on your FEHB provider payments.

- A Marriage of Convenience – Medicare & FEHB

- Medicare and FEHB Options – What Will You Do When You Turn 65? (Part 1)

- What to Consider Before Enrolling in Medicare B (Part 2)

- Should You Change to a Lower Cost FEHB Plan When You Sign Up for Medicare (Part 3)

- Medicare Part B and FEHB Update (Part 4)

- How to Delay Part B Premiums

This article is a collaboration between Kevin Moss of Checkbook.org and Dennis Damp, host of www.federalretirement.net.

Helpful Retirement Planning Tools

Schedule A Retirement Benefits Seminar in Your Area

- Retirement Planning For Federal Employees & Annuitant

- Budget Work Sheet

- Social Security Guide

- Medicare Guide

Disclaimer: The information provided may not cover all aspect of unique or special circumstances, federal regulations, medical procedures, and benefit information are subject to change. To ensure the accuracy of this information, contact relevant parties for assistance including OPM’s retirement center. Over time, various dynamic economic factors relied upon as a basis for this article may change. The advice and strategies contained herein may not be suitable for your situation and this service is not affiliated with OPM or any federal entity. You should consult with a financial, medical or human resource professional where appropriate. Neither the publisher or author shall be liable for any loss or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Posted in BENEFITS / INSURANCE, ESTATE PLANNING, FINANCE / TIP, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post