Posted on Thursday, 14th August 2025 by Dennis Damp

Print This Post

Print This Post

I retired in 2005 at age 55, almost 21 years ago! I wouldn’t have retired if I didn’t have 35+ years of service at the time and an avocation, my business to fall back on after leaving government service.

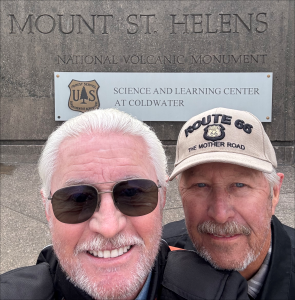

My federal employees’ retirement planning site helps me connect with thousands of retirees who are genuinely making retirement work for them and their families. Many travel extensively. Tom and Marlee, a couple in their 80s, have gone on 30+ cruises to date and have more scheduled. Many volunteer their time at church and various organizations to make a difference in their community.

Foot Loose and Fancy Free

Retirement at it’s Best

Ready, Set, Go

Shortly after retiring, one of my co-workers sold his home, stored his furniture, and he and his wife traveled throughout America in a motor home for two years before settling down.

Earl, an expert system specialist I worked with for many years, would often tour America on his vacations, traveling as far away as Alaska on his Harley with friends. He and his wife purchased a condo in Florida and moved there after retirement. Earl meets a group of retirees at a local gym to work out during the week, which keeps him and his friends not only engaged but healthy.

Phil planned to retire early and devote his time to outdoor activities. Unfortunately, health issues got in the way, and he wasn’t able to fulfill his dreams.

The key to a successful retirement is planning for and knowing upfront what you intend to do before leaving, as well as ensuring you are financially and physically prepared for retirement’s challenges. Take time to plan your exit and use our retirement planning site to help you through the process. Begin with our updated complimentary reports and Retirement Guide, listed below, to get started in the right direction.

- How to be Emotionally and Physically Prepared When You Retire

- How to be Financially Prepared When You Retire

- The Ultimate Retirement Planning Guide – Start Now!

What’s on Your Agenda?

Many expand their hobbies by joining associations, traveling to conventions, building workshops, and growing their collections. Carl, one of the individuals I worked with for many years, is now a master woodworker, creating beautiful furniture and turning pieces of wood into works of art. He also has a classic car that he and his family cherish.

Retirees often devote more time to their families, church, and charities, while others pursue a wide range of hobbies, including gardening, classic cars, cooking, sports, and collecting everything imaginable. Anything other than work for this group, and I can understand that.

Join other federal workers on the FedWork Network.

Sign up for this Free Service to get started

The Flip Side

Contractors often seek out federal retirees to return to work, frequently performing similar functions. Steve and Tom retired from the FAA and subsequently were hired by contractors, performing various tasks at facilities they previously worked with before retirement and at other locations around the country. They enjoyed working part-time and supplementing their annuities.

Many plan to grow a small business or non-profit. Randy started an engraving business and specializes in unusual and unique gifts for retirees and others. He had a side business while still in government that provided the foundation for his larger full-time business in retirement.

Chuck had several businesses, including designing and manufacturing custom golf clubs, and he became a golfing instructor at a local country club in northeastern Pennsylvania—a dream job for golfing enthusiasts.

I’ve been working non-stop since my early teens, over 60 years of continuous, uninterrupted work. I still enjoy the challenge of getting up each morning and going to work in my study after making coffee and toast for my wife and me.

When I retired, I expanded my part-time publishing business to full-time, which I started in 1985. I’ve sold off two-thirds of my business since 2009 to slow down a bit and explore other interests, plus our family and three grandchildren keep us on our toes.

ICE is Hiring 10,000 New Agents, Retired Annuitants Encouraged to Apply

Choices to Make

Long before submitting your retirement paperwork, sit down with your significant other to set your retirement agenda. You can’t do this on your own; your actions, whatever they are, impact your entire family.

Take the first step and don’t give up when things don’t go your way. Shake it off and start over to refine your plans and put things in motion. Others focus on their investments, expanding their knowledge to grow their retirement nest egg and estate for their heirs.

So many choices, and it’s all up to what YOU want to do for essentially the rest of your life. Abundant opportunities and experiences are awaiting you if you have the courage, desire, and tenacity to seek them out.

Words of Wisdom

I was thinking recently about how children in the 1950s and 60s were raised compared to today, and this came to mind; I had to write it down. Of course, there are exceptions with every generation; this is just a general observation.

“When you give someone everything, they expect more and appreciate little. When you provide them with the essentials, with limitations, they appreciate everything they receive and work hard to acquire more.”

Helpful Retirement Planning Tools

- Financial Planning Guide for Federal Employees and Annuitants

- TSP Guide

- Free Retirement Planning Report

- Budget Worksheet

- Retirement Planning for Federal Employees & Annuitants

- The Ultimate Retirement Planning Guide – Start Now

- Deciding When To Retire – A 7-Step Guide

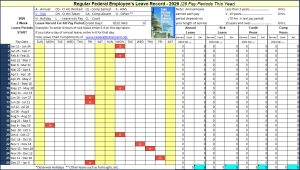

- 2026 Federal Employee’s Leave Chart

- Medicare Guide

- Social Security Guide

The information contained herein may not be suitable for your situation. This service is not affiliated with OPM or any federal entity. You should consult a financial, medical, or human resource professional where appropriate. Neither the publisher nor the author shall be liable for any loss or other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Tags: Case Histories, CSRS, Emotionally Prepared for Retirement, FERS, Financially Prepared for Retirement, Retirement Activities, Retirement Choices, Retirement Planning, Retirement Plans, Retirment Observations, What to do in Retirement

Posted in ANNUITIES / ELIGIBILITY, BENEFITS / INSURANCE, ESTATE PLANNING, LIFESTYLE / TRAVEL, RETIREMENT CONCERNS, SOCIAL SECURITY / MEDICARE, SURVIVOR INFORMATION

Comments (0)|  Print This Post

Print This Post